In case you’ve ignored markets for a month, interest rates have made a very impressive move. Meanwhile, the media punditry loves to wield the old axioms that bond money is far more intelligent than stock money. Is this true? History will tell you that it certainly is not. If bond money was so smart, why were they lending to Greece for all that time? Or better, why are non-investment grade corporates getting the kind of bid that only A or better bonds did before. And who in their right mind would lend at Treasury type rates for 10 to 30 years to a company in the rapidly changing handset industry. That industry is littered with corpses. Those investors are already taking a big hit:

So, over-indulgence in risky bonds is not a new story, but now it appears that some may get a hard lesson in duration. Duration is that ugly beast that eats bond values during periods of volatile or rising interest rates. Suddenly a 1% shift in the yield curve makes an 8% hole in your long-term bond. And folks may just stare at their statements at the end of the year wondering who told them they were, ahem, “risk-free”.

So quick look at what the 10 and 30 year yields have done lately. The CBOE used to have a forward swap index that was a proxy for interest rate volatility, but they apparently stopped publishing that data. I feel that it would be a useful data point, to gauge how current rate movements compare to past events, maybe as a predictive gauge of larger rate moves.

30 Year bond rate:

10 Year:

Courtesy of Stockcharts.com

Clearly these moves are shocking some folks. Those are 60 basis point moves in one month. And the Fed is still buying 90% of all new treasury issuances:

http://www.bloomberg.com/news/2012-12-03/treasury-scarcity-to-grow-as-fed-buys-90-of-new-bonds.html

What does this mean? First of all, the punditry is wrong about tapering and wrong about the timing probably wickenburg payday loan. Just because the economists thing the Fed will taper this fall, it does not mean they will. The economists are using their crystal ball to project certain job and inflation metrics into the future, and if there is one group of people that are consistently bad at their job, it’s these guys. Furthermore, people don’t like to take Ben at his word, they have to read things into what he is saying. WIth inflation at such low levels, he is contending with a two-pronged enemy, that is not signalling a taper in any way.

Yet, regardless of what people want to hear versus what is true, fear is creeping into the bond market, and that can affect stocks. First, it provides a more attractive place for certain people to park money. Like an automatic stabilizer, the bond market will take in money at better yields. That leaves less for stock allocation. Secondly, higher yields have a slowing effect on the economy, making financing costs more prohibitive to investment, from cars to homes, to corporate cost of capital. Slower spending, slower investment, tougher environment for stocks.

It will be interesting to see if rate volatility equates to equity volatility as as the year moves on.

The VIX had a quiet day as did the futures:

| Symbol | Contract | Month | Time | Last | Change | Open | High | Low |

|---|---|---|---|---|---|---|---|---|

| VX M3-CF | S&P 500 VOLATILITY | June2013 | 16:24:09 | 15.60 | -0.20 | 15.60 | 15.85 | 15.40 |

| VX N3-CF | S&P 500 VOLATILITY | July2013 | 16:24:13 | 16.70 | -0.20 | 16.65 | 16.85 | 16.50 |

| VX Q3-CF | S&P 500 VOLATILITY | August2013 | 16:15:00 | 17.45 | -0.25 | 17.55 | 17.65 | 17.30 |

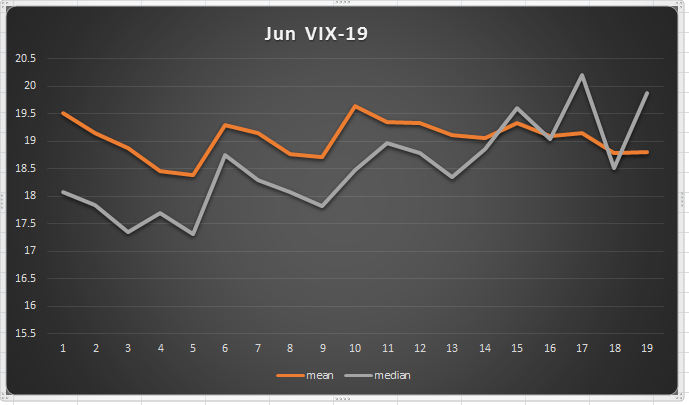

And volatility historically likes to ebb a bit as the June cycle wears on; although the median is telling you that the market has had some rough Junes.

Of all seasons, summer is the weakest, so if you start hearing the “summer rally” stuff floating around, just be aware that the summer is #4 of 4. It also can be quite volatile, as we saw in 2011.