| Symbol | Contract | Month | Time | Last | Change | Open | High | Low |

|---|---|---|---|---|---|---|---|---|

| VX J3-CF | S&P 500 VOLATILITY | April2013 | 15:58:41 | 14.52 | 0.72 | 13.80 | 14.75 | 13.75 |

| VX K3-CF | S&P 500 VOLATILITY | May2013 | 15:58:38 | 15.63 | 0.38 | 15.25 | 15.78 | 15.10 |

| VX M3-CF | S&P 500 VOLATILITY | June2013 | 15:58:41 | 16.53 | 0.18 | 16.25 | 16.60 | 16.12 |

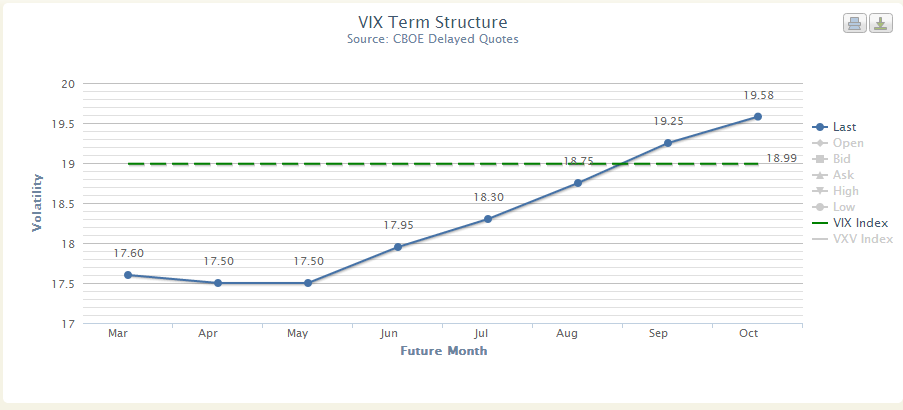

Today’s sell-off was not taken that seriously, as evidenced by the reaction of the volatility futures. We could be looking at another scenario where spot VIX is higher than one or more futures contracts. Recall how the curve versus spot appeared on February 25th:

Chart courtesy of vixcentral.com

Big difference if this were to occur late this week or early next week. The futures could not blow-off a VIX spike as easily this time around. February 25th was four weeks from VIX expiration on March 20th. Now we are 9 trading days away, and backwardation becomes much more real.

Backwardation of the futures should be taken seriously, as it can represent a new volatility surface that is just beginning to develop. This is how short vol traders who have been making easy money can get burned. Furthermore, short VXX traders, who believe that the VXX will never go higher ever again, will start to see the benefits of a positive daily roll yield, when the rolled near term future is sold for a profit when buying the next month.

Commodities futures traders will tell you that you do not sell a market in backwardation, because that means that people are short the commodity. Watch this clip where Dennis Gartman explains it in crude terms:

http://video.cnbc.com/gallery/?video=3000108967

So, what can occur would be that people are short protection, or exposure to downside derivative hedges. That would make the VIX go higher as there aren’t put sellers like there are covered call sellers. Thus, the VIX rises higher due to S&P option implied volatility rising on demand for synthetic shorts. This is why the VIX rises on put demand, and not call demand, although in theory it could.

We lightened up on most stocks we didn’t want to hold through May yesterday and bought more index puts, which were cheaply priced due to vol being so low. This demonstrates why the volatility products are very, very poor hedges, as the market can fall and the VIX may not reciprocate initially.

Outlook/Action:

From here through May, we will probably look to buy puts when the market bounces. It is plain silly that morons on CNBC can tell you that there will be no pullback over 3% and that there may be no pullback at all this year. People have such short memories and do so little homework in finance sometimes that it can just amaze. The fact remains that May and June represent two of the worst months in the markets for the year, and they should have to prove themselves worthy when the markets haven’t paused for several months. Respect history before ignorant knuckleheads with their “money on the sidelines” rant.