The market is struggling with 52 week highs while sentiment and the news is turning bearish. Sound like springtime?

Everyone wants to read FDX and ORCL earnings into a global and earnings gloom context, and frankly I can’t tell you if there is a read-through there. The simple fact is that the bull has had a long run and April turns into May, and you know the rest.

The European market headwinds aren’t any worse; they’re just being listened to and reverberated. That comes with market prices going lower, as news follows price. People always want an explanation for market moves, and stating the fact that there were more sellers than buyers is not enough to sell media. This is an age old phenomena, well described in Reminiscences of a Stock Operator.

There are only 5 days left in the quarter, and the folks whose career rides on sending out paper on specific dates on the calendar tend to get nervous. Next week sets up as bearish, so we are sitting on some long vol Buy Viagra positions.

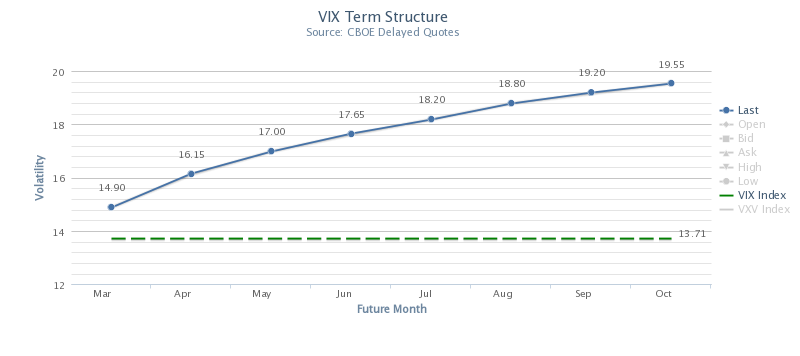

The VIX rose 10%, yet the futures aren’t buying it yet. Another 10% rise in the VIX and they’re not going to have any choice.

Action/Trades:

Closed VXX $19 puts for .60 and a double. We should have closed them yesterday, but it appeared that Ben would at keep sellers at bay for a couple days, but we were wrong. Still a rock solid 100% return on those.

Still holding the $18 puts, as we got them so cheap during the last spike.

Closed the weekly short legs of our VXX calendars, so we are long VXX April $20 and $21 calls. We will start selling on any spike, because April is still historically a good month for stocks.

Long VIX $14 calls. To be sold on any spike.

Outlook:

Next week sets up as bearish. We could see the VIX reset its range, from 13 to 16 or so. With May around the corner, a sub 12 VIX would be a surprising figure as the VIX is rolling into May right now.