Markets broke out of a three week range while bonds got absolutely hammered today. This is another paradigm change as higher rates are not translating into stock market volatility. Oil surged back to the highs as well, so while these two factors are headwinds to the economy, the market does not care. Will it care anytime soon? It is certainly acting like there are no sellers and buyers on the smallest of dips, and now there is a lot of bond and gold money sloshing around with the ever present POMO cash.

I warned yesterday that VIX futures were laying out a new course of lower premiums to spot VIX and telegraphing a lower VIX and higher stock prices. Today continued that trend of lower futures and lower VIX:

| Symbol | Contract | Month | Time | Last | Change | Open | High | Low |

|---|---|---|---|---|---|---|---|---|

| VX Q3-CF | S&P 500 VOLATILITY | August2013 | 16:32:12 | 13.60 | -0.30 | 13.70 | 13.75 | 13.45 |

| VX U3-CF | S&P 500 VOLATILITY | September2013 | 16:32:12 | 15.05 | -0.35 | 15.20 | 15.20 | 14.90 |

| VX V3-CF | S&P 500 VOLATILITY | October2013 | 16:32:12 | 16.05 | -0.30 | 16.15 | 16.15 | 15.90 |

The VXX remains untouchable, unless you are selling while you are buying, via calendars or spreads. My VXX $16 calendar will work should we get the smallest of volatility bounces over next week, as this week’s short call is worthless. That is how you manage risk getting long vol in the VXX and not pay exorbitant margins on VIX calendar spreads. I paid .19 for Aug2nd/Aug9th and while the long call is worth .12, on any blip in vol the trade will work, or even a significant profit should there be a down day in the market. Imagine that, a down day!! It has been 6 weeks since there has been a down day of any significance.

Where is the bottom in vol? Who knows. It could be 11 with the Aug future at 11.50. that is a long way down still, another 14% in the August contract. But I still believe that if the market melts up, folks will be looking for protection into a notorious September, and that will hold spot VIX up as the middle/late August arrives, and that will help the VXX. But until then, the VXX remains vulnerable to 1-2% down days. If for some reason there is spike in vol, then the VXX is primed for a big move higher, but the price you pay for waiting around is enormous.

If you want to ride the market, should you feel that it broke out and is going higher, calls spreads in the SPY are not expensive, with implied vols of 10. DIA spreads are even cheaper. Here is how you can improve your odds of being successful buying index calls:

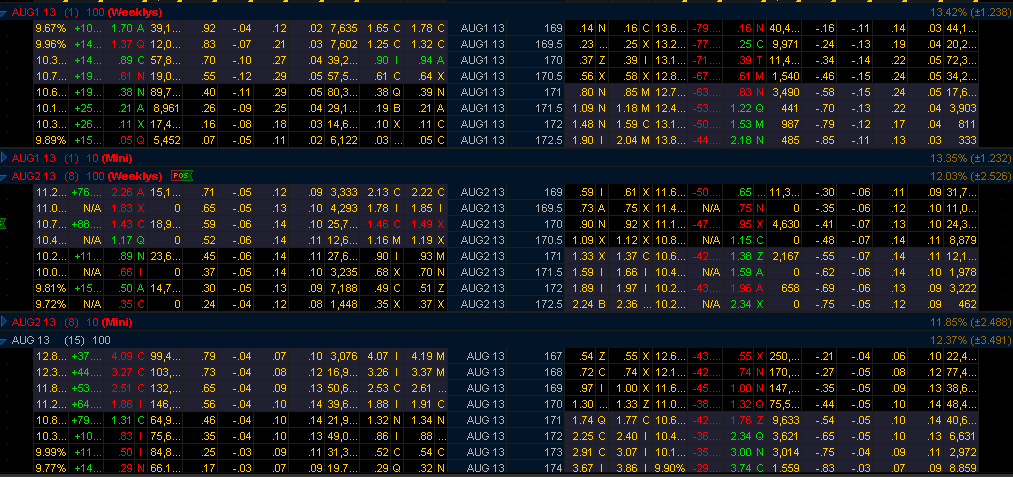

This SPY chain offers so many combinations that can work in a melt-up, flat or trickle-up scenario. You can sell tomorrow vs next week in a calendar, next week versus August 17th for real small spreads, and even do a diagonal for a credit. Here is one example:

Sell tomorrow’s $171.5 for .20 and buy August $172 for .50 for a net debit of .30. If the S&P remains below 1715 tomorrow you get a free ride on the 172’s for 3 S&P points. Great deal.

You can buy the Aug 9th/Aug 17th call calendar for .37. Again, upside for less than 4 S&P points with minimal risk. If the market remains flat, falls, or rises, this trade is a winner.