Quiz time: What can go wrong with the VXX if the VIX stays flat and the futures rise? Ok, let’s step back a minute. What can go wrong with the VXX if the VIX and the futures both remain static?

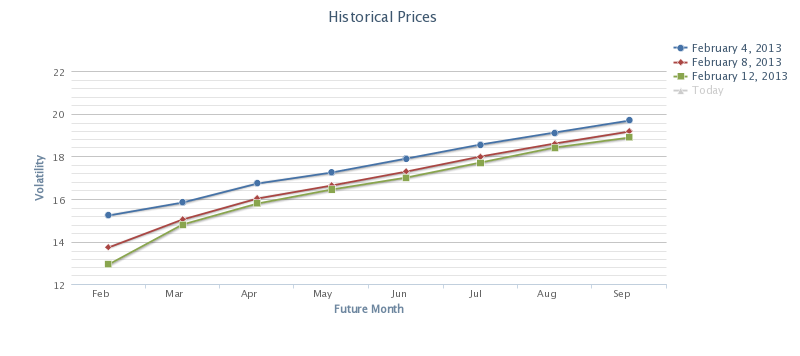

A lot is the answer to both questions, because the VXX gave away roughly 7 cents in “roll toll” today (I just invented that term), and the spread widened between the VIX spots for both months and the VIX futures. So the futures are sitting on a large premium. One of the two is going to have to give in. The problem for the VXX is that the VIX will have to rise by a significant amount before futures expiration JUST to hold the VXX upright at its current price. Let’s look at how that resolved itself last month:

February 12th was the last trading day for VIX futures in February. The entire curve came in by 6-10% at the March and Feb expirations respectively. Now, you can easily formulate speculations as to why this happens, by asking yourself, who would want the VIX to be lower and what would those people have to gain? The VIX can be moved at settlement, by bidding on certain S&P options, but that is a topic for another day.

Anyway, here is how the VXX reacted to this repricing of the futures curve:

So, there may exist an asymmetric risk/reward setup next week, provided the stars stay in this alignment. And, historically there is a good chance that they will. What if the VIX actually fell over the next two weeks? We will go into more detail tomorrow as we unveil some proprietary data on VIX behavior for March.

Trade/Action:

Staying long VXX $19 puts. They got cheaper today and are almost in the buy zone again. They should not have fallen by as much as they did considering the relative price changes in the futures and VXX.

Volatility Arbitrage Trade:

Yesterday’s QIHU trade is working well but is not yet closed. The short strike is essentially zero.

PETM, tweeted out at 3pm today:

March/April call calendar with IV spread at 16%:

Short $65 March call

Long $65 April call

Trade cost- .68

PETM guided lower than analyst estimates, (shocker) and the short strike is toast. The key now is how much profit we can wring out of the long call.