Jon Najarian said that volatility was here to stay recently and that the VIX would not see the mid teens until September. Today the VIX was as low as 16.34, and the most popular 50 day moving average in market history being tagged today from below did not seem to awaken the VIX much as it closed at 16.86 or so. Everyone on stocktwits and on financial entertainment TV were proclaiming that the S&P is going lower now that it rallied to the 50 day. It is fairly unanimous. It may do just that, but it may burn everyone getting short at the 50 as well.

The futures are holding up above 18:

| Symbol | Contract | Month | Time | Last | Change | Open | High | Low |

|---|---|---|---|---|---|---|---|---|

| VX N3-CF | S&P 500 VOLATILITY | July2013 | 16:06:15 | 18.10 | -0.75 | 18.55 | 18.60 | 18.00 |

| VX Q3-CF | S&P 500 VOLATILITY | August2013 | 16:06:11 | 19.00 | -0.60 | 19.40 | 19.45 | 18.90 |

| VX U3-CF | S&P 500 VOLATILITY | September2013 | 16:06:05 | 19.82 | -0.58 | 20.10 | 20.20 | 19.75 |

The spread to spot VIX is roughly 7%, and the roll is starting to get heavy. Next week with a shortened Wednesday, no trading Thursday, and a low volume Friday, has the potential to do damage to implied vols. Nothing has really changed today regarding the VXX, the puts are working, albeit slowly, and the July 5th short call spread as already fallen from .52 to .23. A down open tomorrow could offer an opportunity to sell another one, as the futures are giving you a buffer being above spot VIX.

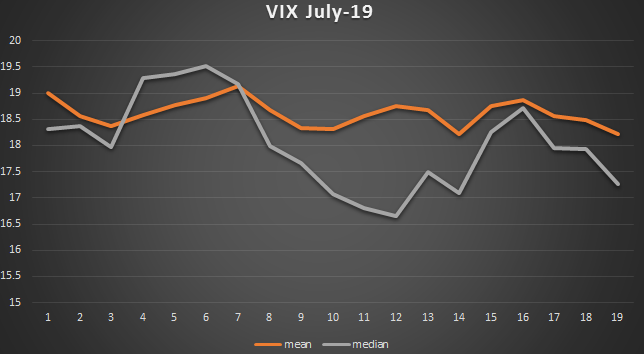

July shows this historical VIX pattern:

We are on day 4, and historically the VIX likes to fall during the week of the Independence Day holiday, as you can see from days 6-10. Makes perfect sense the with extra decay due to the abbreviated market schedule. Selling a spread out to July 14th may make sense with the implied vols on the VXX for that week well over 60 on the call side. Again, the futures are doing you a favor. Maybe a 22-25 short vertical for .45 or so.

If you’re bearish, a July 5th/July12th 162-163 call diagonal for about 7-8 cents may be a nice opportunity as well.