As the Syria situation is beginning to appear like bad parents having difficulty enforcing a one-week grounding for smashing the family car while drinking and dragging, the leaders will meet at the G20 in just days, as the big players return to the desks next week with little clarity. If this blows off, there’s the job report/Fed fiasco, DC buffoonery, and just plain bad market seasonality to deal with.

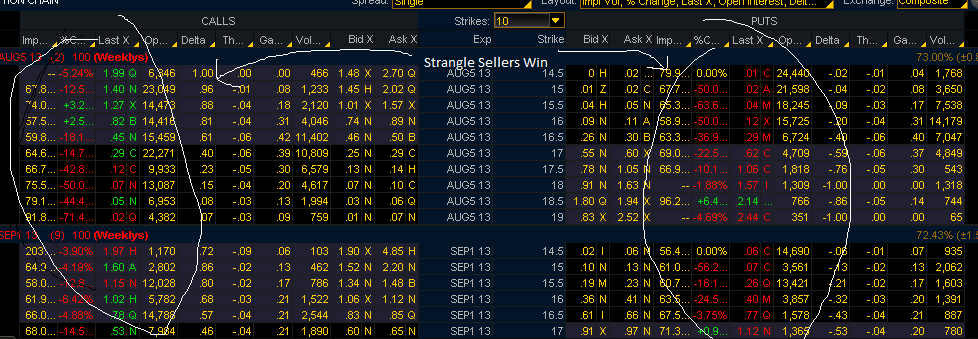

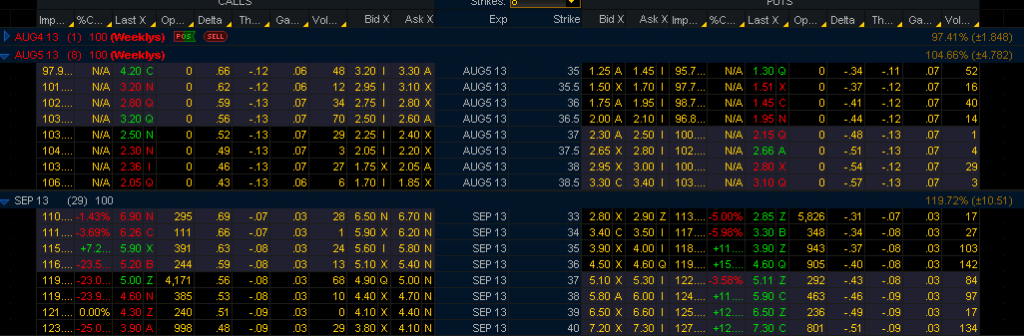

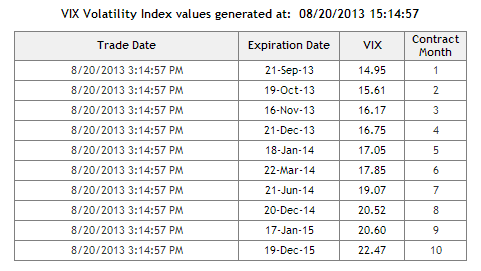

The VIX and VXX rose, catching up with the after-hours futures move we highlighted yesterday. The VXX also rose on a day when the market was up, which is pretty rare. It is not rare to see the VXX fall when the market falls, but the reverse is rare. This is indicating that the futures are seeing higher future vol than the options (significant premium over spot VIX) while one must keep in mind that the three day weekend decay will do some depressing in options vol, holding down the VIX a bit. The Sep VIX future:

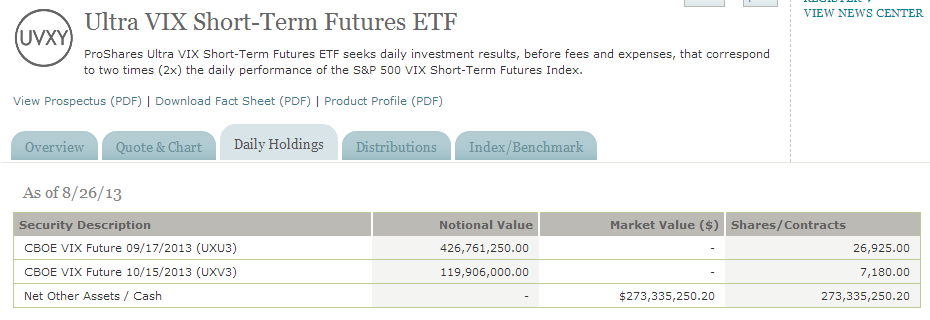

The VXX is now holding 60%/40% of September/October VIX futures, so it is important now to give as much attention to the Oct future:

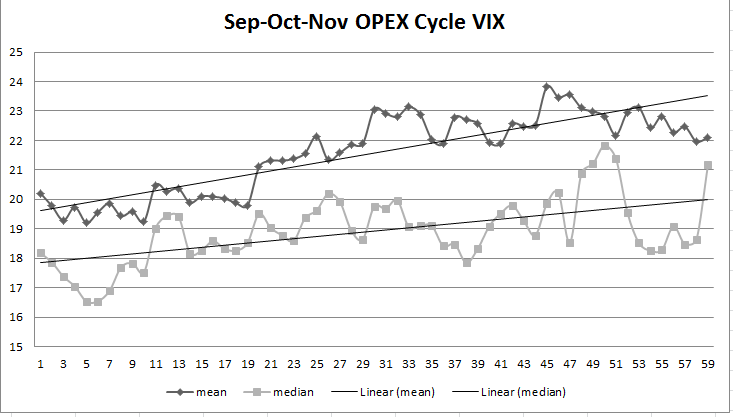

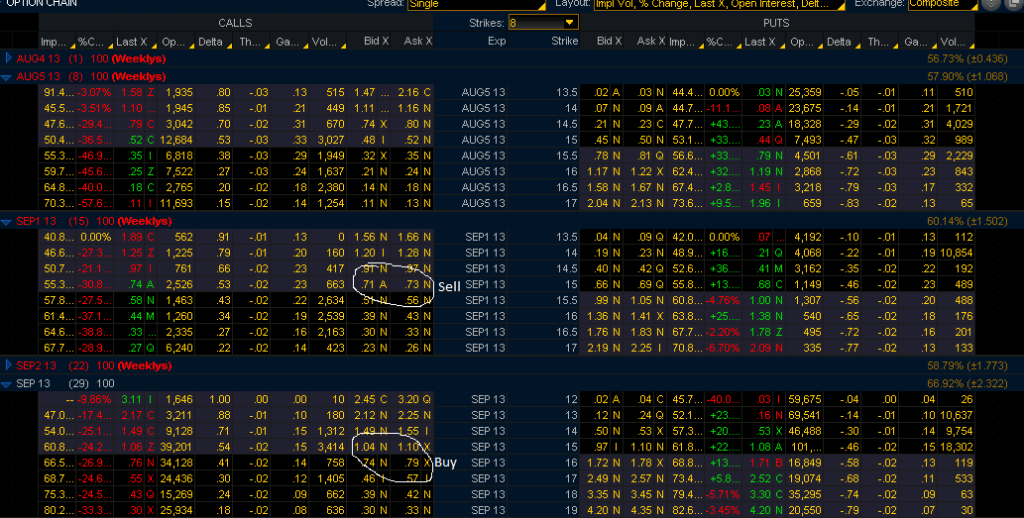

With October nearing 18, now things are seemingly reverting to the long term average for this time of year:

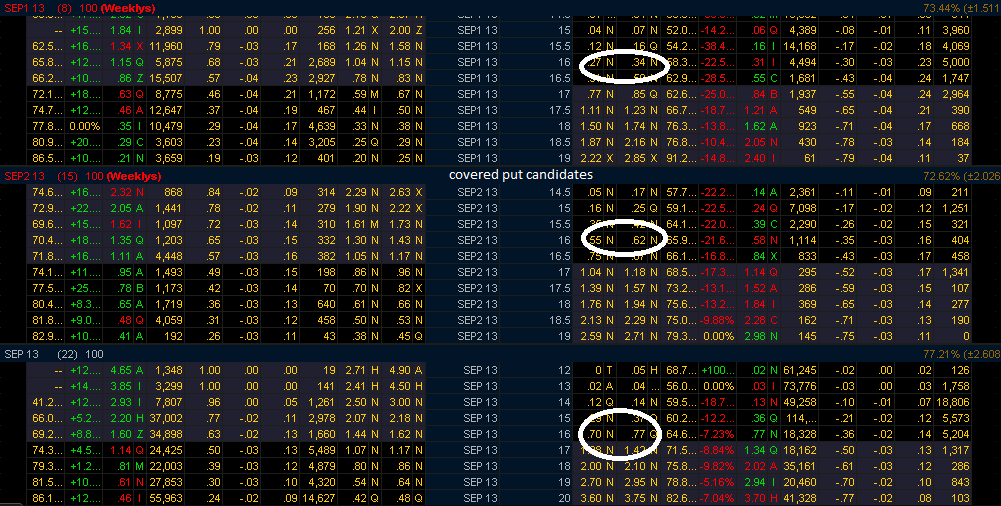

We may be nearing a point where shorting the ETN’s and selling puts against it will work nicely. This is a covered put. The idea would be to sell the VXX or UVXY, knowing they have long-term gravity, but in the meantime as the futures remain high, make money selling puts against the short position. This can be done for week after week in the VXX:

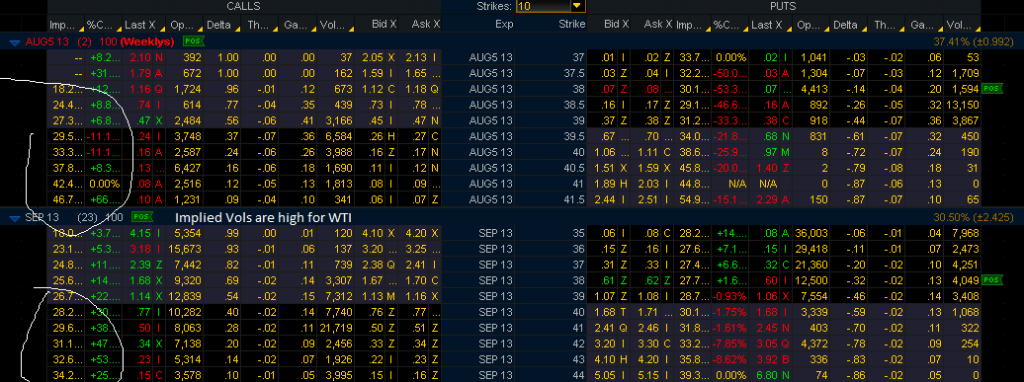

Meanwhile, oil decided to make me look good just hours after yesterday’s post:

Have a great weekend everyone. The next two weeks should be fun, if not sickeningly hyperbolic and repetitive. Maybe you can invite your friends over for a CNBC taper drinking game. (Fast Money is worth 50 “tapers” alone….)