What jobs report? April is the strongest month for the Dow and #2 for the S&P 500, so what has occurred over the past two days is not surprising. The same cannot be said for May which is one of the worst months of the year for stocks. Yet the VIX term structure is demonstrating very cheap vol for May:

Remember, this chart is not the futures structure, it is the actual S&P implied vol for the forward months. 13.21 for May versus 13.07 for April. This is a classic example of the VIX being more a reflection of historical volatility than a representation of future or forward volatility.

The futures set up with a May price of 15:

| Symbol | Contract | Month | Time | Last | Change | Open | High | Low |

|---|---|---|---|---|---|---|---|---|

| VX J3-CF | S&P 500 VOLATILITY | April2013 | 16:37:04 | 13.65 | -0.70 | 14.15 | 14.50 | 13.60 |

| VX K3-CF | S&P 500 VOLATILITY | May2013 | 16:37:05 | 15.10 | -0.44 | 15.35 | 15.53 | 14.90 |

| VX M3-CF | S&P 500 VOLATILITY | June2013 | 16:37:04 | 16.05 | -0.43 | 16.35 | 16.41 | 15.85 |

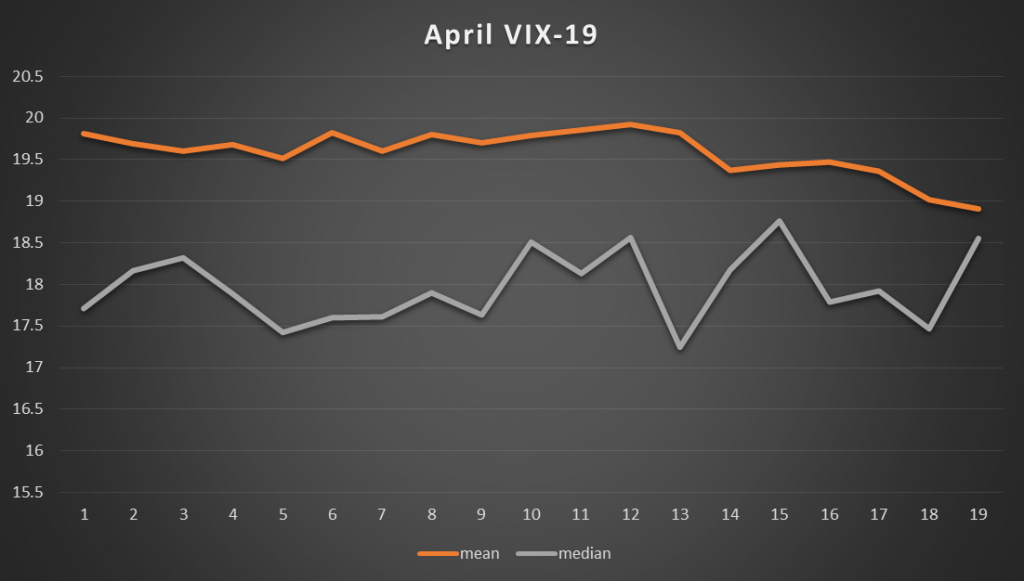

Here is what the VIX looks like historically in April. This chart sends mixed messages, and is one of the months whose trend does not resemble other months. Yet we can see that the end of the cycle tends toward lower vol. So the short VXX trade looks attractive. The negative roll is around 10 cents/day or .5%. The May contract could easily fall 5% heading into expiration, so 18 and change on VXX is entirely possible by next week.

With earnings season gearing up next week, there probably isn’t going to be a whole lot of anything between now and the end of the OPEX cycle. Yet the seasonal advantages the market has are about to go away and we are going to get a real good look at who’s left to hold it up next month. Should be very, very interesting.