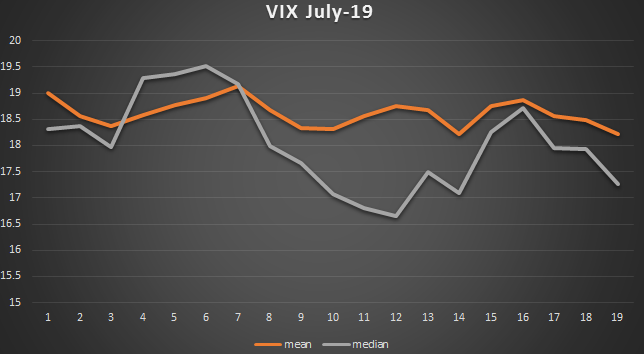

The Dow and S&P touched their record intraday highs and reversed course today as bids were hit constantly between 3 and 4 pm. The Dow fell 140 points from the high and the S&P fell 12 points from its high into the close. Today was eerily similar to the May 22nd reversal that ended up being the top for six weeks. The VIX futures couldn’t have cared less:

| Symbol | Contract | Month | Time | Last | Change | Open | High | Low |

|---|---|---|---|---|---|---|---|---|

| VX Q3-CF | S&P 500 VOLATILITY | August2013 | 16:41:08 | 13.90 | -0.40 | 14.30 | 14.45 | 13.65 |

| VX U3-CF | S&P 500 VOLATILITY | September2013 | 16:41:08 | 15.40 | -0.30 | 15.70 | 15.75 | 15.15 |

| VX V3-CF | S&P 500 VOLATILITY | October2013 | 16:41:08 | 16.35 | -0.35 | 16.71 | 16.73 | 16.20 |

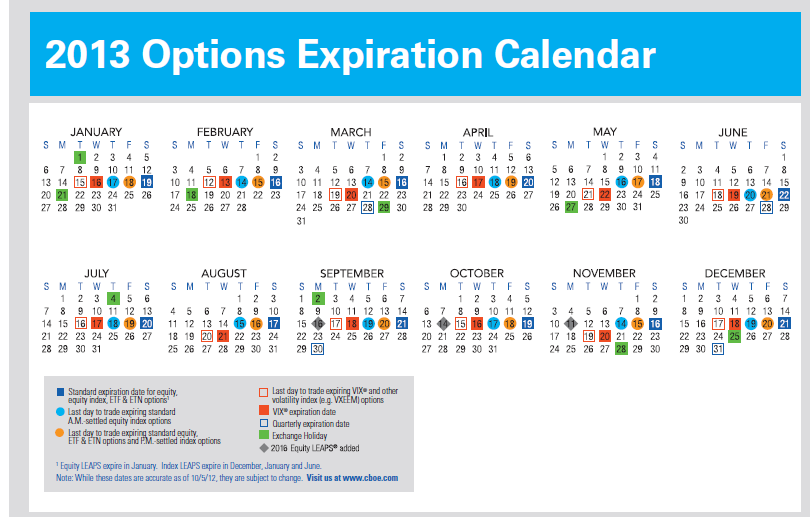

With the VIX sitting at 13.45, this is a very narrow spread to spot VIX. It is not unique this year for the front month to be this low and the spread to be this narrow, but it is unique that this is occurring with 3 weeks to expiration. The futures are sending a message that the VIX is going to 12 or lower without any premium for unforeseen event risk. It is a very loud all-clear signal. Is this message correct? Who knows, but the futures are charting a new course here.

All year, even as the futures fell toward VIX closer to expiration, they maintained a larger spread than .50. Here is one recent example:

| Date | Near | Next | Days to | VIX | Spread |

| Month | Month | Exp. | |||

| 05/10/2013 | 13.85 | 15.10 | 8 | 12.59 | 1.26 |

| 05/13/2013 | 13.65 | 15.10 | 7 | 12.55 | 1.10 |

| 05/14/2013 | 13.55 | 15.05 | 6 | 12.77 | 0.78 |

| 05/15/2013 | 13.70 | 15.15 | 5 | 12.81 | 0.89 |

| 05/16/2013 | 13.95 | 15.35 | 4 | 13.07 | 0.88 |

| 05/17/2013 | 13.20 | 15.10 | 3 | 12.45 | 0.75 |

This was only a week to expiration, and the spread was much wider with the VIX at lower levels! This has been the pattern every time the VIX fell to this level. But the market Payday Loan action today as a reversal hammer was put on the chart did not impress anyone in vol land. It will take much more to get their attention. A convincing break below 1675 perhaps, the range for over two weeks.

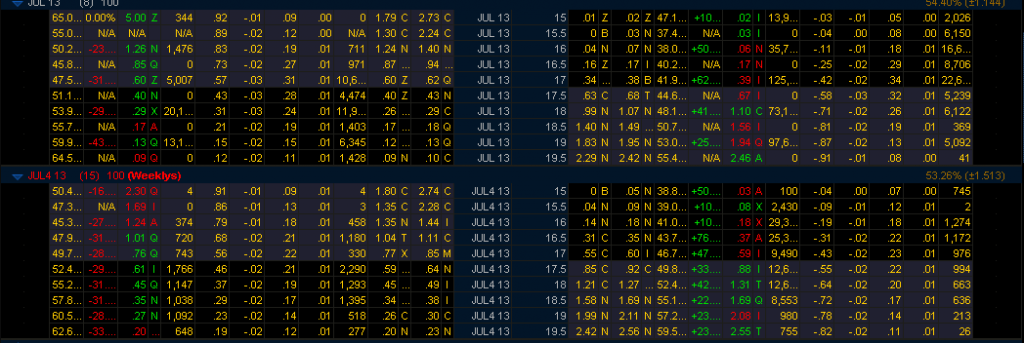

Implied volatility in the VXX has plummeted. At the money call IV’s are in the 30’s. Amazing. It’s far from rare to see IV between 80-100 on the VXX. The actual value of the VXX is 9 cents lower than the closing price, just something to be aware of if you are putting a position on. The ticker on Yahoo is ^VXX-IV. Anyone should know where this stands at all times, as this is the NAV of the futures in the VXX.

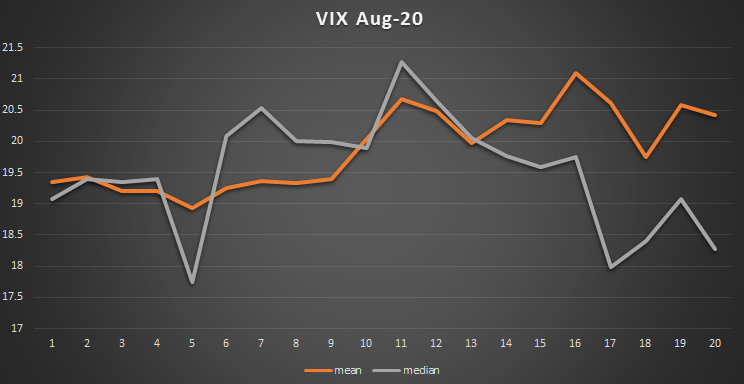

What to do then? The VIX last August fell into the 13’s but the futures fell below 15 only at expiration. This is a new paradigm. The only expectation in the market right now is for lower volatility. This is while the VIX rolls into September:

VIX Volatility Index values generated at: 07/31/2013 15:14:58

| Trade Date | Expiration Date | VIX | Contract Month |

| 7/31/2013 3:14:58 PM | 13.06 | 1 | |

| 7/31/2013 3:14:58 PM | 13.57 | 2 | |

| 7/31/2013 3:14:58 PM | 14.57 | 3 | |

| 7/31/2013 3:14:58 PM | 15.17 | 4 |

Do you really think that heading into September the VIX will be 13? I don’t. At some point the futures will stop falling. The problem to solve is when to get long volatility. I’m not inclined to get long volatility right now, outside of the aforementioned calendars which really are a theta play first. In fact every little pop in vol has been a boon for VXX put buyers. Today they made a fortune, again.

Just for reference, not that it will matter in these POMO times, August is one of the worst months for stocks historically, #10 Dow, #9 S&P, and September is #12.