Pundits in the financial media are working overtime to explain a natural price action in equities. An old axiom by Jessie Livermore postulated that news follows price and that is what is happening these days, especially when ISM services came in at an all-time high (established in 2008, not a huge hurdle mind you), and S&P 500 corporate earnings are poised to grow 10% year-on-year. So the du jour explanation was an old story about more troops on the Ukrainian border.

So maybe there was a runaway news algo at 1pm today, who really cares? These times are a gift, either for those looking for cheaper stock (re:Warren Buffett et al, he has a record cash horde) or for those looking to sell some expensive volatility premium. I fall into that camp of course, and these days are great.

First some common sense, and then some data. Do you really think Russia wants to invade the Ukraine? Probably not. But if Mexico or Canada were in the midst of a civil war, would the U.S. move some of their otherwise idle troops into a nearby area in case something occurred? Of course.

Secondly, if the Fed raises rates, is that such a bad thing? Ok, maybe the cost to buyback stock gets more expensive, but retirees get to spend more money via their less risky savings/treasuries investment returns, and banks can loan more money as their portfolios are less risky. (At higher rates, loan portfolios can handle more defaults, thus more lending.) Both of those are positive for economic growth, and thus corporate earnings. The financial sector is the S&P’s largest, and they would love to loan at higher rates instead of being a conduit for refis. Look at the KRE, the regional banking ETF, it is down 7% this year and that correlates almost perfectly with the rally in bonds.

So the market is overreacting, right? No, the market has to go down sometimes, that is how money gets extracted from stocks and if you believe the Fed is pumping it up to boost the economy that is a good thing. People forget that outflows have to go somewhere else…

In reality, this is just another seasonal and normal dip/correction, whatever you want to call it. August ranks last in all months for performance on the S&P 500 since 1987. Sometimes market selling leads to more selling, and the technicals are broken in the short term. Look at the SPX:

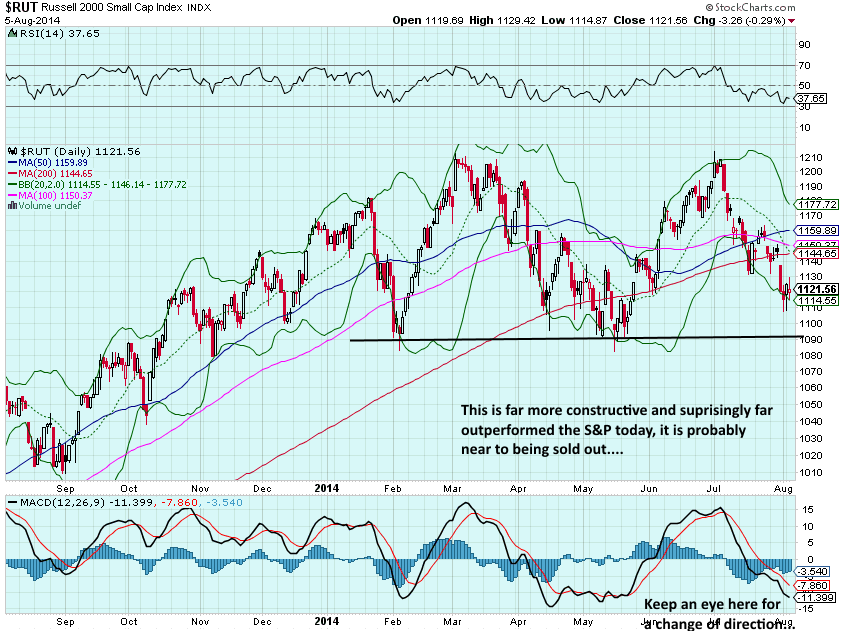

Looks ugly, but there’s obvious support nearby. Keep in mind that earnings are winding down, and stocks tend to get faded after the earnings season ends. Mid-August historically is stronger than the beginning. Yet, this was a real bright spot today, if you want this correction to end…

The small-cap index, the leader to the downside and the demonstrator of the breadth divergence we have been seeing lately, wanted to go positive today. It certainly appears that the selling in this area is nearly over.

Consider the NYMO, the CPCI, and the percentage of stocks trading below their 20 and 50 day moving averages, and we are probably closer to the end than the beginning of this mini-correction. Take advantage of it while it lasts…

To subscribe to the weekly Volatility Analytics newsletter including real time trade alerts, click the link in the above menu.