Wow, that was easy. This is why bull markets make everyone feel like a hero, because they’re easy to trade. Yesterday we highlighted that today was historically the strongest trading day in March, and it lived up to its billing, for no apparent reason. There was no news. (China and the Fed are very old news.) There simply were buyers and few sellers, as the chase for quarterly performance is on.

When this market rolls over (and let’s just be honest with ourselves, it certainly will when the seasonal buyers have exhausted their purchasing power), things will get a lot tougher. The market sentiment will turn negative, and you will hear about global slowdowns again. Probably there will be a move in Spanish bond yields. You will hear about a strapped consumer as gas prices reach $4 and their new tax burden is causing him/her to dip into debt/savings. The financial media headlines follow price, not the other way around. For today, it’s a secular bull market that will last for years.

The VIX fell again, and the spread between the spot VIX and the futures widened. This situation could be a slow painful grind lower for futures holders, VXX holders and VIX option holders. The VXX is unsustainable at these levels if the VIX does not move above 14. There quick payday loans is about a 9% difference between the front month future and spot, so the difference will shrink and they will start to trade in tandem the closer we get to March 19th.

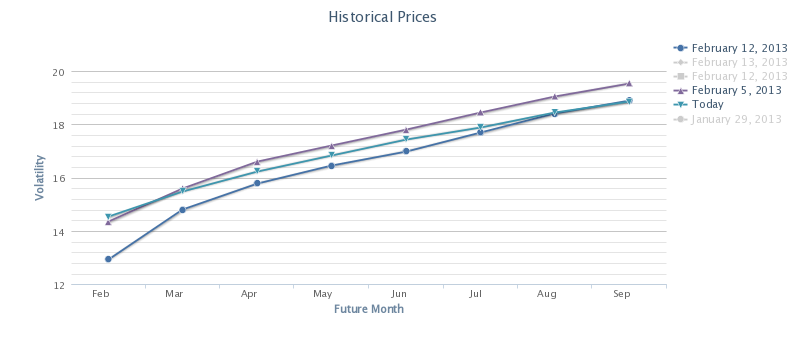

Here is what could happen to the VIX futures curve, using last month’s two week run toward expiration as a comparison. There was a significant shift lower in the curve as the futures neared expiration:

Outlook/Action:

In a word, none regarding the VIX. We have VXX April $19 puts, and there is no reason to add or sell right here as we get a slow grind in the VIX futures. The roll is heavy now (up 1% today to 6%), and a small spike in the VIX will do little to help the VXX.

Volatility Arbitrage Trade:

Using QIHU earnings as the backdrop, we sold the March $37 and bought the April $38 calls for .30 debit. Because the IV in the front month is so much higher, a slightly higher, flat, or down move in QIHU will be very profitable. The trade has a buffer of 10% to the upside, so if the stock moves higher by 10% before March 15th, the short calls will not hurt the trade.

Long QIHU $38 April calls for 1.18

Short QIHU $37 March calls for .86

Follow us @VolatilityWiz