The VXX is now holding all July futures. Here is how they stand:

| Symbol | Contract | Month | Time | Last | Change | Open | High | Low |

|---|---|---|---|---|---|---|---|---|

| VX M3-CF | S&P 500 VOLATILITY | June2013 | 16:38:09 | 16.80 | -0.19 | 16.80 | 17.10 | 16.65 |

| VX N3-CF | S&P 500 VOLATILITY | July2013 | 16:38:08 | 17.65 | -0.17 | 17.80 | 17.88 | 17.55 |

| VX Q3-CF | S&P 500 VOLATILITY | August2013 | 16:38:08 | 18.35 | -0.25 | 18.50 | 18.57 | 18.25 |

Meanwhile the VIX closed today at 16.60, which is where July basically sits, and with good reason:

VIX Volatility Index values generated at:Â Â 06/18/2013 15:14:55

| Trade Date | Expiration Date | VIX | Contract Month |

| 6/18/2013 3:14:55 PM | 16.63 | 1 | |

| 6/18/2013 3:14:55 PM | 17.06 | 2 |

So the futures premium to spot July is roughly 6%. It is very possible that you could see what I call a “volatility exhale” tomorrow after the Fed meeting, just for the simple fact that it is over. This frequently occurs when there is an event that has the market’s keen attention, and because the VXX is holding all of the front month, it can move up or down a lot faster than when it has rolled a significant portion to the next month at a higher price. The farther month tends to act as a sort of an automatic stabilizer.

It would not be out of the ordinary to see a 10% move lower this week in the VXX. The market would have to cooperate and remain quiet to higher for this to happen, and a sell-the-news reaction is certainly a possibility. But with the SPY far from overbought, the MACD curling up, and price moving above the 10 day SMA, it seems to be set for a retest of the highs.

The last days of the opex cycle and the early ones of the next cycle generally see the lowest volatility. The VXX has seen many big moves lower during these stretches in the cycle. As recently as April, the VXX fell $3 as the VIX went from 17.5 to 13.5 in three days at the end of the cycle. If the VIX fell to 15 and the July future maintained an .80 cent spread to spot, that right there is $2 lower in the VXX.

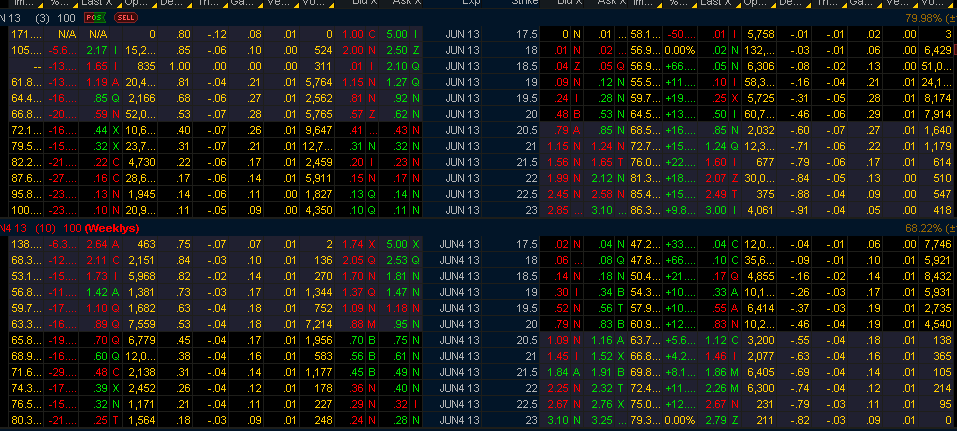

VXX option chain:

The plan is to try to find a small spike in vol tomorrow to leg into the $21 puts at a lower price. The reason I like this strike is because you don’t need the VXX to move to maintain most of your capital, yet if it does you have a high delta for speedy profit. The lower strikes are not cheap, but they could pay handsomely provided the VXX moves sharply lower. The VXX puts for next week are just too expensive, even at $21. It is all about the Fed meeting on this trade.

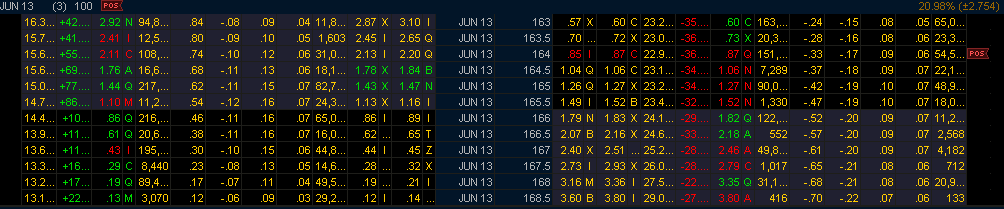

As a sidenote, the SPY weekly puts are showing very high implied vol, so we started a put diagonal:

SPY option chain, weekly:

WIth the weekly SPY puts showing an IV of 23, the 1640 puts were sold for .85. Paired with next week’s 1630, the diagonal price was .25. If the S&P does not absolutely crater tomorrow, the short puts will evaporate into thin air and next week’s puts will be gravy to hold for a few day or to sell for a quick profit.

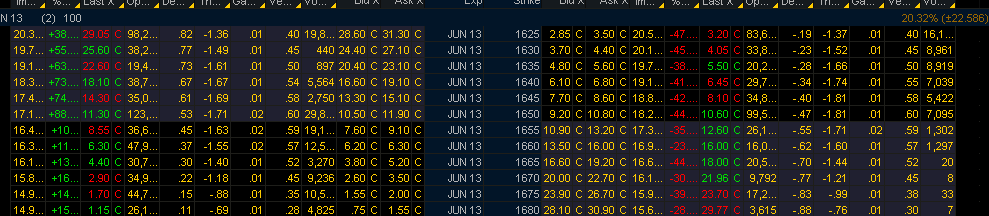

Interestingly, the SPX puts show lower implied volatility:

If anyone can explain that phenomenon, I would love to learn something. TIA.