Generally, on a day like today, I would have been excited to write this post, because we have been predicting this market action for a couple weeks. Yet, it coincides with a horrific event in my hometown.

The Boston Marathon of 2013 will change things yet again. Who’s going to bring their children to the race next year? Everyone in Boston knows runners and has been to the race; virtually everyone has taken in a Sox game on a Patriots Day morning and walked just outside the park in time to watch the runners finish. It is probably Boston’s greatest day of the year.

This is the world we live in now and these photos capture how awful yesterday was:

http://www.boston.com/bigpicture/2013/04/terror_at_the_boston_marathon.html

Of infinitely less importance or significance, the markets:

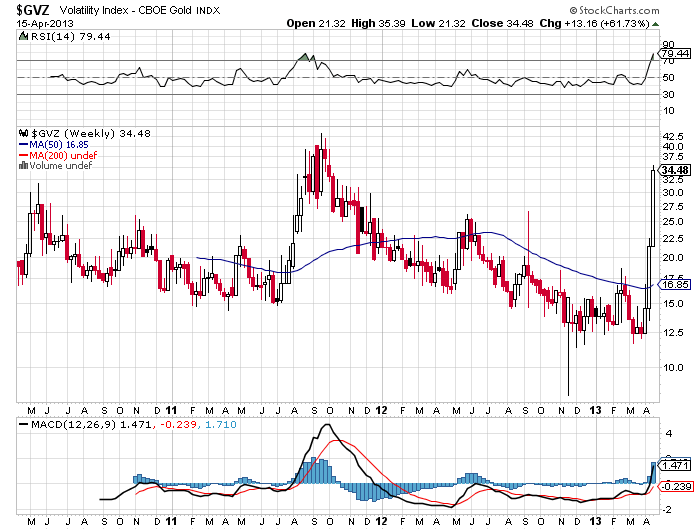

Gold volatility rocketed higher as the door out was far too small for the crowd:

Here is my take on yesterday, and take it with a grain of salt, as this is far from my area of expertise.

When you see global markets in one area or another getting absolutely demolished, it has to have repercussions or shock effects in other markets. Simply because there are inherent correlations.

The metals and commodities markets can hurt stock markets because they, for example:

A. portend of global economic weakness

B. force investors to move money around

Here we have two separate events that correlate to stocks. You may have a marking down of commodities on a perception of a slowing global economy. Then you have those needing to get liquid as a result of that. You can certainly have it the other way. There could be a draw-down in equities causing a draw-down in commodity exposure.

You may feel that the dollar is to blame and that the global/U.S. economy is not doing that poorly. My point here is not to debate that at all. It is to say that when you see another market getting hammered, you’d better be prepared in stocks, because something is happening that isn’t quite apparent yet. And as a result, equities are going to be affected, and in different ways.

Virtually of the the index puts we have been storing away like squirrels doubled or nearly doubled yesterday, reinforcing the main point we have been making over and over again that we were primarily the buyer of low implied volatility with a window of over two months. 10% implied vol on an index should be purchased heading into May and June, that should be a hard and fast rule.

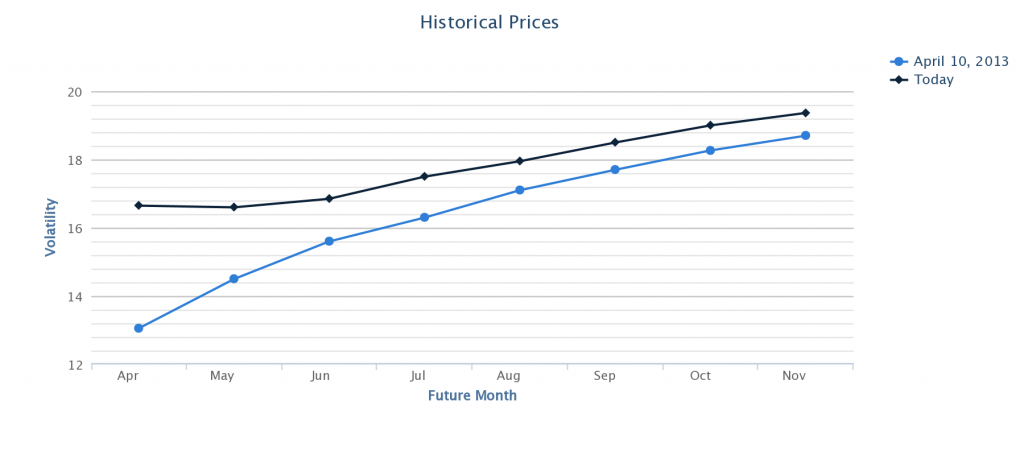

Here is how the term structure changed in two trading days:

Source: vixcentral.com

So now we have slight backwardation and a flat curve. This can be an early warning sign of a significant correction, yet the last few times it has not been. I suspect that any major sell-off will wait until after a chunk of earnings are revealed. But let’s be clear about one major fact: economic metrics have been worsening.

Watch the Russell 2000 and the transports. These are canaries in the coal mine generally. The Dow will be the last to show how much a market has deteriorated internally.

Outlook/Action:

Looking to sell our May puts, and add to June puts on significant bounces. Respect April, it is still #1 for the Dow and #2 for the S&P. You will probably have days with strong earnings followed by ones where it appears the global earnings outlook is poor. So, choppy trading is certainly possible and would be consistent with a short-term market top.

I am traveling, so the posting will be sporadic and limited unfortunately.