These are the days that option sellers love. Nothing happened. Theta burn on higher volatility options and weeklies took its toll on those long options and volatility. One who holds an option is not only long a portion of the underlying, but he is also long volatility and short theta. Not a good day for most of those folks. For those that follow me on twitter, it is has been pretty clear that I have been primarily a seller of vol and spreads over the past couple weeks, considering where we are in the cycle and where we are in the market.

I am always on the search for inflated volatility to sell, but right now what is on my mind is getting long some volatility, as I anticipate something to occur in the next few weeks. The summer is not going to be a slow grind up until September; the odds of that happening are rather small.

So, the futures:

| Symbol | Contract | Month | Time | Last | Change | Open | High | Low |

|---|---|---|---|---|---|---|---|---|

| VX N3-CF | S&P 500 VOLATILITY | July2013 | 16:24:56 | 14.85 | -0.25 | 15.15 | 15.20 | 14.75 |

| VX Q3-CF | S&P 500 VOLATILITY | August2013 | 16:25:11 | 16.35 | -0.30 | 16.65 | 16.65 | 16.30 |

| VX U3-CF | S&P 500 VOLATILITY | September2013 | 16:15:00 | 17.45 | -0.35 | 17.78 | 17.78 | 17.35 |

Four trading days left for July and 24 for August. That means that the VXX is moving on August now and as you can see there is still 2.20 of premium to spot VIX which will buffer any up moves in the VIX provided they are blips and not 25 point S&P waterfalls. A 10% move higher in the VIX is nothing at low levels so this buffer is not the same as it was two weeks ago with the VIX at 17 and the front month futures at 19 and 20. There’s a lot more money tied up in puts at those levels.

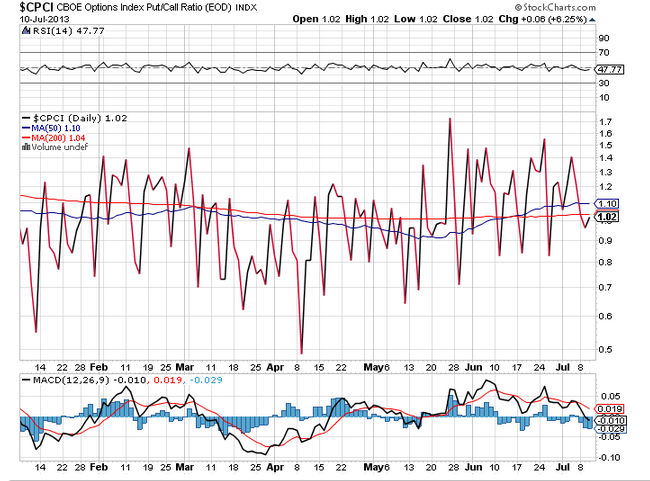

Index puts to calls are relatively low right now:

Yet the XLF has been seeing some heavy put action the last two days. Yesterday was an astonishing 23-1 put/call ratio:

Today it was 8-1 and while yesterday the majority were bearish put spreads, today the popular opening position were naked puts on the ask for August, very bearish. But, as a caveat, I have mentioned before that these ETF’s have become a hedging tool. They are less costly than VIX options and let you be sector specific. The IV on these puts ranged from 19.5 – 25.

I have a suspicion that sometime between next week and the end of the month we could see rising volatility. I think that selling end of month put spreads in the VXX from 17 lower might be a nice play right here. The S&P is up 3% this month already, and there is a lot noise coming down the pike, starting with China GDP on Sunday night. This should be fascinating as the export print last night was the worst since October of 2009. A plethora of flat top-line corporate earnings and interesting guidance to follow that and big economic data points as well. Gasoline is rising fast and the oil economic choke collar is engaging.

This is not a bearish take, just a suggestion that we are now becoming vulnerable to more vol. My guess, and I stress guess, is late OPEX week or the week after. My crystal ball is on the blink, so don’t blame me if we go straight to 1700 from here.

Oil vol is rising:

And with good reason. The prices are getting frothy up here. I am short UCO July call spreads and long August puts. I am eagerly awaiting the commitment of trader report on Friday to see if the managers are more than the 10-1 long than they were on July 2nd.

Update on other open positions:

VXX short call spread July 12th $20.5 – 22.5 is toast for .40 profit.

SPY short call spread July 12th $166-168 is in limbo at .36, sold for .32. It sits right on resistance with two days to go. I still like it here, and I may add to it tomorrow.

New position tweeted today:

Short IYT July 19th $115-117 call spread for .54. Oil and the transports surging higher yesterday? One has to go down.

Considering these short call spreads:

SODA for July 19th – broken chart

YELP for July 19th – rest period

GMCR for July 19th – gap magnet

Still trying to find a weekly calendar spread in the financials that I like.

Follow @VolatilityWiz on twitter and stocktwits for real-time trading ideas. A subscription service is in the offing; if you are interested in receiving information on this in the near future, shoot me an email using the contact link above.