Where would the market have been today without the health care and consumer staples sectors? There are some fascinating divergences in the market, and it is not painting the healthiest of portraits.

The S&P and Dow were up, but:

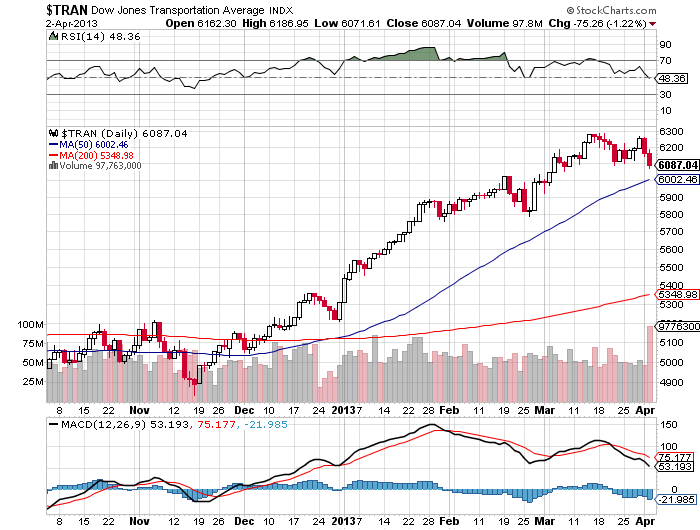

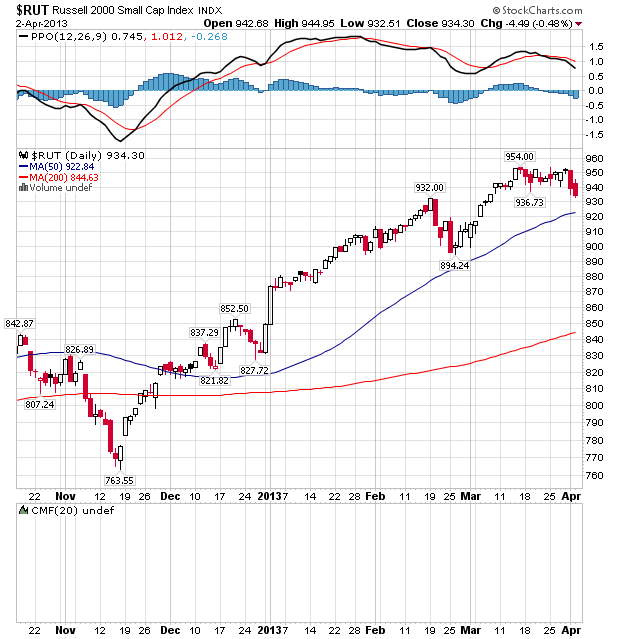

These two charts alone should give you pause, as this was not evident by catching a market update. Are the internals rolling while health care (up 1.48%) and staples defend the averages? The VIX is certainly not demonstrating any concern, neither are the futures:

| Symbol | Contract | Month | Time | Last | Change | Open | High | Low |

|---|---|---|---|---|---|---|---|---|

| VX J3-CF | S&P 500 VOLATILITY | April2013 | 16:49:31 | 13.80 | -0.60 | 14.20 | 14.25 | 13.75 |

| VX K3-CF | S&P 500 VOLATILITY | May2013 | 16:49:31 | 15.25 | -0.53 | 15.55 | 15.60 | 15.15 |

| VX M3-CF | S&P 500 VOLATILITY | June2013 | 16:49:30 | 16.35 | -0.36 | 16.50 | 16.60 | 16.18 |

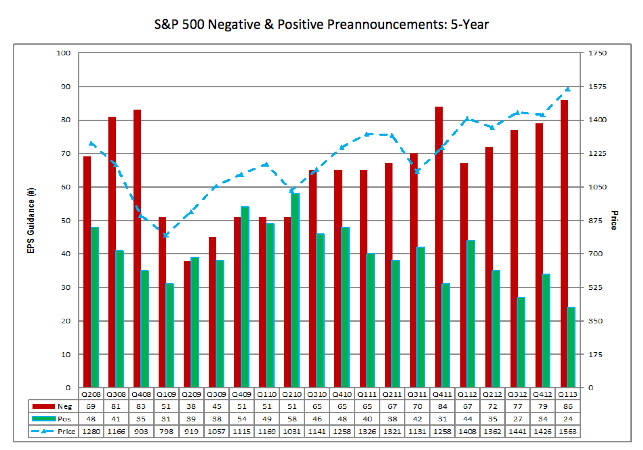

And this has not been a canary in the coal mine yet, but throwing it out there:

The beat rate has been solid every quarter when the bears have used this data point, or commented on abnormally high margins/GDP. Yet it is worth noting.

IWM June puts are very cheap, and we added a few 95’s today. Not saying the rally is over, but May is almost here and it pays to be prepared while everyone assumes the year will never see a correction.

We are hearing a lot of that these days. That IF we see a correction, IT WILL ONLY be a 3-5% drawdown. Who are these people kidding beside themselves? That feels like toppy complacency to me.