Watching the last two weeks, one might certainly get the impression that August will be a snoozer. Especially after the last two weeks have seen virtually no movement on any front. (outside of individual earnings-driven names) The S&P is virtually unchanged from July 15th and is trading in tight ranges. Volatility is quite subdued and the VXX has remained flat over the last week, as the spot to August premium has dwindled, while still having over three weeks to expiration of the August contract.

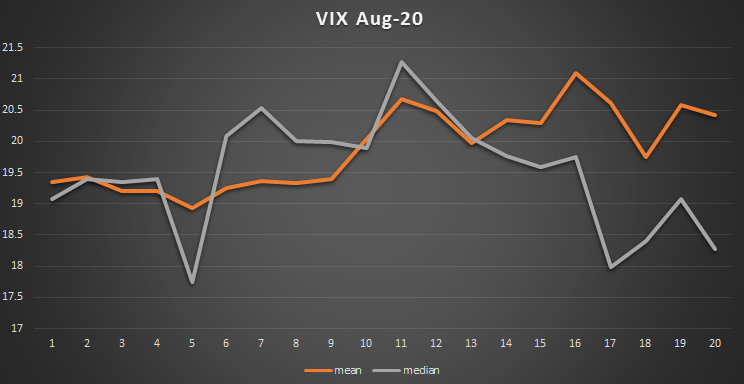

If there is going to be any volatility in this opex cycle, it should be soon. The small caps are rolling over (IWM MACD cross to the downside), the transports (IYT) are looking to retest its 50 day, and the SPY is looking to cross over as well. There are numerous signs of weakness, but with trading so light it may not matter. Â Let’s take a look at the Volatility Wave for August:

We are on day 6 here, and the pattern for volatility shows a tendency for vol to rise beginning this week after doing nothing in the first week, which is very typical for the first week in most cycles. Clearly, any volatility will hinge on the FED, the constantly over-hyped and very misunderstood jobs number on Friday, and the GDP print on Wednesday. GDP is expected to be terrible, so a bad number probably will have no effect. A very good jobs number or FED language could restart the taper hysteria, but it certainly seems that most of those shocks have already been felt, and could be muted.

The futures will probably hold up for a bit, as September is notorious for negative action and August premium to spot VIX is around 1 with 3+ weeks to go. So outside of roll (roughly 5 cents per day) there is not a lot of downside to the VXX, as we have been suggesting over the last few posts. Keep in mind that the VIX itself is rolling into September, so it will probably not fall to the 11-12 area. Spike risk has reduced a bit, solely due to the fact that September now represents a larger portion of the VXX, soon to be over 40% in the next couple days.

| VX Q3-CF | S&P 500 VOLATILITY | August2013 | 16:00:40 | 14.65 | 0.20 | 14.55 | 14.85 | 14.45 |

| VX U3-CF | S&P 500 VOLATILITY | September2013 | 16:00:38 | 15.90 | 0.05 | 15.90 | 16.10 | 15.83 |

| VX V3-CF | S&P 500 VOLATILITY | October2013 | 16:00:38 | 16.94 | 0.04 | 16.90 | 17.06 | 16.85 |

There aren’t many trades in the VXX right now that have a distinct advantage from a risk/reward perspective. Buying calls is a waste generally, but selling them in verticals is not offering a favorable trade either. Here is one of the few ideas that will work if the week is uneventful:

Short VXX August 2nd 15.50 for .42

Long VXX August 9th for .62

This calendar works best if the VXX just sits here and rolls. Then on Friday you will be left with the August 9 calls which will be worth .40+ and you only spend .20. The risk on this trade is less than the .20 you are putting up as the deltas are roughly similar. Not much can go wrong on this trade. A spike in vol is covered with nearly equal delta, and falling VXX will leave you with more than .20 at the end of the week. I will probably put this on tomorrow.

Here are the IWM and IYT bearish set-ups. I went long a small IWM weekly 104/103.5 put spread for .25 that will pay 2-1 if the IWM closes below 103.5 this week.