Why are markets unprepared for the next two months? I have no idea, and after this week, you should be thinking hard about how the next few months are going to transpire. The market is flagging at 6 year highs, on declining revenue and earnings, and there is no buying pressure in the options market.

I’m not predicting a move either way. All I am saying here is that the puts are not being priced correctly; there is not enough demand. This disrespect is forcing me to think that the market is failing the smell test, and it is going lower to force those to respect the downside. DIA and SPY puts are easily obtained ATM for an IV of 13 or less.

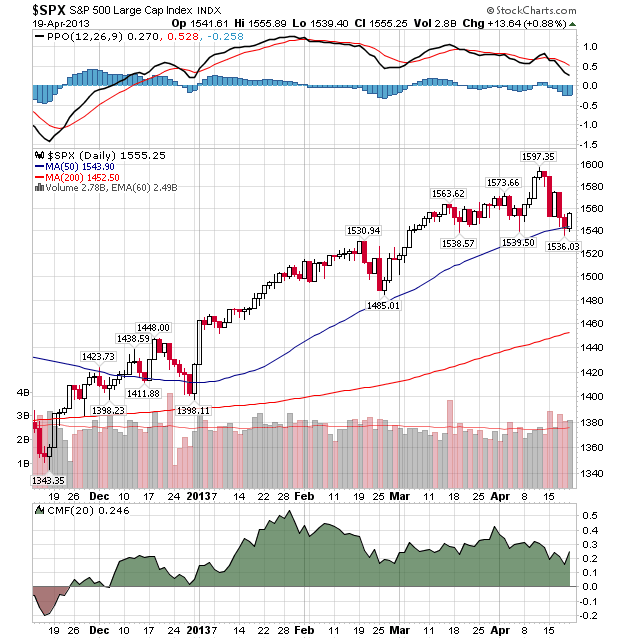

If you are fundamental, there are plenty of bearish arguments. If you are technical, there are plenty of bearish arguments. If you have common sense, you can be bearish. Look at a chart of the S&P:

What looks good about that? New all-time highs and a u-turn to Buy Viagra test the 50 in short order. Contrary to popular belief, Ben B. does not sit at his computer and stick-save the S&P by purchasing futures contracts between 3 and 4 pm. This kind of talk is pure heresy, not unlike thinking that there was a movie studio that filmed the moon landing.

Look, taxes are over. People are done meeting with their advisers and telling them to rebalance to equities. The natural economic cycle is shifting to the natural summer slowing. The dollar is rising relative to other global currencies. (major headwind to earnings, analysts have a tough time putting this in their “models”)

May is #8 for the S&P and June is #10.

So, go get long and BTFD. It’s all about being full invested because your time horizon and dollar cost averaging make it all ok.

Outlook/Action:

Still holding June index puts. Buying put calendars on stocks during earnings when high IV makes it cheap. Expect April to hold up, and all bets are off during May and June.