Recent sample letters and trades:

Volatility Analytics Newsletter – May 2nd

‘Cash on the sidelines’ is being thrown at the markets with record speed

We know sentiment is high, it’s the Roaring ’20 part deux after all. But, until recently, folks haven’t truly embraced it, eschewing ‘investing’ in a lot of cases for upside calls and other methods of achieving upside exposure. Well, that has officially ended, a lot of people have voted with their money.

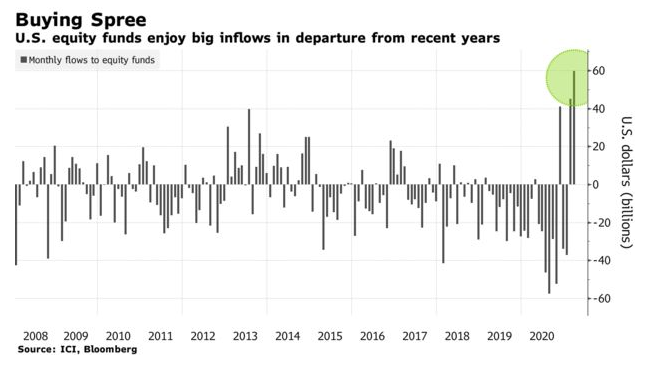

There are plenty of examples. First, equity fund flows are eye-popping:

The same is true globally:

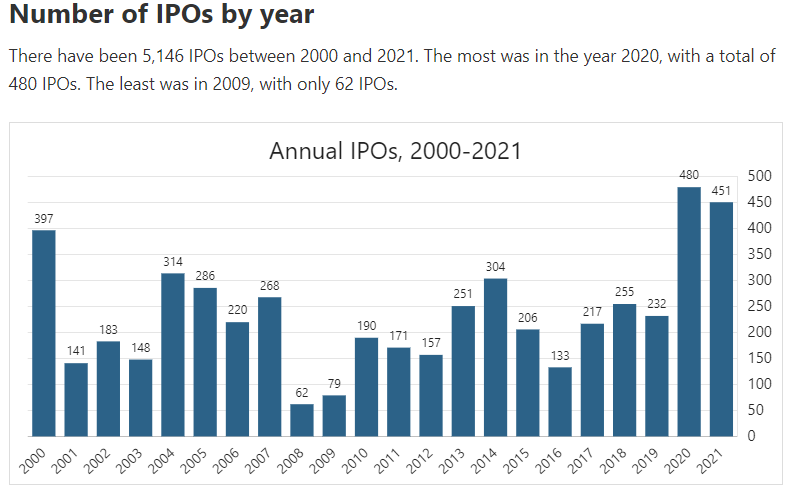

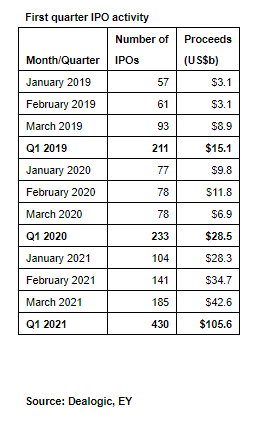

Then you have IPO volume, which has reached last year’s elevated level already:

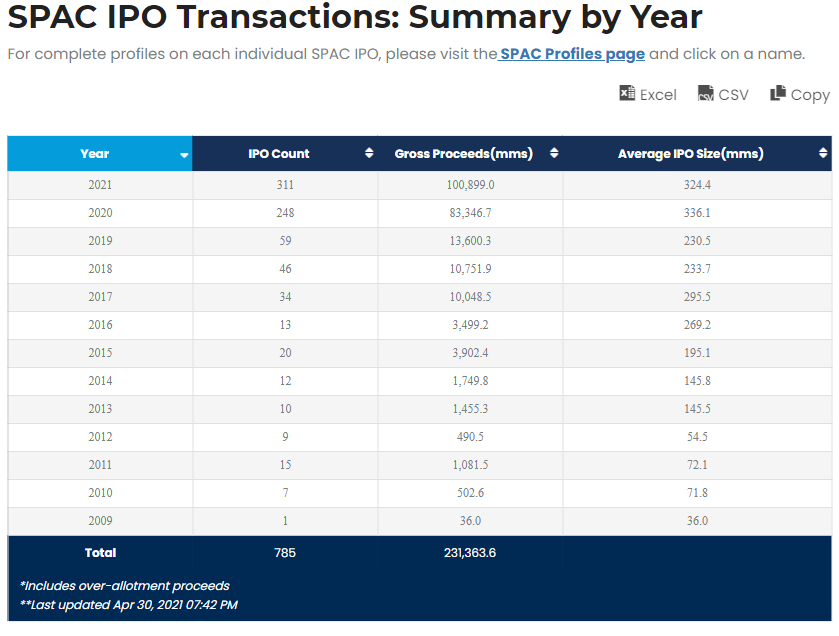

Don’t forget SPACs:

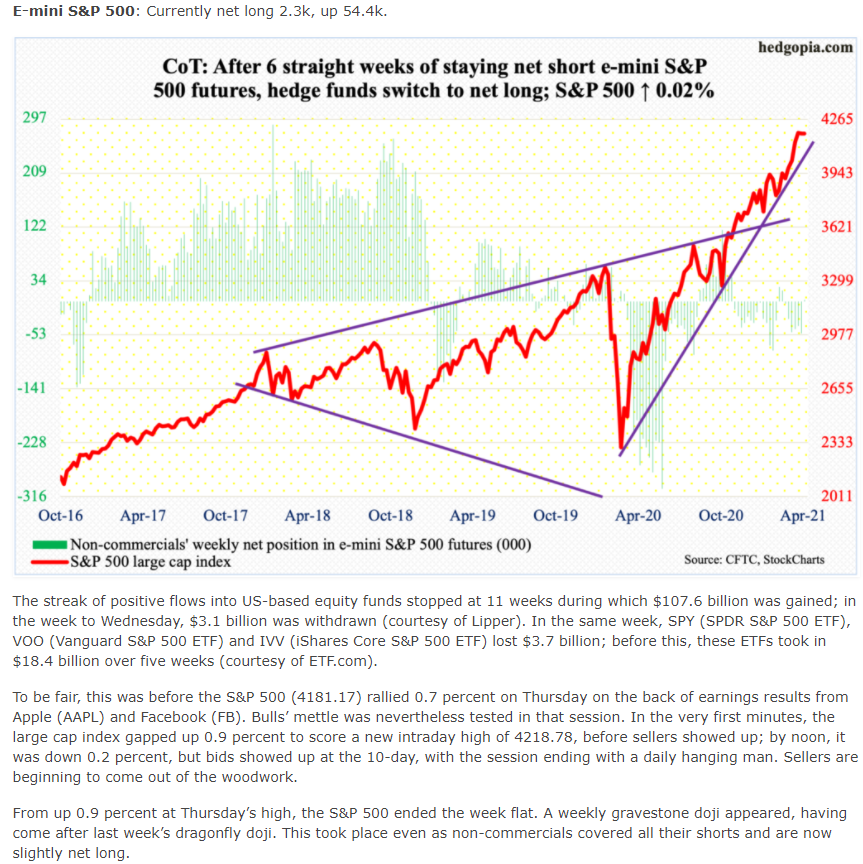

And, speculative positioning in S&P 500 futures, just went from net short to long for the first time in a while, in what amounted to a giant squeeze in one week:

That is a lot of people buying a lot of stuff in a very short period of time. So, it would make sense that folks have made it clear what they think of the rest of the year.

This information doesn’t make me bearish; I avoid that kind of thinking as much as I can help it. But paying attention to flows is important, and clearly there is a long capitulation on multiple fronts, as well as a lot of speculation in companies that make no money and never will, and many that have growth expectations that are quite unrealistic:

This kind of behavior doesn’t typically just go away; and neither is May usually a month prone to corrections. Going back to something I mention frequently, calendar risk, isn’t a problem in May. It’s a problem for money managers in September and October though, because they can see their end of year performance being under threat, and they have a quicker trigger finger to cut and run.

So, it wouldn’t surprise me to see people hang in there, at the minimum until they see Jackson Hole event on the calendar and a potential Fed policy of deciding to actually be “thinking about” something is in their near view. Which probably means, more bump and grind and up in July anticipating another earnings spike party.

This chart continues to amaze:

I’m going to go out on a limb and say, like Peter Boorish in the famous Trader documentary of Tudor Jones in 1987:

(You can enjoy that fabulous film here: https://drive.google.com/file/d/0B-D5AKivENQTdlVkNG1lejNYT1k/view?usp=sharing

The odds of a correlation that high, as he says in the film looking at the S&P 500 correlation chart they were using back then were 1 in 1000. 11:00 mark in the movie.)

Anyways, digression aside, I don’t have any firm expectations for May, I’m not heavily positioned and keeping an open mind.

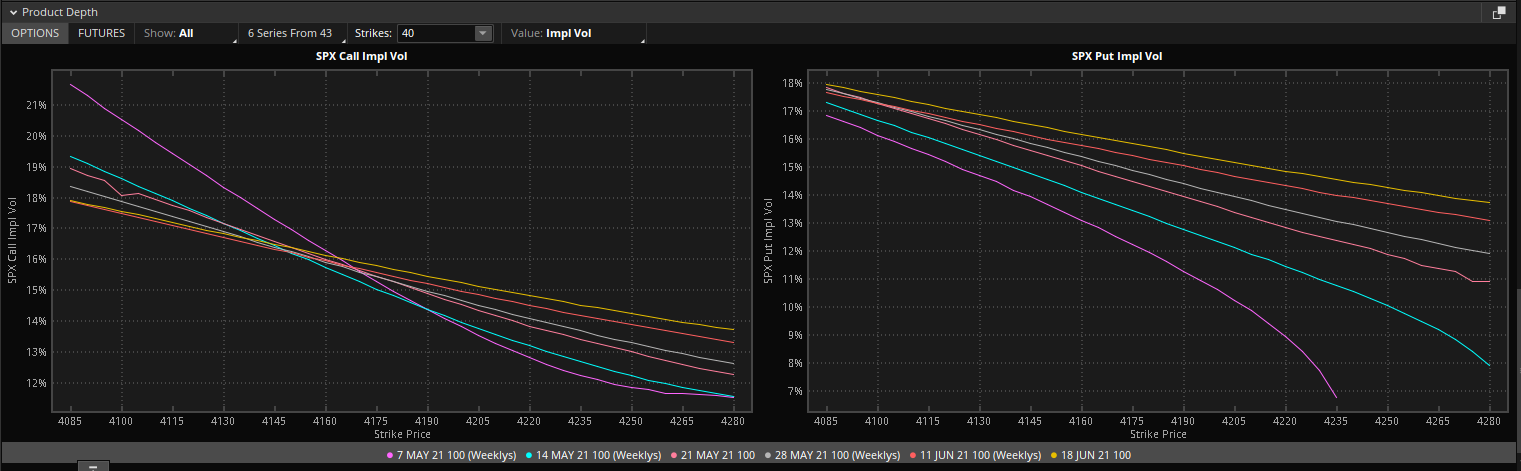

Looking at SPX volatility curves, the market doesn’t seem to have much of an expectation for anything either, at the money vols range from 12 to 15 over the next six weeks and -3% down in SPX, they’re firmly bunched around 18:

(If you want to listen to how a master of vol trading looks at term structure and skew, I highly recommend following Cem (https://twitter.com/jam_croissant) and listing to the interviews he often gives: https://open.spotify.com/episode/5MSJDsyrSYQVM361xor1Xn?si=xkYmR5vDT9iXtQ5qabg9Cw)

Volatility Trade:

ARKK put calendar spread

Sell May 21st $115 put

Buy June 4th $115 put

Net debit: $1.00-1.10

Cathie, Cathie, Cathie. She’s a fin sport now, people watch her for entertainment. Her daily trades, her wild theories, her use of Cunningham’s Law:

May 21st vol is elevated versus the terms around it, simply because there’s more demand at the monthly expiration, so in essence, this trade is anticipating more demand for the back leg when we get there:

Last week, a two-week pair (Apr 30/May14) was profitable from about 111 to 127, that is a giant +/- 6% of spot. Looking at the chart:

It’s been living between 110 and 125 since early March. I’d target $2-2.50. Last week near the money paid $3-3.8 at expiration of the short leg.

Volatility Analytics Newsletter – Apr 23rd

VOL rubber about to hit the road? Buckle up

This week was a warmup. Ask yourself, did anything really happen?

A tax policy that has no chance was leaked, and companies that no one cares about reported. (Except for one, which, frankly, deserved worse. Buying back stock, please. At least split first and lure in more retail if you need to pay the board, NFLX, save your capital.)

The dearth of significant news didn’t stop this from happening:

That is a meat grinder, and a lot of options folks weren’t spared the damage. The long tech earnings spike call crowd were roadkill in an instant on Thursday, just as short vertical yield types got squeezed right back in bout of fair play on Friday.

Imagine you envisioned the glorious finality of a market top (people just love to do it, I have no idea why, human nature I guess) and tried to sell some calls or call verticals as the market fell on Biden’s gambit:

O

O

Ooof. That stings, all-time high tick, as folks were getting squeezed. Just to see it drop 20 points into after-hours prices, like a double burn. You have to be ready for stuff like this, the market is carrying a lot of derivative baggage these days. As I tweeted yesterday, during the -1% hour that had everyone flopping around like a fish dropped on the hot summer quay, gasping at the horror of billionaire taxation and how that will end investing as we know it:

And ludicrous ramps like today and late in the afternoon are symptoms of the weight of leverage, the weight of the carry trades. It’s not like people were scooping up everything under the sun in their IRAs on a whim. Just look at how it went once settlement trades were being forced/closed:

One theme out in the fin-duncery is the idea that, “Oh, the market has corrected under the surface, and now it can go higher.” These people kid themselves for a living.

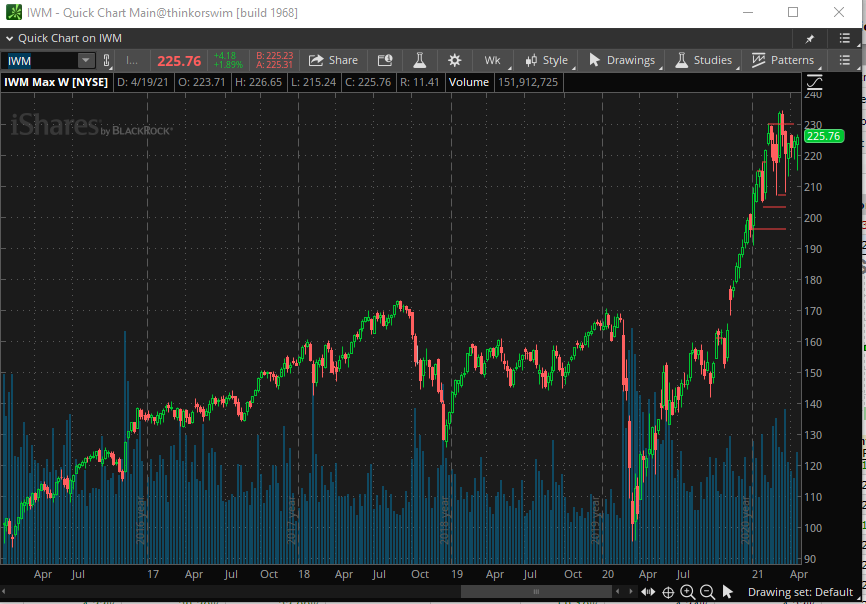

See, first they eyeball a chart like this:

Then these people, think about it, reflect upon the few crowded popular stocks their mote stems can remember like, $PTON falling 35% from its top tick (after an 800% rise mind you), and they say, “The froth has come out.”

Well, let’s just see what is really happening to all those Russell 2000 stocks that have broken technicals and have cooled off:

Say what? The index is perched near its top tick. Note to the fin-challenged, time flattens out the moving averages, so they are easy to breach. You’re welcome. (Selling investments and basic math don’t like to go together; this is some sort of investment management Italian dressing rule ((Neither does math-based risk management and selling risk, even worse, see the news.))

And while I’m at it. Beware of the ‘Tony Dwyer is a genius’ theme. The guy thinks the market runs on aero physics, that stocks and markets fly and stall like an airplane. No, no they don’t.

Speaking of apes, I’m working on a new theory, I call it “top tick syndrome”. Basically, what you hear all the time in finmedia, is something like, “Oh, the stock is down 20% from it’s high, it’s a buy here.” Oh really?

What makes people think that the top tick matters at all? Why do people that buy a stock think they are owed the top price they’ve ever logged in to see in their account? You know I’m right, they do feel that way. A manager or stock is only as good as the top tick, in the holder’s eyes. And the higher things go, the higher the expectations are for the future, regardless of how far the, ahem, ‘asset’ has come or how great the returns have been or have been pulled forward due to questionable monetary policy.

Top tick syndrome, is what may infect Powell to never raise rates or never quantitatively tighten. He might slow the pace of easing, but even that will, in all likelihood, get a nasty reaction.

Alright, so back to things that matter. I’ve got a feeling that this week was just an appetizer for the potential whipsaws of next week. Obviously, Jay the Autopilot will do his reticent tap-dancing routine on Wednesday afternoon. “Dot plots don’t matter”, and useless naffy dreck. The usual.

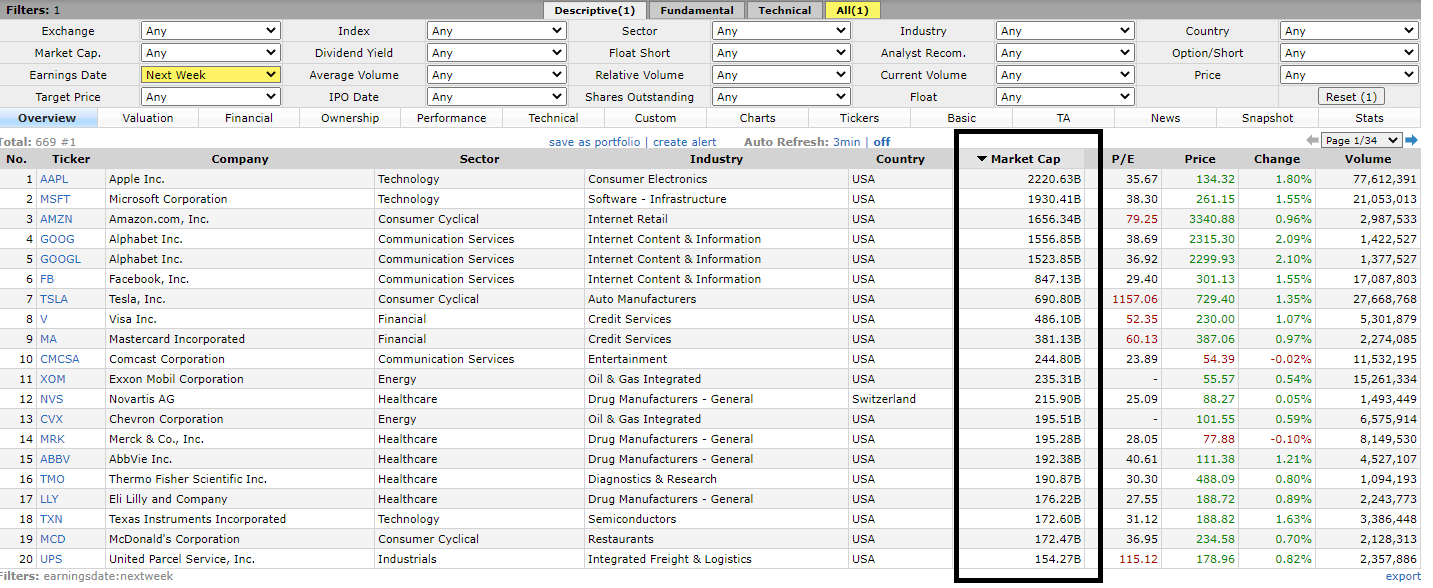

What matters is this:

Yes, earnings season begins next week. All that stuff before, weak opening bands; you stay at the beer garden while Dokken tries out some new tunes until Metallica comes on stage. Nobody cares that $CSX missed by a penny for the first time in years. (That is true though, that did happen, see you had no idea.)

(And speaking of bank earnings, these appear to be one of the biggest jokes there is during earnings season. ((Adjusted, refried, non-gaap social ebitda less other compensation expenses is clearly more comical, obviously.)) We can probably agree, that two things are true about banks. 1. No one knows what they’re up to, so Mr. Investment guru, don’t tell me their P/Es are too low versus the market. Maybe it’s because it’s totally opaque the risk they have and they deserve a higher risk premium. We just saw that again with $CS. 2. If regulators have a tough time figuring out where the risk is in the banking system, no suck-up conference call analyst is going to know. And banks use loan valuations as an earnings toggle like a bartender pours beer. Whatever flavor they are feeling like, “Here’s an extra pint of loan loss reserves to whet your earnings whistle, Fella.”)

So, at least, we are going to hear about companies that make actual money by taking your data and selling it. Now that’s a business! And many trillions of dollars of these businesses report this week. And everybody and their great grandma owns them, so, this matters to markets. It’s the show everyone has been waiting for. And afraid to sell until they see.

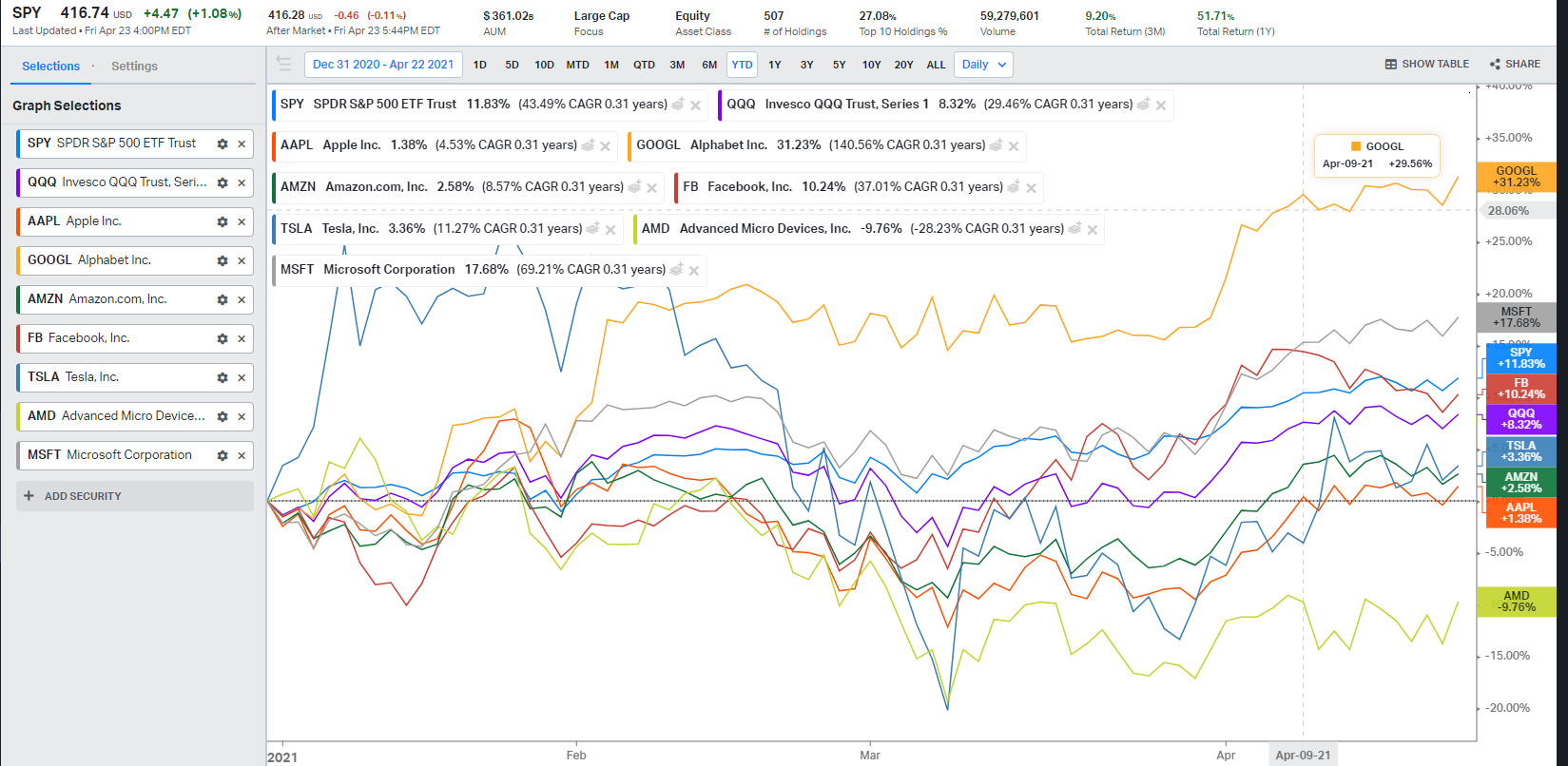

Now, I’m sure you’ve heard this too, “The FAANG stocks haven’t been doing that well, they’ve pretty much been basing since last summer.” Yeah, right:

No sane steward of capital should expect any more than what they’ve received since last summer in these stocks; they should be grateful, and in fact, should be worried a bit, that they might have actual risk in them.

At the end of the day, I’m sure they’ll put up whatever non-gaap stuff beats the eternally inept analysts that are always under their numbers. (Do any analysts have the guts to put the number where it should be?) There’s a whole fraud business based on this, call Estimize. https://www.estimize.com/ Here’s how this crock works. You sign up, you put your estimate 10 cents above the Street. Whammo, you and your crowdsourced buddies are better than the analysts! This site charges money for this! Amazing.

So, I expect that we are in a game of chicken scenario, where folks will want to sell a few things to pay taxes or take profits after these reports, a sort of, no encore at the earnings concert, bummer. Normal people and their managers may be selling a little, affecting markets as opposed to option driven gamma ramps/negative gamma flips. Just markets behaving normally as the Fed sponsored ATMs they really are.

I’m looking for some chop later next week, it should be interesting. I don’t see implied vol in May being particularly high or low, but I would imagine that the RUT will probably show relative strength versus QQQ a little longer, since a lot of those companies report afterward. As for early May, I want to see what happens late next week before I take a stab at that.

Volatility Trades:

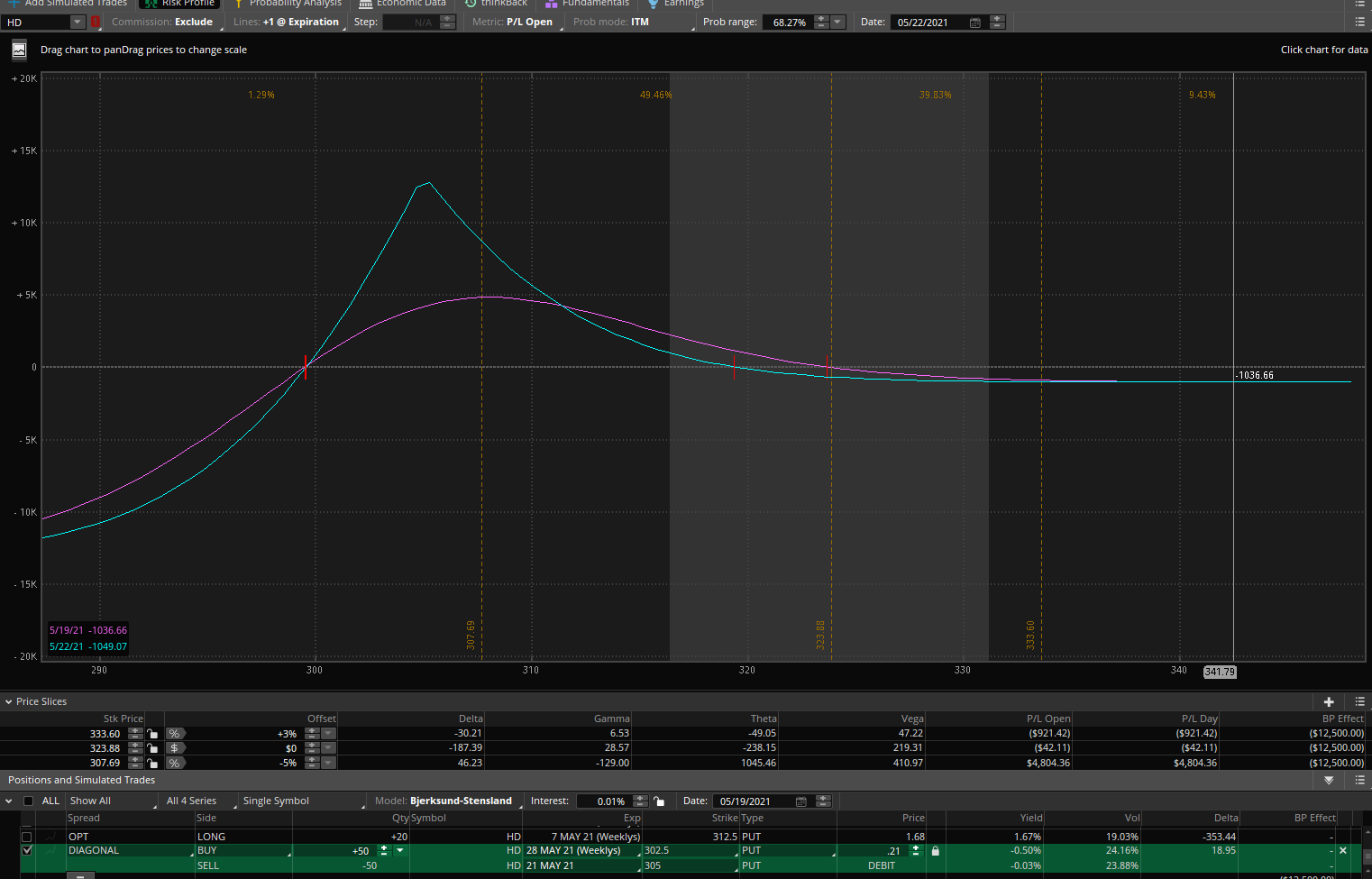

HD Earnings volatility diagonal spread

Sell May 21st $305 put

Buy May 28th $302.5 put

Net debit: .20-.25

The premise for the trade is in the chart:

For 20 cents, you get the post earning downside, they report on the 18th. It’s a popular stock, and for good reason, they make money and are privy to lots of different positive catalysts in the current economy. But that is almost comical euphoria, and you just know the machines are ready to cut this thing on a trend break. Plus, look at how the earnings reactions have been lately:

Nice combination, euphoric run into earnings combined with a history of hangovers. 20 cents is, let me see, a cost of .006% of the underlying price of $324. I’d call that cheap. The risk is it blowing through $305, and we know that isn’t going to happen, people love it. It’s going to be tough to get a buck on this, which is funny, since it is so loved, people will hammer it with puts hoping to actually get stuck the stock at a lower price. .50 is a good target.

AFRM lock-up expiration put calendar spread

Sell May $60 put

Buy June $60 put

Net debit: $1.10-1.20

I filled this today for as low as 1.10. Here’s the deal. This is a good company in my eyes, it is replacing usurious credit card fees with lower rates specific to what you want to buy. Anything that reroutes people from taking on penalizing credit card debt, I’m a fan of. But, getting some good trades takes work to understand who is buying and selling and we have this tidbit, from an SEC document that nearly nobody reads, the S1A:

What makes me laugh, is that there’s a grammatic error in the box above, literally the proofreader didn’t read it. Nice!

We know this. A. Not many shares have unlocked. B. Earnings are May 10th for the March quarter. C. Employees get to sell on May 12th. D. 7x as many shareholders get to sell on May 24th.

Are you with me now? The window opens on May 12th and then gets wide open after the short leg of this pair expires. They don’t have weekly options, so, it wasn’t like we could thread through a tighter time hole, but for the price, I’m totally fine with that. 1.6% of the underlying for 28 days under $60 is a good price.

Now, the chart:

$63 was the low recently, so $60 seems like a good place to start this trade. Now, this is not a dumb stonk like COIN; it only has an $18B market cap, on just less than $1B in revenues. For comparison, $SNAP has a $94B market cap on $3B in revenues. So, this stock isn’t even a stonk, so it’s not going to crater, it’s probably attractive to smart guys waiting for it to come in on people allowed to sell. I’d be happy with $2-2.5 or so.

.

Volatility Analytics Newsletter – Apr 17th

Observations and High R/R hedging trades

Watching markets these days for a vol trader is like being in church as a 12-year-old. You are just waiting for it to end, and it seems to take forever; you are in vol purgatory.

Equities markets have cover. Who is going to sell before you get to the main event, tech earnings? And that is still two weeks away. So, wait you must.

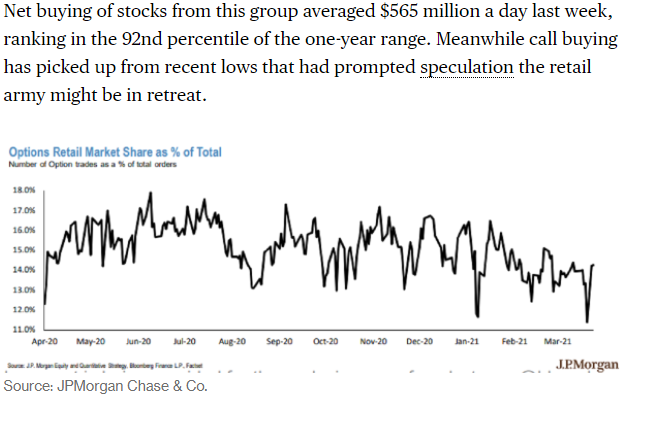

And, this cover, the lack of sellers lets the option traders move markets. Just when the ludicrously out of touch finmedia and punditry started suggesting that the option retail trader has gone away, that he has “decided to spend his stimmy checks on real activities”, or something similarly inane, well, guess who’s back doing what they do best, driving the gamma bus to sights unseen.

They are NOT as dumb as the dumb money thinks they are. Smart money is small and dumb money is big. The roles have been reversed in the era of widespread financial information sharing. (At least in the options world, not commenting on the nouveau asset classes that are all the rage obviously.)

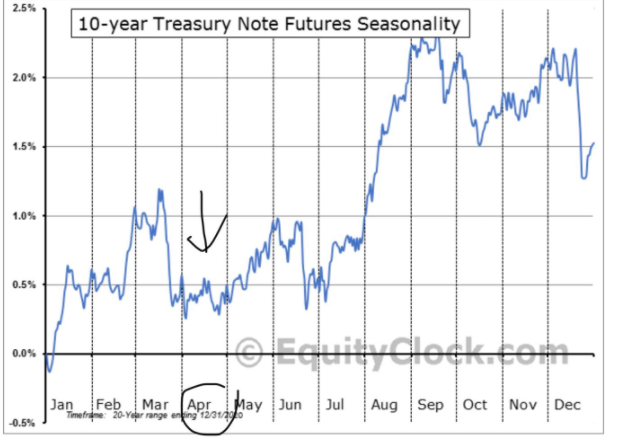

In my volatility forecast, when things appeared tumultuous two weeks ago, I commented on bonds and tech stocks:

“I like to keep an eye on historical seasonality, for no other reason than you can be darn sure the code and the machines know. And you can bet, they are looking at the fact that bonds and tech are entering a strong seasonal period through July. While folks may not expect bonds to hold up, the current infrastructure hype, well that has like many, many months of wrangling and procedure yet to go and who knows how much will get done. It’s not like the Treasury needing additional debt for that is a near-term issue:”

Look, I’m no genius. If I can figure this out, then you can be darn sure smarter option traders at home know all this as well. And they appropriately stayed away from calls in late March, and knew when to start adding them again.

And a simple little chart on the seasonality in 10-yr treasury futures, well, right on schedule while everyone on tv is scratching their heads this week, after a late March drop that was right on schedule as well:

Sometimes, it makes you wonder how little work big money managers actually do. It’s not like I’m burning the midnight oil on research. (Just tweet rambling at those hours. Twambling perhaps.)

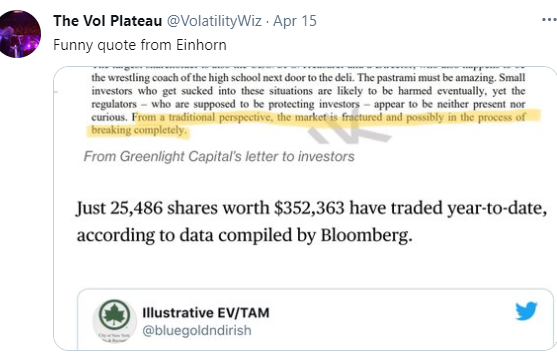

Einhorn elicited a chuckle yesterday. He’s market stymied, making no money these days, outside of whatever egregious fees he charges. And because he’s a baffled billionaire, just part of a growing legion, he’s claiming the markets are on the precipice of blowing out the camshaft:

Doesn’t sound like he’s breaking out the boas for his East Egg Roaring 20’s theme party this summer.

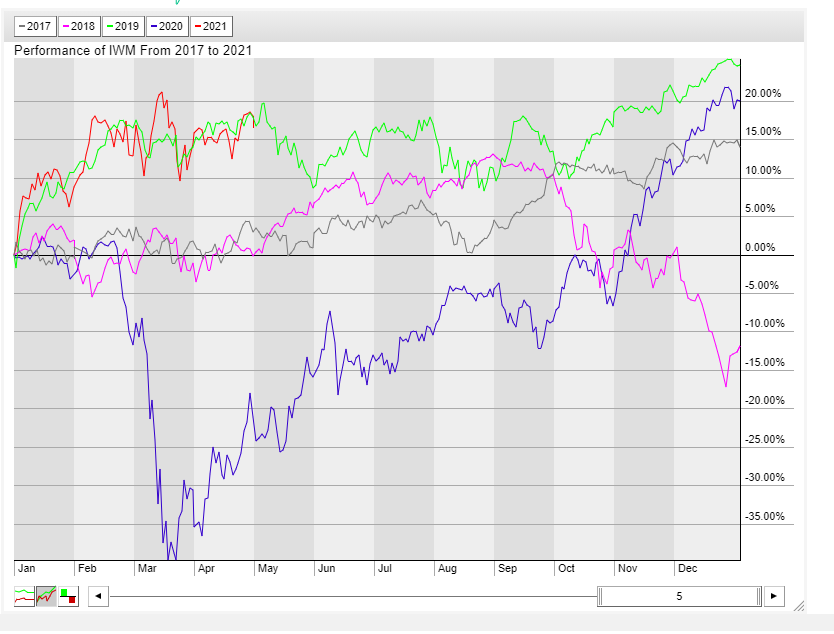

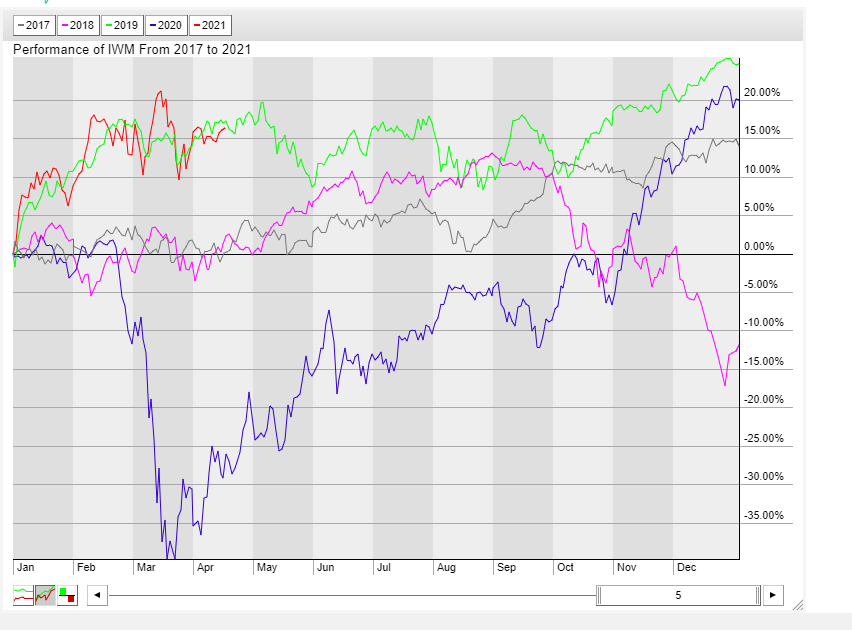

Looking ahead, I’m still eyeing 2019 analogs for potential clues. IWM is still tracking that very nicely:

Uncanny, you just can’t ignore that. The correlation makes sense, in that in the prior years, 2018 and 2020 had shock downs in the indices. So, we will go here for a trade to try to thread the time needle.

Looking at the S&P 500, you see something similar:

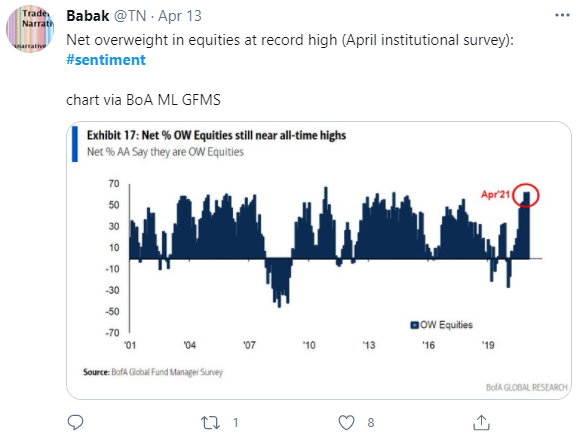

One way we can look at this situation, is that exposure to stocks is at record levels among institutions, managers, advisors, and individuals at the same time. Managers:

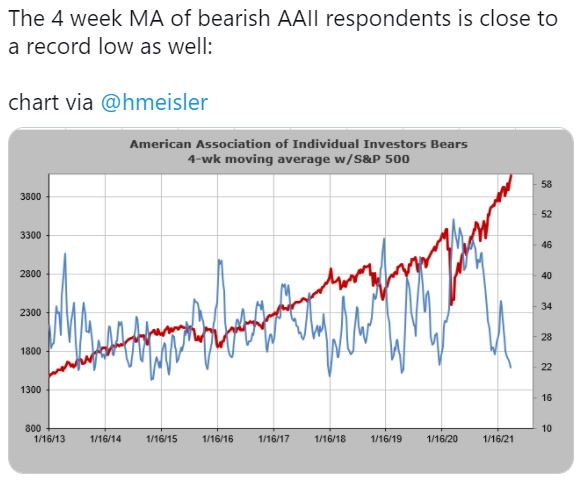

Individuals:

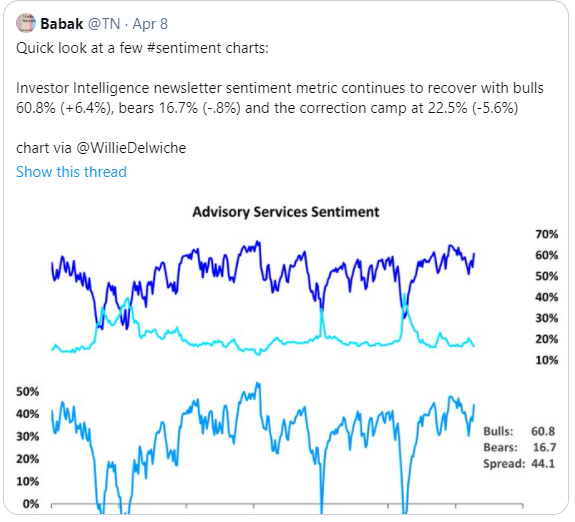

Advisory services:

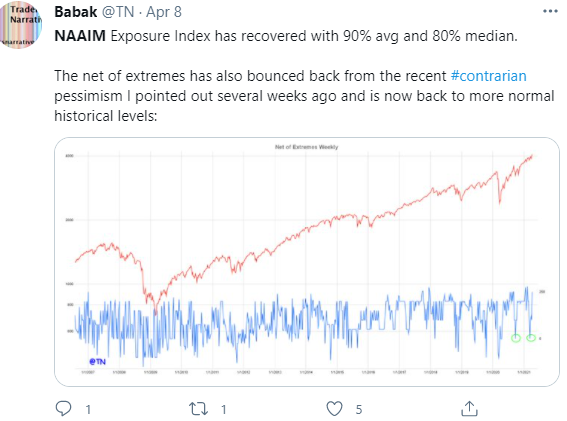

National Association of Active Investment Managers:

Households:

So, it wouldn’t surprise me to see a situation where, the options folks roll off having caught the earnings wave they were looking for, wisely, dealer hedges roll off, and what you have is all of these long equities’ groups sitting there almost/as long as they can be, looking at each other, wondering who’s going to carry the baton.

And then we drift down, while it scrappily tries to hang on.

In 2019, looking at the S&P 500, what you see at the end of April, was a market that had recovered everything from Powell’s rate/taper double gaffe in 2018, and you see a modest retracement with a lot of bottom wicks, showing you that for several days, the market hated finishing at the lows, but closed lower than the open. Until a May opex ramp, shocker.

I’m not predicting anything specific, but would this surprise you if it played out somewhat similarly? The seeds are being planted for some sort of temporary exhaustion in positioning and seasonality.

Volatility Trades:

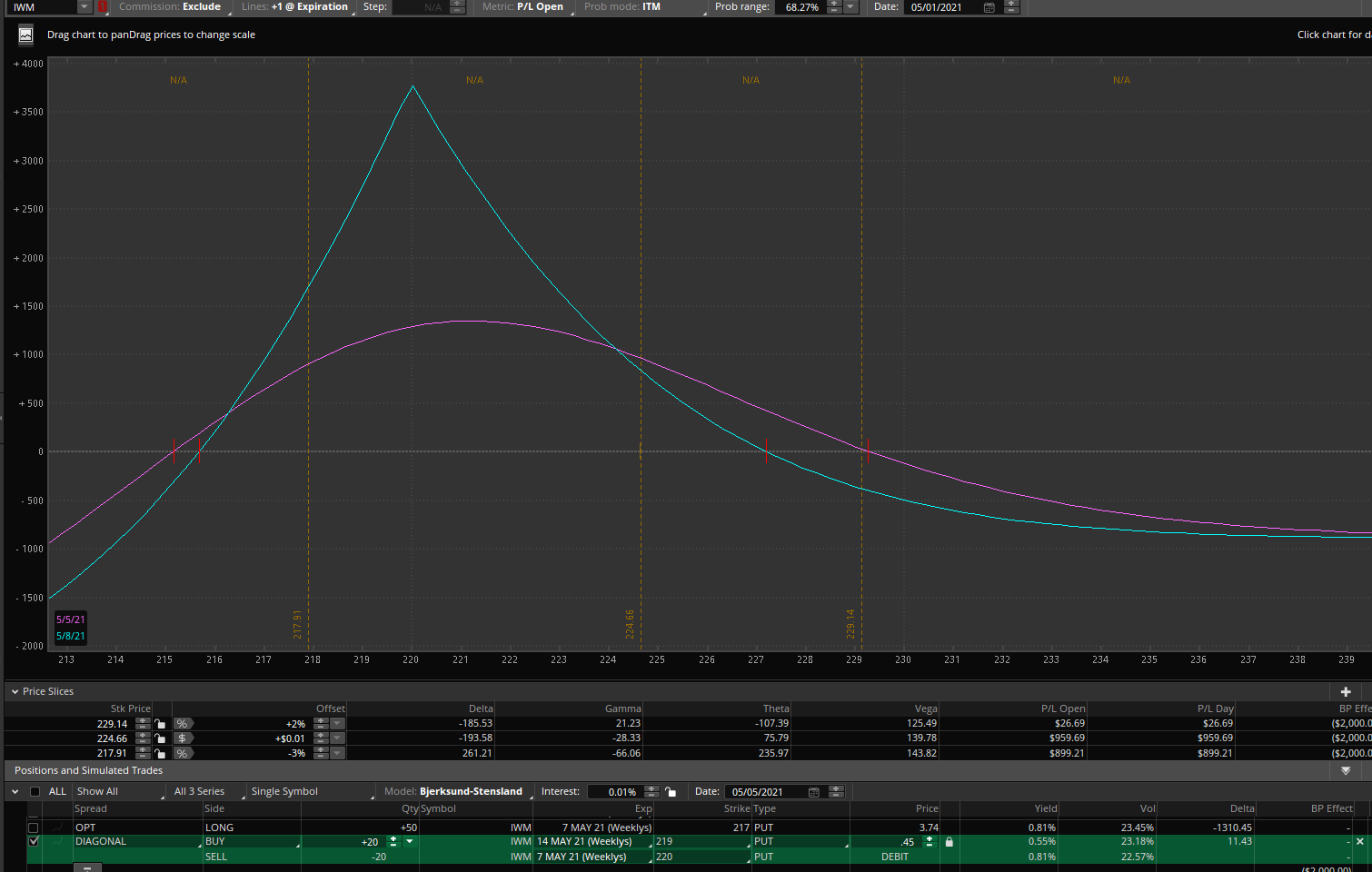

IWM Put diagonal spread

Sell May 7th $220 put

Buy May 14th $219 put

Net debit: approximately .45

I highlighted above that the IWM likes to hang on a little longer into May, because the companies that report in here in the aggregate report later in the earnings cycle. Thus the short leg on May 7th. I’d look for .70-80.

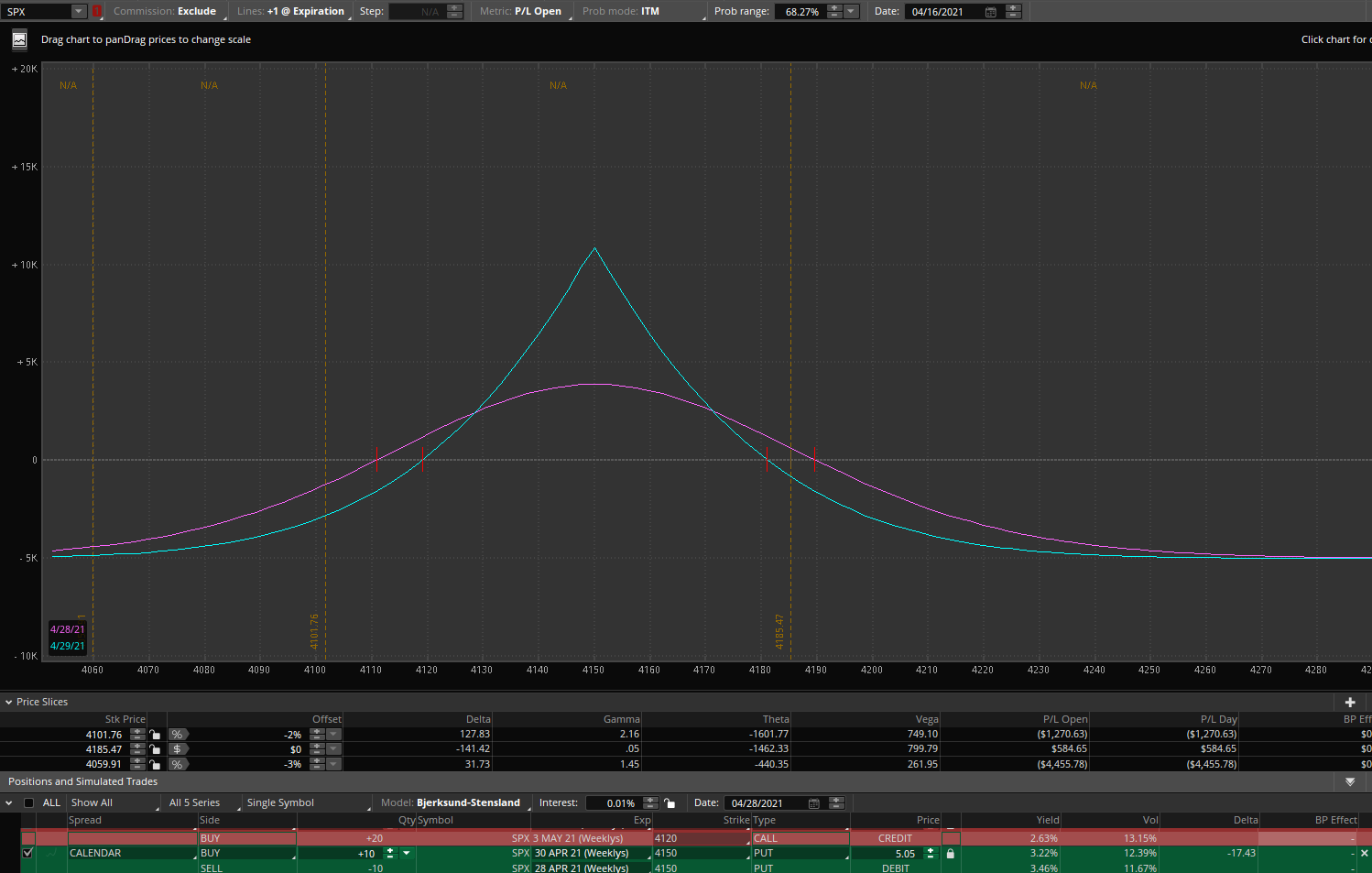

SPX put calendar spread

Sell Apr 28th $4150 put

Buy Apr 30th $4150 put

Net debit: 4.80-5.00

The premise here is twofold. First, April 28th is Fed day. And it also is the dividing line when nearly all the FAANGs will have reported or are about to report. This is probably the call crowd’s end of the line. For 5 SPX points, you get exposure into the end of the month below 4150, a 1% drop from here. Getting $9-11 would not surprise me. The risks are either things going berserk to the upside before then, or the market tanking earlier.

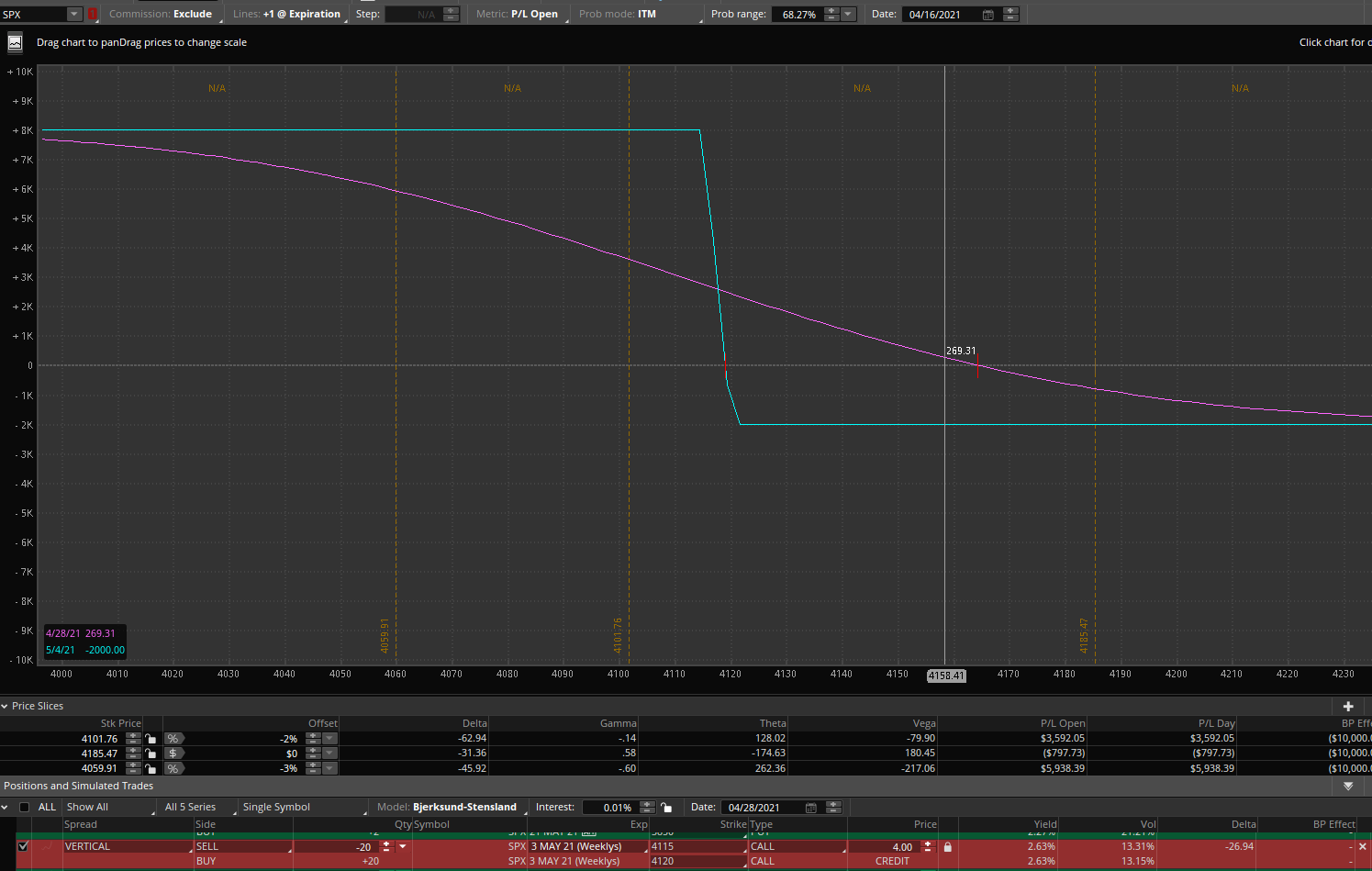

SPX short call vertical spread:

Sell SPX 4115 May 3rd call

Buy SPX 4120 May 3rd call

Net credit, $4

Let’s say you expect more of a reckoning into early May, or, you want to start a cheap hedge. For collecting $4 on a $5 wide spread, a 2% retracement in SPX will pay 4-1 reward vs risk. And, since it’s cash settled, no exercise risk by being too deep in the money. And, if this works, you pay less in tax, due to 1256 60% LT/40% ST tax treatment.

This trade simply just can’t burn you much in the short term. If the index rises 50 pts on Monday, it will go to about 4.40 or so, a loss of .40, but if the market drops 50 points, it will crater to $2, a gain of $2. What’s not to like? So, you have plenty of time to watch the lunacy continue as you wait for a change in trend.

Volatility Analytics Newsletter – Apr 9th

Post Earnings Trade Ideas

Nothing has changed. It’s the time of the month, expiration cycle, and the quarter, before earnings, when the market tends to grind higher, and since my comments from last week still apply toward market behavior and volatility, best to just focus on the trade ideas.

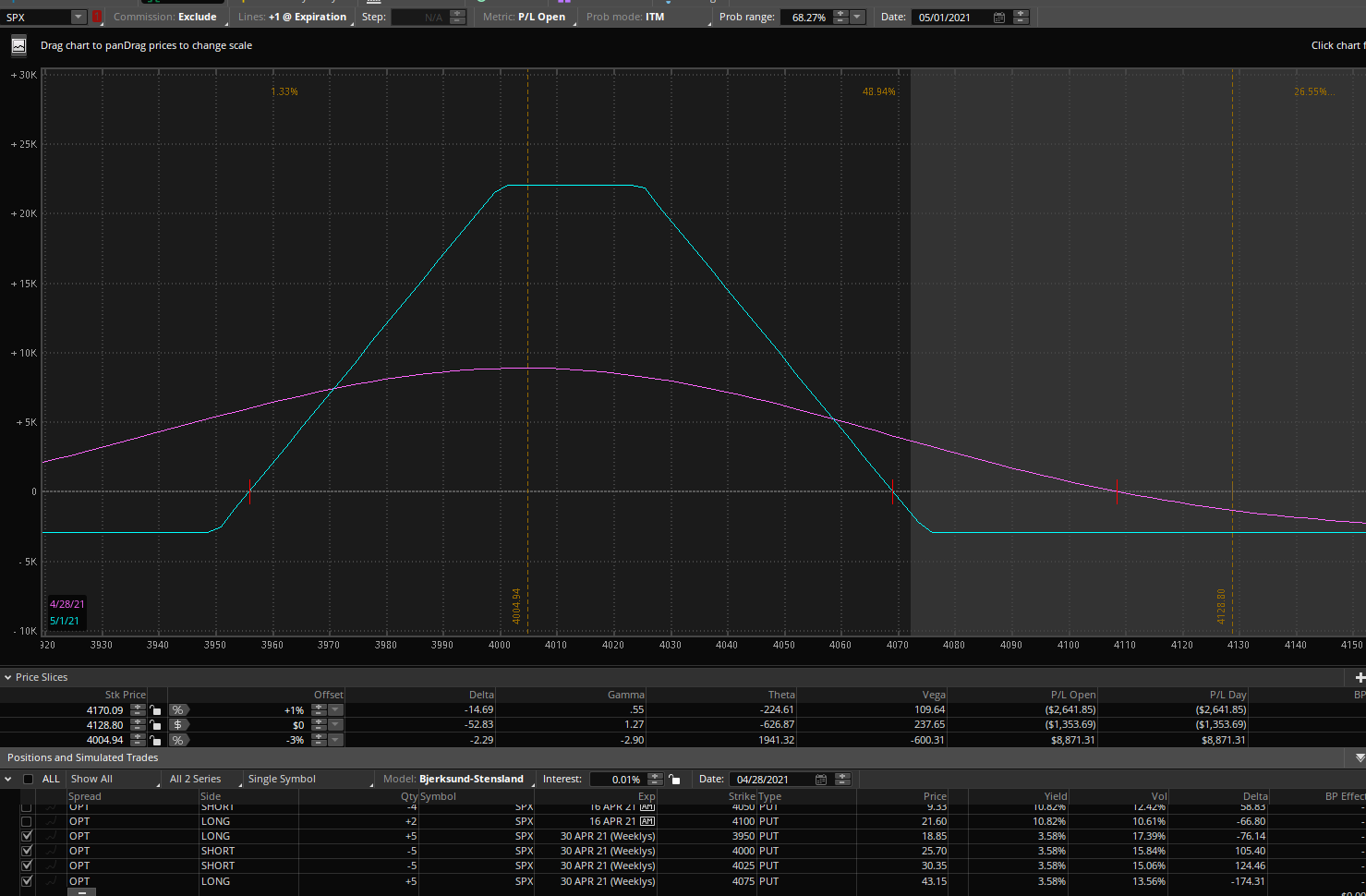

SPX put condor spread:

Buy Apr 30th 4075 put

Sell Apr 30th 4025 put

Sell Apr 30th 4000 put

Buy Apr 30th 3950 put

Net debit: $5-5.50

The Fed meeting is April 28th. On that date, after the bell, $AAPL, $AMZN and $FB report. The day before, $GOOG, $MSFT, and $AMD. On the 26th, $TSLA. The night after the Fed meeting, there won’t be much left to look forward to for shareholders (outside of gallivanting with boas during this decade’s edition of the Roaring ‘20s, of course), and the ‘sell in May’ thing will be staring folks in the face.

For only five S&P points, you get 50 points of width in this spread, and a meager two percent drop from today’s close at that point, will make this worth much more. I’d take $12 or so. It will not decay much in the near term.

QQQ put diagonal spread

Sell Apr 30th $322.5 put

Buy May 7th $322 put

Net debit: .70-.75

Again, a cheap post FAANGs, post-Fed trade. For a mere .2% of the underlying, you get all the downside premium/vol below $322 on April 30th. This could easily turn into $2, but depending on what I see toward the end of the month, and where QQQ is then, $1.50 might be more reasonable.

JPM put butterfly spread

Buy Apr 30th $155 put

Sell 2x Apr 30th $145 puts

Buy Apr 30th $135 put

Net debit: 1.75-1.90

Post earnings, volatility lately in this name tends to rise. Earnings are next week, so this trade gives it time for the euphoria of not getting caught in levered swap scandals to wear off.

Looking at how the stock has done post earnings recently:

What you can see, it that in the last two earnings releases, the stock retraced after a few days and implied volatility in the bottom panel actually rose post-earnings. It’s usually the opposite for most stocks.

Seeing as that we are getting this for less than $2 right at the money essentially, any drop post-earnings by April 30th will do fine. A 4-5% retracement from here would be ideal to get at least $4.

AAPL put diagonal spread

Sell Apr. 30th $126 put

Buy May 14th $124 put

Net debit: .20-24

The markets (people) have awfully short memories. Must be all that legal marijuana. The stock was below $120 a couple weeks ago, but now the market assumes that certainly isn’t going to happen anytime soon:

For probably 20 cents on Monday, you can own two weeks of April 30th to May 14th downside below $124. That is a ludicrously cheap price. What happens if AAPL takes off and never looks back to another 4-1 split? You lose 20 cents. Oh well.

What’s comical about AAPL true-believerism this time around, is that the stock usually sees rising volatility into earnings, as you can see in the lower panel. But this time, nope, everyone is completely comfortable that they will bring this bird in with another spike and no sellers to be found. That’s fine with us, I’ll take this any day, over and over for .20.

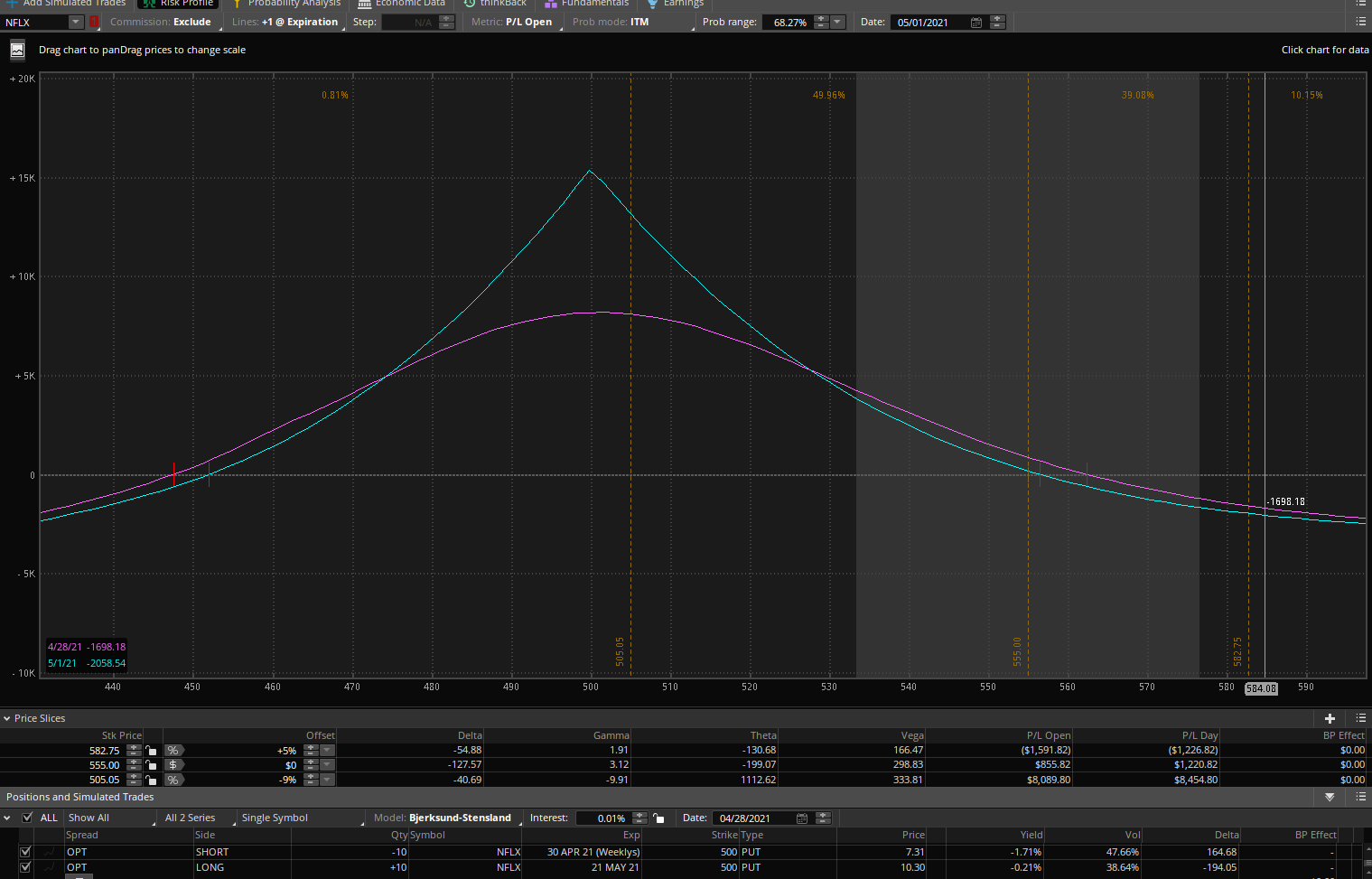

NFLX put calendar spread

Sell Apr 30th $500 put

Buy May 21st $500 put

Net debit: $2.40-2.60

Reopening fade after earnings? You’d like to think that, but people don’t care about anything related to this stock fundamentally since Blockbuster died. I mean, they constantly issue cheap debt to build a library of “assets”, much of which no one will ever watch again. And, everyone has a streaming service now, or it’s coming.

The premise is simple, the stock gets bought around $500 every time. And this trade gives the ‘net new subs’ eurphoria ten days to wear off and holds three weeks of premium below $500:

DASH put calendar:

Sell May 7th $120 put

Buy May 21st $120 put

Net debit: .80-1.30

Well, DASH announced today after the close that earnings will be on May 13th. Perfect. Now we know when the remaining shares will unlock, May 18th.

So, here I am selling the premium the week before earnings and owning the earnings vol and the lockup vol. To get all that for less than $1, two weeks wide, well, these kind of trades just don’t come our way very often.

Forget about that this company will basically never make any real money. And it has a $45B market cap! Laughable, but these are the times we’re in.

Clearly, $120-130 has been support, why? No idea. The offering price was $102 and there is no requirement tied to price as related to the offering price of $102 on the final lockup expiration, that was only for early lockup. (see chart from last week’s letter). In fact, you could see folks get shaken out near $102 this year. But, that support is where we set the trade. I’d look for $3-4.

If it decides to run higher between now and the end of April, I will adjust with more spreads at higher strikes, provided the spreads haven’t widened out to be unattractive.

I’m expecting another quiet week, because vixpiration is after opex, and earnings aren’t here yet, but to see a minor hiccup this week, I suppose with opex that is quite possible, but… everyone is already saying that is a buying opportunity. That’s what they always say when things are stretched.