I just returned from Spain, and you would never know the country is in recession. Madrid Center is under construction in several areas, and is bustling with activity. Same for Barcelona. What awed me was that everyone drinks during the daytime. Now I’ve seen in this in France, but in Spain it just seems more blatant. You go to a public market on a Monday at lunch and everyone is drinking.

Anyway, European stocks surged, just as the economic data points got even uglier:

http://www.ft.com/intl/cms/s/0/e3007a94-ac22-11e2-9e7f-00144feabdc0.html#axzz2RKKS2EeO

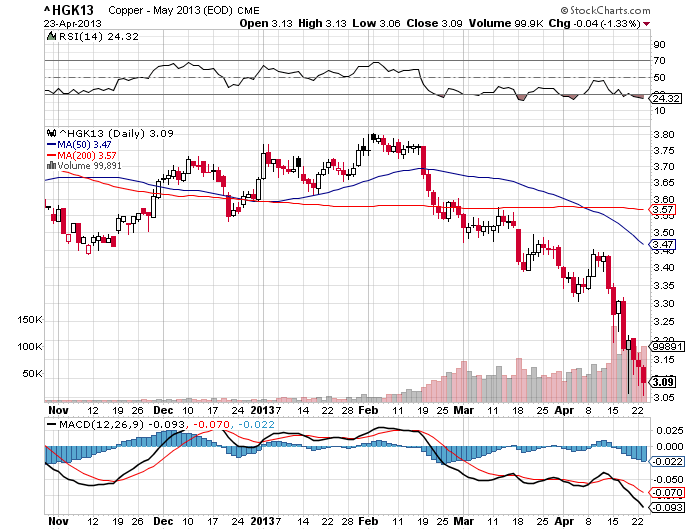

And in China, well, at least the economic data seemed to be reflected in stock prices. BTW, has anyone looked at a copper chart lately? Is this a broken correlation, or is it trying to tell people something, but no one is listening yet? This is becoming a daily tune, copper down, gold down, silver down, oil down…..This action means something. What that is yet, I am not completely sure.

U.S. stocks surged as well, thus the VIX and VXX plummeted. The futures have come in significantly the last two days:

| Symbol | Contract | Month | Time | Last | Change | Open | High | Low |

|---|---|---|---|---|---|---|---|---|

| VX K3-CF | S&P 500 VOLATILITY | May2013 | 16:04:02 | 14.55 | -0.75 | 15.20 | 16.05 | 14.45 |

| VX M3-CF | S&P 500 VOLATILITY | June2013 | 16:04:00 | 15.42 | -0.68 | 16.05 | 16.70 | 15.35 |

| VX N3-CF | S&P 500 VOLATILITY | July2013 | 16:03:32 | 16.27 | -0.68 | 16.77 | 17.40 | 16.23 |

April is #1 for Dow returns since 1950 and it is #2 for the S&P. What you are seeing should not surprise, as this wisconsin cash advance payday loans is what happens in most Aprils. Yet, the “convincers” are making the rounds now. I termed these folks as the pundits that come out at seasonal/annual tops to convince you that markets are not expensive, that long-term investing means that you can invest at highs and not worry, and that the Fed has your back. It’s probably an exercise in convincing themselves that their position/bias is the correct one.

Pundits interestingly, do worse than monkeys when predicting anything. In Jackass Investing (a great book that uses pure facts to debunk everyday supposed truisms in the investing world) Micheal Dever talks about how incredibly bad they are while citing multiple studies. In one study Philip Tetlock took 82,000 pundit predictions and surmised that the more vocal, or more media attention a pundit received, the worse he was in predicting. Reminds one of Twain’s quote, that a combination of ignorance and confidence will ensure success.

Tomorrow we will cover May’s volatility history and compare historical volatility to current implied volatility. Remember that the first few days of a new opex cycle frequently see very low volatility, which is exactly where we are.

Action/Outlook: Holding June puts at low IV in several areas and looking to start adding more after today’s advance. It’s April, so the market can certainly go higher.

Also selling bear call spreads and buying put calendars. These offer terrific risk/reward ratios, and we will discuss a few as the week goes on.