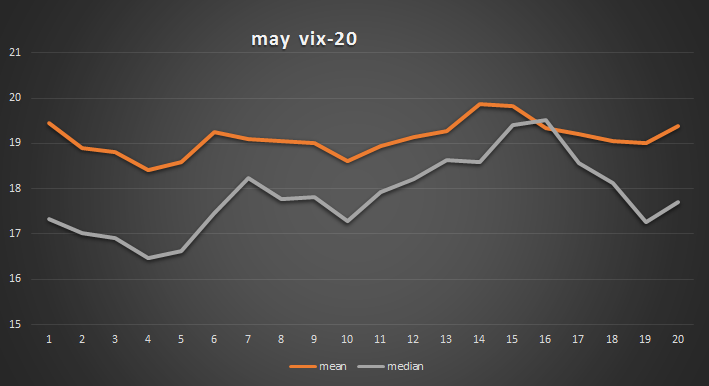

I’ve been talking about getting long June puts for two reasons. The first is simply because these are two of the worst months for the indexes historically. But being long vega is another, and you don’t necessarily need the markets to move lower to make these positions pay well. Let’s look at May volatility:

Thus far, this month’s vol is mirroring our volatility wave. The absolute levels are not that important. What we see here is that as May approaches, volatility tends to rise in anticipation of May. We had another event a few months back that was precisely like this month, September of last year.

Here is volatility in August at precisely the same levels as it rose heading into September:

Look familiar? The VIX fell just after August opex, then rose steadily into September, from 13 and change to 18 as traders anticipated the historically horrible September. Here is how the market acted during this stretch:

The market not only maintained its level, but it actually rose with a rising VIX. This is why you must be aware that the market can fall with a falling VIX as well as rise with a rising VIX. These possibilities certainly affect your option positions.

Outlook/Action:

Added OIH puts on the oil spike, IYT puts and QQQ puts. These areas are heading into very weak seasonality and the IV on the puts is very low. Closely eyeing DIA, SPY, and IWM puts.

We sold IBM bear call spreads last week that paid almost 8-1 at 195-205. We are probably adding AMZN and SBUX put calendars tomorrow. We will tweet those @VolatilityWiz.

We will be adding a real-time email subscriber service soon at a very affordable price, still to be determined, but under $60/month. If you are interested in receiving an email concerning this service, contact me at scott.murray1@gmail.com.