| Symbol | Contract | Month | Time | Last | Change | Open | High | Low |

|---|---|---|---|---|---|---|---|---|

| VX J3-CF | S&P 500 VOLATILITY | April2013 | 16:11:00 | 12.79 | -0.36 | 13.35 | 13.62 | 12.75 |

| VX K3-CF | S&P 500 VOLATILITY | May2013 | 16:11:00 | 14.21 | -0.29 | 14.65 | 14.80 | 14.20 |

| VX M3-CF | S&P 500 VOLATILITY | June2013 | 16:10:59 | 15.22 | -0.23 | 15.55 | 15.77 | 15.20 |

| VX N3-CF | S&P 500 VOLATILITY | July2013 | 16:10:36 | 16.04 | -0.26 | 16.40 | 16.57 | 16.00 |

| VX Q3-CF | S&P 500 VOLATILITY | August2013 | 16:10:40 | 16.74 | -0.21 | 17.05 | 17.23 | 16.70 |

| VX U3-CF | S&P 500 VOLATILITY | September2013 | 16:10:09 | 17.44 | -0.21 | 17.73 | 17.88 | 17.40 |

| VX V3-CF | S&P 500 VOLATILITY | October2013 | 16:09:41 | 17.98 | -0.27 | 18.24 | 18.40 | 17.95 |

| VX X3-CF | S&P 500 VOLATILITY | November2013 | 16:08:57 | 18.47 | -0.18 | 18.75 | 18.85 | 18.47 |

| VX Z3-CF | S&P 500 VOLATILITY | December2013 | 16:01:59 | 18.85 | -0.15 | 18.99 | 19.10 | 18.85 |

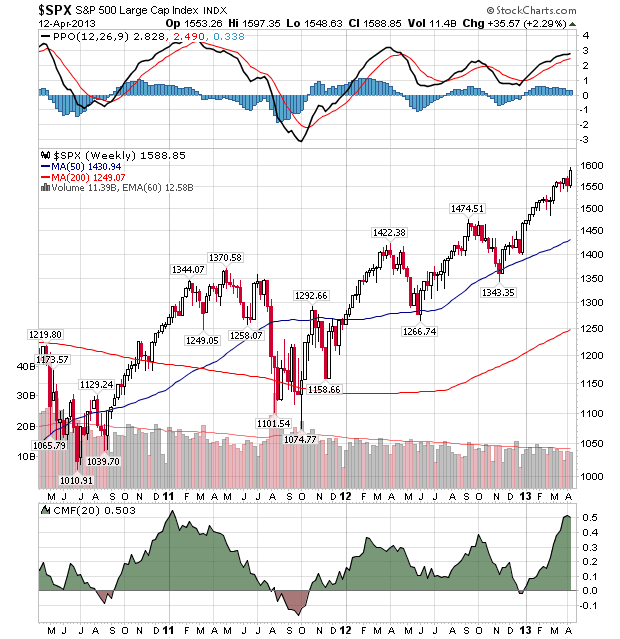

No one expects even a hiccup in May. It stands to reason, that this kind of thinking and lack of preparation implies that there will be one. Every May for years has been troublesome, IF there has not been a down month preceding it in the prior six months. Go back decades, this set-up for May and June is amazing.

Puts on the QQQ, SPY, DIA, IYT, XRT, XLF, are all attractively price with very low implied volatility. Put calendars during earnings are also excellent opportunities, as you can sell the high IV in the front contract and own the May or June contract at a fraction of the cost.