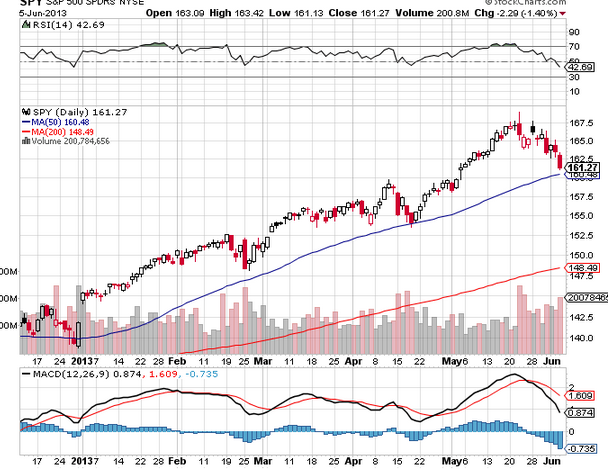

It appears that we’re approaching a sort of “show me” moment in the market right now, where the VIX appears to want higher percentages and the S&P is nearing a support line (50 day sma) that it has held religiously since last October. In today’s algo-bot market, where the vast majority of trades are made by artificial intelligence, trends seem to last longer and technicals are heavily respected, so this may be a critical juncture for 1-3 month market direction.

(I apologize to readers for my recent absence; I’ve been dealing with a confluence of events, including the CFA exam, and food poisoning, but I should have time to post 3-5 times per week going forward.)

If the 50 day is decisively broken, a lot of folks will be stopped out, that is just the fact of the matter. They do not debate it. Whether there are others to step in on POMO faith, during interest rate volatility, and questionable macro and seasonal factors will be very interesting.

Courtesy: Stockcharts.com

In the meantime, the VIX has in my opinion been very well behaved as the S&P has fallen 80 points, or 4.7% in 10 trading days. Last year as this seasonal fall was occurring, on it’s normal May schedule as opposed to late May early June, the VIX saw levels well above 20. What followed was a summer which saw the VIX explore depths not seen in several years. So, we are at a bit of a crossroads here, IMO.

Nothing has changed frankly, except the month. Macro data is still stinky to meh, but not awful. So it is BLATANTLY obvious that the Bernanke is not even close to turning down the money machine. This can’t be more clear. Furthermore, where are rates going to go with core inflation going LOWER? Forget about core inflation, oil and gasoline are lower than last year. He may print just to reach the inflation mandate:

Source: Dallas Fed

So, futures are tracking the VIX very closely