Remember all those technicians with the most famous 50 day moving average of recent times? All those experts that said volatility was “here to stay” for a choppy summer. And those bond kings, that said 2.5% wouldn’t happen this year? Wrong, wrong, and wrong. Being on CNBC or running a $100B bond portfolio does not come with a crystal ball, and so here we are at new highs in stocks.

It seemed like a fairly easy contrarian play, with everybody in the world talking about the 50 day that we would move above it. While I was positioned for lower volatility, I was caught off guard by the size of the move in the S&P and was forced to roll out and up our S&P call spreads.

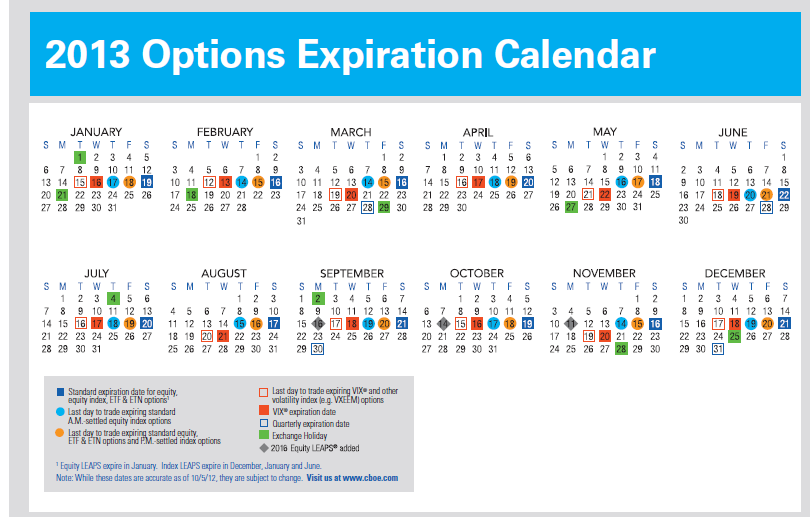

This year has been a textbook year for stocks in their behavior seasonally, so let’s look at what’s ahead, from a historical standpoint. July is the best month of the summer in the third quarter, #4 for the Dow, #6 for the S&P. July is very bullish in the first half, and as I have pointed out with the volatility wave in prior posts, this right here is the trough historically for vol in the July cycle. The second half of July and the first part of August have demonstrated weaker performance.

As I mentioned yesterday, the crowd is now feeling like we are headed to the moon, and that may be so, but I feel as if we will see higher volatility at some point in the next three weeks, and I chose late next week and the following week as a raw guess as to when that will happen. But while we wait, there are high percentage plays to be made that will work with flat or higher vol. The VIX futures:

| Symbol | Contract | Month | Time | Last | Change | Open | High | Low |

|---|---|---|---|---|---|---|---|---|

| VX N3-CF | S&P 500 VOLATILITY | July2013 | 16:40:37 | 14.50 | -0.35 | 14.35 | 14.75 | 14.20 |

| VX Q3-CF | S&P 500 VOLATILITY | August2013 | 16:40:37 | 16.05 | -0.30 | 15.90 | 16.10 | 15.80 |

| VX U3-CF | S&P 500 VOLATILITY | September2013 | 16:40:37 | 17.20 | -0.25 | 17.10 | 17.20 | 16.90 |

The VIX was as low as 13.5 before it finished almost unchanged. The futures are still catching up to it, and July has 3 trading days remaining. This means that the VXX will move up or down primarily on the August futures, which have a reasonable spread to spot being that spot is so low. That will act as a bit of an upside shock absorber. Furthermore, one should not expect significant deterioration in the VXX as we have seen recently due to this structure. The roll is still around 9 cents per day for 3 more days. Then it will be rolling into September at a lower negative yield.

Now, here is where it gets interesting. September is notorious for market sell-offs, but just like May, sometimes it gives everyone a head fake early, gets over zealous shorts covering, and then the selling comes in October. This occurred last year. But, due to this anticipation, the September VIX futures can hold a bid and the curve can get steep.

The other big consideration is the fact that the VIX futures have another week to expiration in the August cycle. That means that the roll has 5 extra days and that the premium to spot will hold on longer. These two factors, the September bid and the August cycle length can hold up the VXX for a long time and prevent decay. So, there is not a ton of downside to the VXX, it may not fall much for quite some time, only having a smaller roll yield to hurt it.

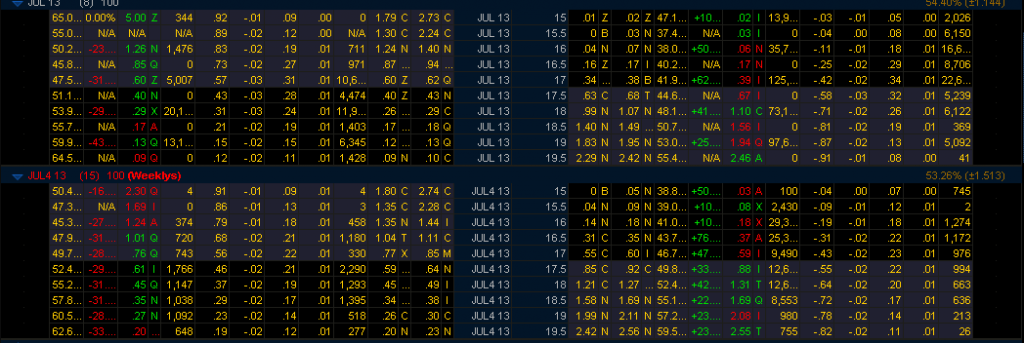

That means that making money on it is still easy. Sell put spreads. Since we can’t make the easiest money selling elevated IV in call spreads during a sell-off, we have to take the opposite approach, and thankfully the VIX is not in no man’s land, like 16-18. It is low enough to take advantage of the VXX on the other end of the option spectrum.

I am trying to time this, so I held off today. I will start one tomorrow and add Monday depending on how the market handles a potentially damaging China GDP number. (Not that the market cares about the global economy or light revenues right now, it could care less.) Â What you might see is a low in the VXX around mid-day and then put buyers in the S&P coming in Friday afternoon ahead of next week’s plethora of market moving events.

Specifically I am looking at selling a spread next week and the week after starting at 17. The July 26 puts have 4.4% of downside priced into the VXX, and that will be tough even if the market does not see a down day between now and then. And if that happens, it is easy to roll it down. I like the risk/reward set-up, it is in your favor.

Oil volatility fell 6% today as oil fell. Funny how that happens. This literally means that the call option volatility deflated quickly as it reversed course, the opposite of S&P VIX behavior. The OVX or oil VIX is based on USO options using the S&P VIX methodology. I expect flat to lower oil from here over the next month, and as I posted and tweeted, I am short UCO call spreads and long August puts.

BTW, the NYMO is showing the highest short-term overbought level since June 2012: