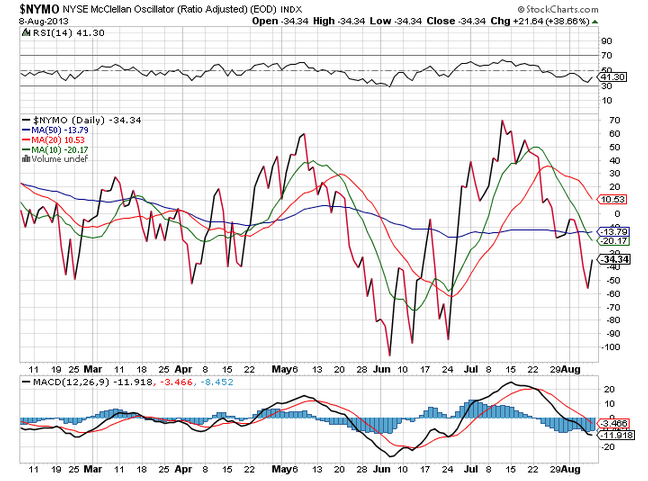

Another day, another buy of the dip. Which make me wonder this: While ignorant pundits chastise the VIX for being dysfunctional now that we are in a bull market (not the case folks), what does the NYMO, or McClellan oscillator do for anyone? How can a market be oversold when it is a couple S&P points off all-time highs?

A reading, like yesterday’s reading of -60 is supposedly an oversold market in the short-term that has a higher probability of going higher due to recent selling pressure. This selling pressure is determined to be a more recent moving average of declining stocks relative to advancing stocks below a longer-term average (19ema vs 39ema). But here is what bothers me about this indicator:

What if the futures for a few days just open the market lower and the investors buy the dip and the market finishes slightly lower. That is not selling pressure at all. It is just the futures market playing games with opening market maker bids. In fact, this week has seen lower opens and consistent buying. In my mind, the market may be overbought in the short term, far more than people expect. This is not a conjecture on whether the market is going lower, just a request for commentary on this oscillator.

Back to the VIX. Continue Reading