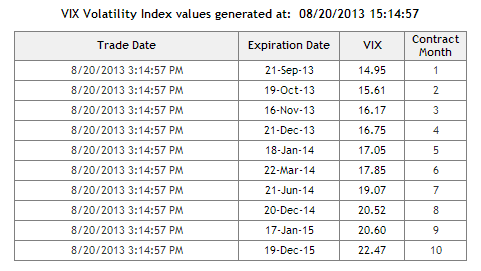

Volatility made a round trip today, albeit in a tight range between 14.25 and 15.25. The market bounced, but gave a lot of the gains away in the last hour. The Dow did not even bounce, even with HD (a DJI component) demonstrating that it has leading fundamentals in the consumer space. The stock proceed to get smacked down at the open and even had a mini-flash crash in the afternoon:  This is ugly price action and if it weren’t for financials, small-caps and transports showing relative strength, today’s bounce in the S&P would have been written off as a total waste. Futures fell to nearly 15 in the Sep contract, which as of tomorrow is the entire VXX and UVXY holding:

This is ugly price action and if it weren’t for financials, small-caps and transports showing relative strength, today’s bounce in the S&P would have been written off as a total waste. Futures fell to nearly 15 in the Sep contract, which as of tomorrow is the entire VXX and UVXY holding:  So for the time being, the VXX and UVXY have a solid floor in that the Sep contract will dictate their movement almost entirely. And with a myriad of potential issues lingering after Labor Day, one can not reasonably expect the Sep future to fall far below 15. (If it does, the VIX Sep $12 option is a great trade) This is what the VIX is rolling into:

So for the time being, the VXX and UVXY have a solid floor in that the Sep contract will dictate their movement almost entirely. And with a myriad of potential issues lingering after Labor Day, one can not reasonably expect the Sep future to fall far below 15. (If it does, the VIX Sep $12 option is a great trade) This is what the VIX is rolling into:

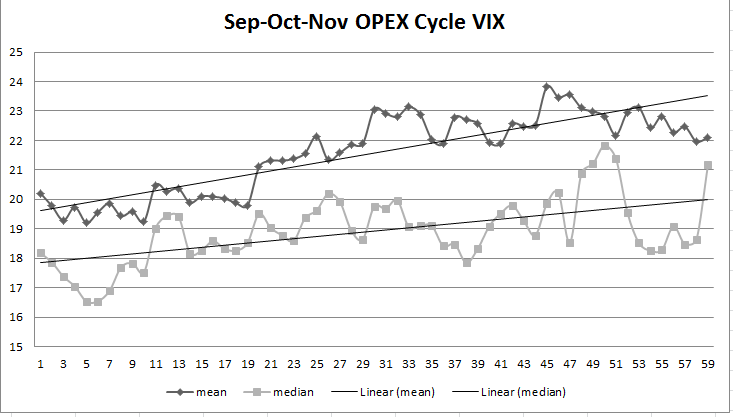

October isn’t going to fall significantly anytime soon either. Part of the reason for their stiffness beyond the aforementioned buffoonery in Washington and Fed meeting, is a seasonal factor. Investment managers have what I call calendar risk. They will cut and run without asking questions in the fall if their year of 20% gains is jeopardized. This tendency causes the following seasonal dynamic in the VIX:  This a chart of the VIX over time in the 3 OPEX cycle from mid August to mid November. Day 10 is the day after Labor Day. So we have changed from a sell the rip in vol to a buy the dip. That has been working in the VXX:

This a chart of the VIX over time in the 3 OPEX cycle from mid August to mid November. Day 10 is the day after Labor Day. So we have changed from a sell the rip in vol to a buy the dip. That has been working in the VXX:

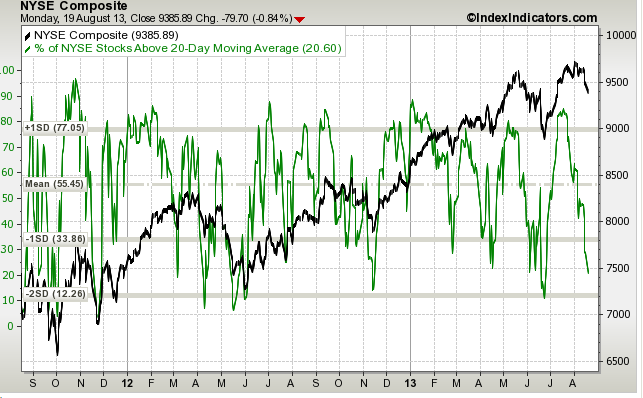

I’ve been trying to find vol trades, but we’re in a sort of no man’s land right here. I am actually thinking about selling the Fed vol tomorrow, but how much downside is there? I’d rather let the vol come out and try to get long Sep vol on a dip. Lots of stocks are breaking down, and the percentage of stocks above their 20 day moving average is hitting very low levels (hat tip http://vixandmore.blogspot.com/)

Tomorrow may determine the short-term market direction, while the end of August is typically bullish. Let’s see how tomorrow shakes out. I’m still short crude, long a silver calendar (AGQ aug4/sep $24) and long an AAPL spread into the launch, selling weeklies against Sep2, the launch week.