Another day, and another ridiculous number coming out of U.S. manufacturing. The Chicago PMI was the lowest since…..2009. Really?

http://www.marketwatch.com/story/chicago-pmi-slumps-to-35-year-low-2013-04-30?link=MW_latest_news

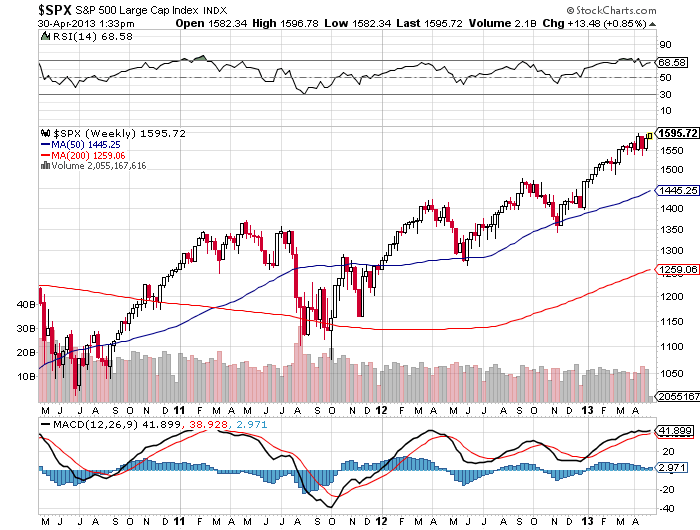

Meanwhile, the crowd of folks saying that May “might” only see a “1-3%” correction is loud. They cite that “everyone is hating the market”, but all these people are in. So, who is hating it? The “money on the sidelines”?

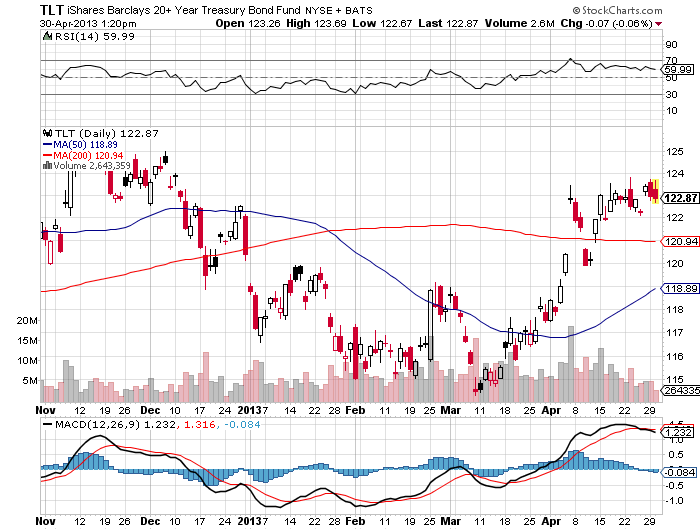

If the money on the sidelines is desperate to get into stocks, why are bonds going up?

Now, yesterday an analyst in Japan stated that shipments of cars to the U.S. are slowing. I can’t find a single data point to support this, but here is the quote cited by Bloomberg:

âOverseas demand gathered momentum in the past few months, but the pace of growth is moderating a bit now,â said Junko Nishioka, chief economist at Royal Bank of Scotland Group Plc (RBS) in Tokyo and a former Bank of Japan official. âShipments of cars to the U.S. are slowing.â

The consensus is calling for an ECB rate cut on Thursday, and even more measures to help the economy. So, logic would dictate that quantitative easing would equal a falling Euro. So, on cue, the Euro did exactly the opposite and shot up:

Consider this: What is a rate cut going to do to an economy when the banks are short of capital already?  Wouldn’t the banks just eat up the excess liquidity and not lend? Isn’t that what occurred in the U.S. until the Fed started outright buying financial assets? On that note, ECB board member Joerg Asmussen, the bankâs top official for international relations stated:

“Asmussen echoed recent comments by Draghi that the central bank would find it difficult to carry out monetary stimulus through the purchase of financial assets. A number of central banks around the world, including the U.S. Federal Reserve and the Bank of Japan, have sought to expand the supply of money in their economies in an effort to boost growth.

Asmussen said such methods were ânot easily applicableâ to the eurozone because the 17 countries have differing market interest rates and because companies tend to get their financing from banks, and not from bond or money markets.”

Can you imagine if the U.S. printed a 2.8% decline YOY in retail sales? That is exactly what happened this morning in Germany:

| 02:00 | Â Â EUR | Â Â Â | German Retail Sales (YoY) | -2.8% | -1.2% | -2.6% |

Equity markets are not interested in any of this. What they appear to be doing is following a textbook seasonal pattern. April is right on the money, for what it is supposed to do. The April change in the Dow is just basis points from the historical average. A lot of folks are saying that you need a blow-off top to confirm the end of the rally, and that selling in May is not going to work.

You can have it exactly the opposite. This market can just roll over and die on seasonality, without any special event. Need evidence, just look at last year.

What special volume/event occurred in May 2012? How about in May of 2011? How about May of 2010? (If you answered the BP oil spill for 2010, you get partial credit)

This is either a K.I.S.S. moment, or the market will ignore bad data for a long time. I don’t have the answer, but puts are cheap.

If anyone is wondering why I haven’t opined much about VIX products lately, it’s because there was no action to be taken. The VXX is doing absolutely nothing. Buying calls using VXX is gambling (literally) whereas put buying on the VXX is not, and the opportunity to do that has just not been there from an asymmetric risk/reward scenario. Â I’m sure some complex theta strategies are doing phenomenally well, but I personally do not engage in that, outside of occasional VXX butterflies which probably have been awesome trades lately. Those can be 5x+ trades on the weeklies with very low risk.

VIX futures:

| VX K3-CF | S&P 500 VOLATILITY | May2013 | 16:33:03 | 14.45 | -0.33 | 14.70 | 14.97 | 14.40 |

| VX M3-CF | S&P 500 VOLATILITY | June2013 | 16:33:03 | 15.40 | -0.18 | 15.50 | 15.74 | 15.30 |

| VX N3-CF | S&P 500 VOLATILITY | July2013 | 16:33:02 | 16.25 | -0.08 | 16.26 | 16.46 | 16.0 |

Action/Outlook:

No action. Still eyeing XLE, DIA, SPY, IWM, XRT puts/bear call spreads and equity put calendars.