VIX futures fell 3% in the front month and 2% on the back month, as the VIX fell 3.5% today. This pattern of quiet trade is eerily similar to January and February, and if you are holding volatility, you should be worried with expiration dates 6 and 8 trading days away for the options and VIX futures respectively.

With the VIX looking like it may trade below 13 again, here is how the futures reacted:

| VX H3-CF | S&P 500 VOLATILITY | March2013 | 16:15:00 | 14.20 | -0.50 | 14.65 | 14.80 | 14.15 |

| VX J3-CF | S&P 500 VOLATILITY | April2013 | 16:15:00 | 15.25 | -0.30 | 15.60 | 15.60 | 15.20 |

| VX K3-CF | S&P 500 VOLATILITY | May2013 | 16:15:00 | 16.15 | -0.20 | 16.30 | 16.32 | 16.05 |

There certainly no panic in the air here, in more ways than one. The spread between spot and the front month is 10%, and this is unsustainable. The question is whether the VIX will rise or the futures will fall, and that will be played out over the next week or so.

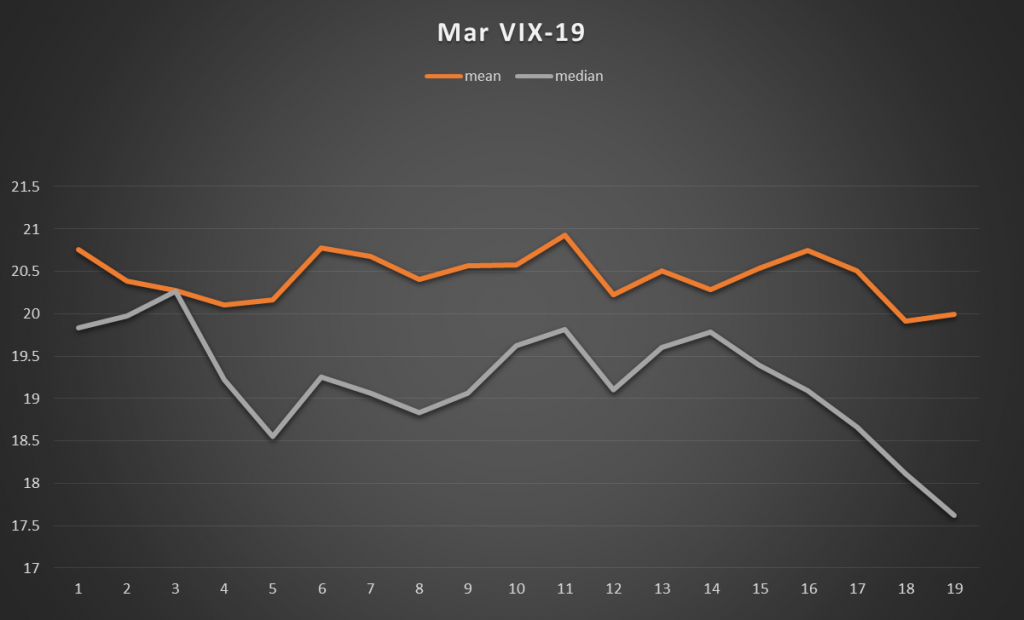

The worst case scenario for VXX holders is if the VIX falls further. The VXX will have enough trouble rolling and holding premium even before it deals with the potential of a lower VIX. Let’s take a look at March VIX behavior over the OPEX cycle:

This Pokies chart is using this year’s 19 day OPEX cycle, portraying VIX historical mean and median values. While the VIX is below these numbers today, that should be adjusted for the several years when the VIX was much higher due to market conditions. The pattern appears to show a sharply declining VIX in the last week of the OPEX cycle.

So, the million dollar question is, what will the VIX do over the next 6-8 days? And how will that affect the VXX and VIX derivatives?

Shown at the top, the VIX futures are denying that the VIX will remain at 13. I don’t have a crystal ball, but one thing I can surmise here is that the VXX faces three serious headwinds in the near term. That should be pretty obvious. And a lot of folks would love to collect the VIX insurance payments that everyone made expecting more volatility due to the sequester, and overbought market, etc.

Trade Action:

Long VXX Apr $19 puts

Sitting tight and watching the show next week. If there is a spike, will add around .30.

Volatility Arbitrage Trade:

Sold HRB March $26 calls

Long HRB April $27 calls

Cost – credit of .01

Provided HRB stays below $26 at expiration, the $27 calls are free.