Another weak bounce in the S&P saw selling at day’s end, reverberating after hours into higher VIX futures prices that seem to anticipate more selling tomorrow. The stock trader’s almanac shows the second to last trading day in August as very bearish, with 13 of the last 16 being down days. The Sep future mildly sold off during the day to rebound late:

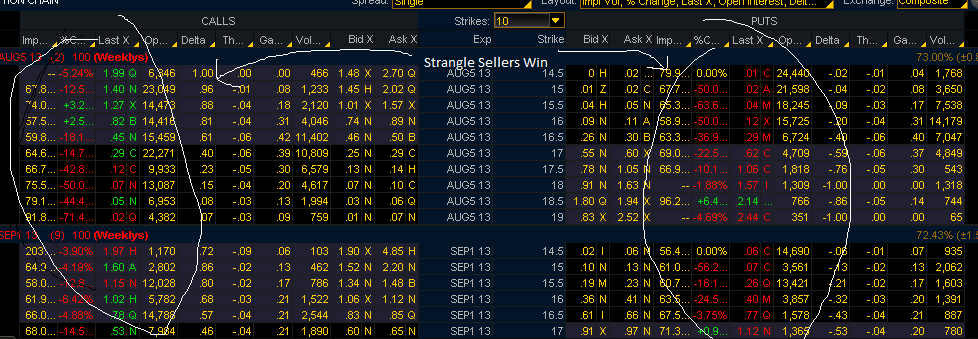

Nobody but vol sellers won in the VXX, as both sides of the trade in the forward two sets of weeklies took it hard today:

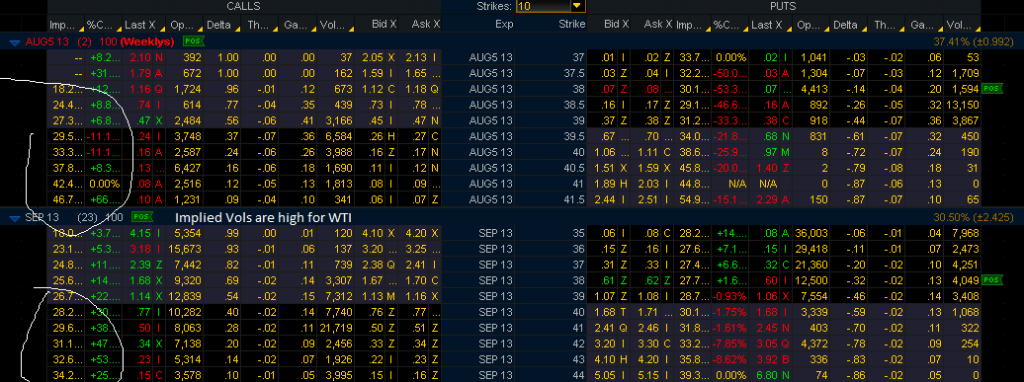

Crude volatility is reaching extreme levels, even though all fundamentals and seasonality are quite bearish:

So the goal is to find shirt pokies some vol to sell in WTI, as it is quite elevated. A couple ideas would be selling puts in SCO, the double short crude ETF, and selling call spreads in the USO. Implied vol is in the 90th percentile these days in both of these funds, and oil is extended. This does not imply that some near-term event couldn’t cause a significant spike, but the odds up here are less than they were at $90, and the options are pricing like it will happen:

A Sep $40-43 spread would pay over .50, and oil would have to cross $113 or so on Sep 20th for this to fail.