It certainly is quiet out there. The S&P’s typical “case of the Mondays” weekly sell-off could only muster 3 points lower on the index for an hour before it meandered higher for the rest of the day. This kind of action decimates the VIX and volatility products. The VIX couldn’t even open higher on a Monday, which is telling as it has a tailwind of repricing implied volatility due to the weekend decay.

The VIX is still outpacing the front month futures in a race to the bottom, with the finish line being expirations dead ahead. This month is fitting the model to a tee thus far, and long holders of VIX related derivatives are hurting.

VIX Futures Chain:

| Symbol | Contract | Month | Time | Last | Change | Open | High | Low |

|---|---|---|---|---|---|---|---|---|

| VX H3-CF | S&P 500 VOLATILITY | March2013 | 16:48:16 | 13.00 | -0.80 | 13.90 | 13.95 | 12.95 |

| VX J3-CF | S&P 500 VOLATILITY | April2013 | 16:48:16 | 14.45 | -0.67 | 15.30 | 15.30 | 14.35 |

| VX K3-CF | S&P 500 VOLATILITY | May2013 | 16:48:16 | 15.55 | -0.53 | 16.12 | 16.20 | 15.45 |

| VX M3-CF | S&P 500 VOLATILITY | June2013 | 16:48:16 | 16.40 | -0.25 | 16.79 | 16.85 | 16.25 |

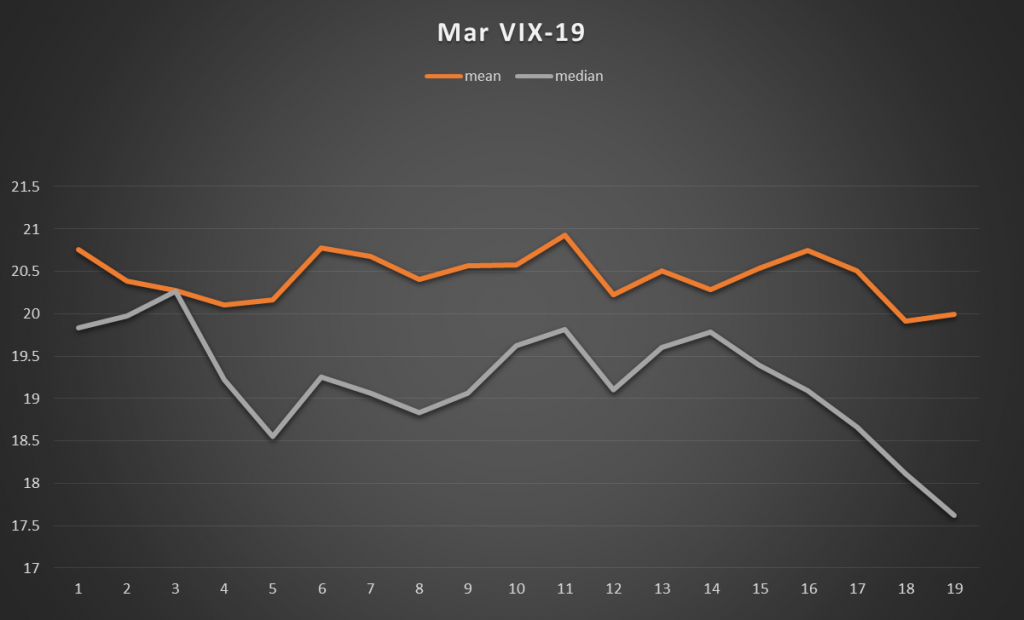

The VIX fell 1.03 or 8.18% (that’s a percentage of a percentage) while the March contract fell .80 or 5.8%. So the spread actually widened. There isn’t much hope for these contracts, as this is how March typically plays out:

Yes, we are running out the last few days of this cycle, so history is suggesting that save for a tsunami or other unforeseen event, it’s going to be a quiet week.

Trade/Action:

Our VXX $19 puts finally priced out appropriately, rising 20 cents today, bringing our paper profits to over 100%. Now the game is afoot, what to do from here. We are going to target $1, now that the delta has kicked in, the risk/reward is shifting, and 3% down days in the VXX are going to make a big difference in these options. Â History is behind the market this week as well, as history demonstrates that this is a strong week for equities.

New Trades:

Long VIX calendars

Short March $13/Long April $13 for 1.50

Short March $14/Long April $14 for 1.30

With just days until expiration for March, the VIX is going to have to really move to hurt us on these spreads. And frankly, the moves on the long legs will probably more than compensate us in the event of a VIX spike. Then we ride the Aprils for a big discount and wait for a VIX spike in the next cycle.

There will be more VIX trades so stay tuned:

@VolatilityWiz