For most of the month of November, the negative roll yield on the VXX was fairly low, frequently in the 4-5% range. The reason for this primarily rests with the month of December, and the inherent seasonality of the VIX.

The holiday market closures (extra decay when stocks sit idle) and seasonality of the equity markets have huge December and January VIX effects. The S&P’s top performing month since 1950 is December, and it is also #2 for the Dow Jones Industrial Average. As slowly rising markets are inversely correlated with a rise in the VIX, the options market anticipates lower volatility, and investors are unwilling to pay a high price for S&P options.

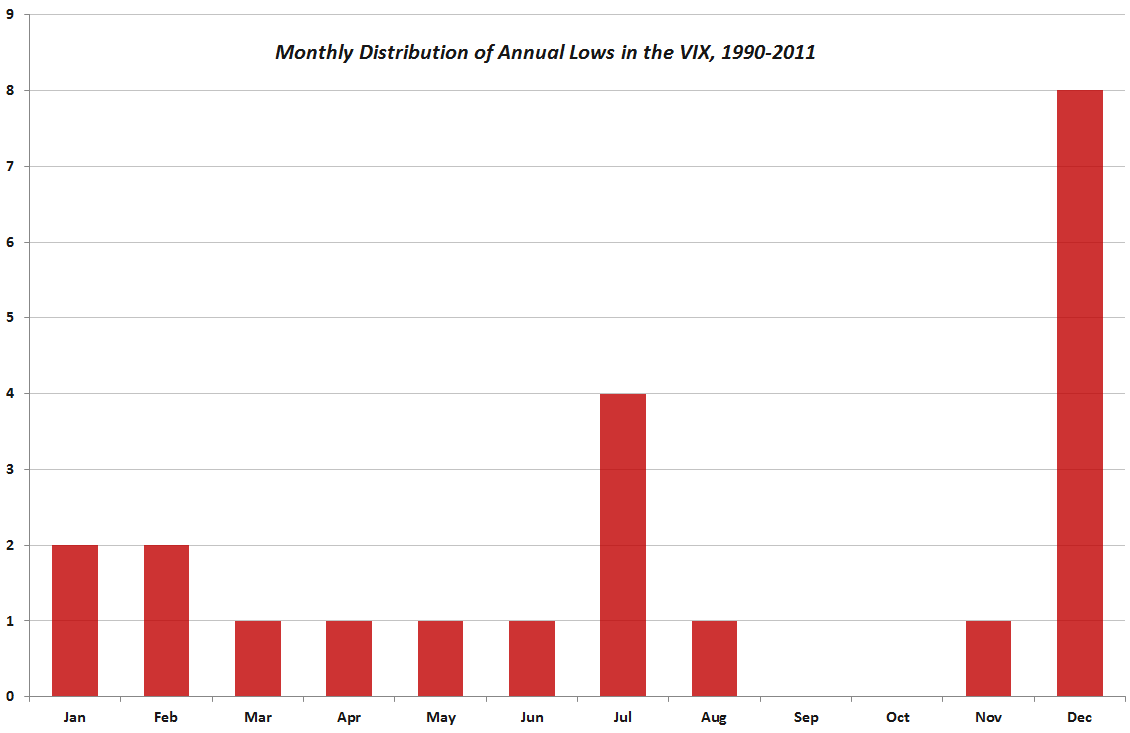

The chart below, courtesy of Vixandmore.blogspot.com, demonstrates the distribution of annual VIX low points. Clearly, December has a significantly high probability of being a low point for implied volatility for the entire year:

Source:http://vixandmore.blogspot.com/2011/12/december-is-cruelest-monthfor-vix.html

Now we can assess the damage that will be done to the VXX. It will hold all December VIX futures at the open on Wednesday, and will be rolling into January for the next 23.5 trading days. Current December and January VIX futures at the close on Monday:

| VX Z2-CF | S&P 500 VOLATILITY | December2012 | 16:35:53 | 16.60 | -1.62 | 17.95 | 18.05 | 16.55 |

| VX F3-CF | S&P 500 VOLATILITY | January2013 | 16:35:53 | 18.65 | -1.29 | 19.62 | 19.65 | 18.45 |

The negative yield as a daily calculation:

2.05/16.60= 12.3%. This essentially means that the VXX will fall by .123 / 23 x $31.7 = .17/day, every day, all prices remaining stagnant. If the January and December futures fall closer to a spot VIX of 15.2, then there will be additional decay to the ETN.

As the VIX falls below 15, a better option for hedging volatility is the VIX options, as they do not carry the headwinds of the VXX. In fact, deep in the money VIX options look attractive when the VIX hits yearly lows, as they have less extrinsic value and offer quick returns in the case of market sell-offs due to ineptitude in Washington.