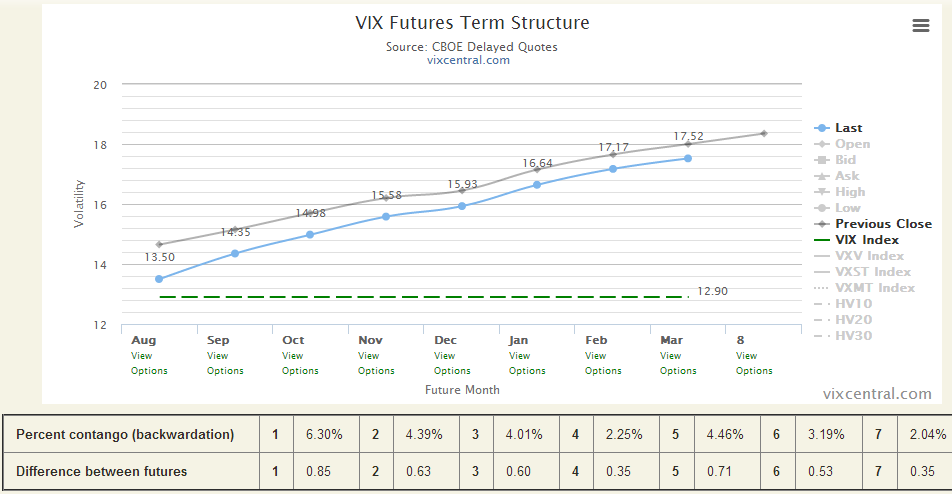

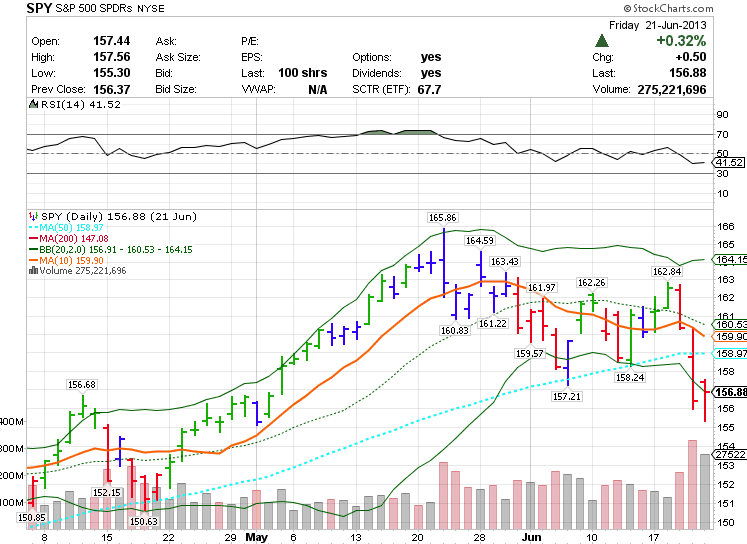

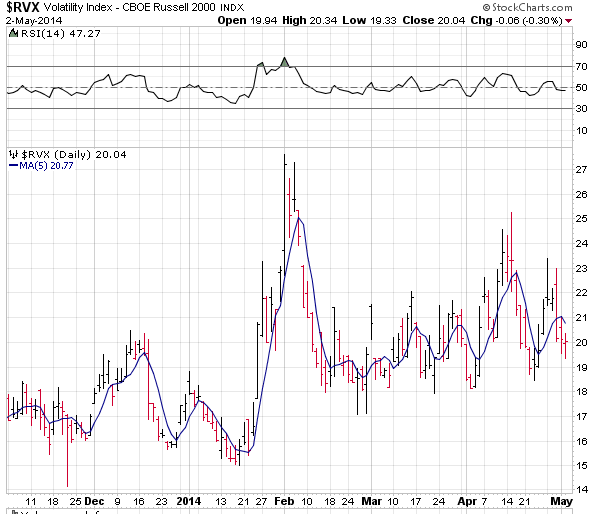

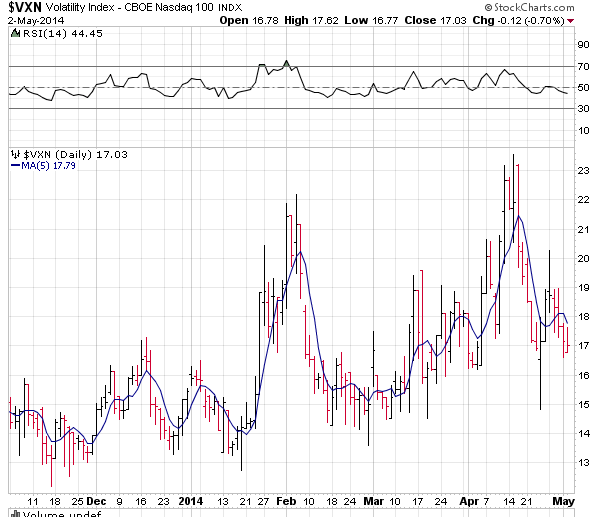

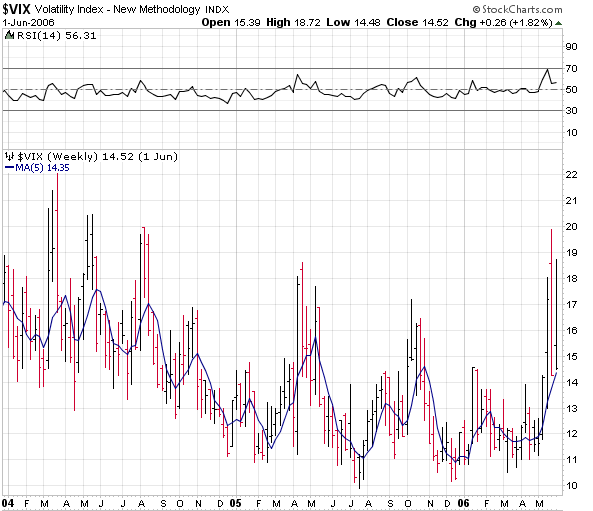

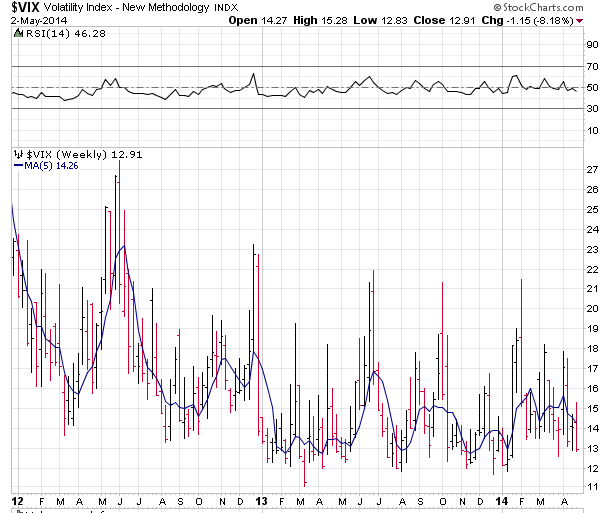

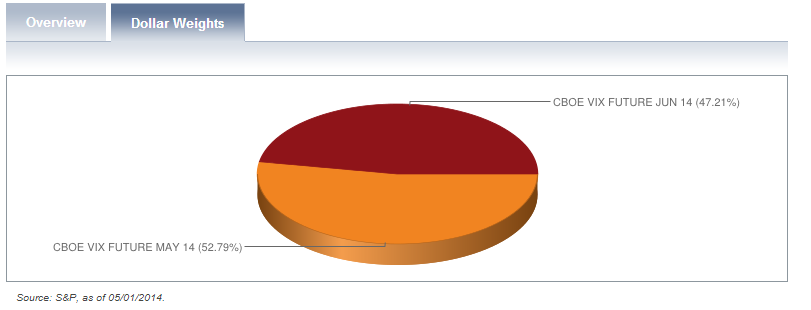

In part one, we looked at the ranges of different sector VIXs, compared the S&P VIX to a similar past time-frame during a mid-term election cycle, examined the current VIX futures contango structure, and did some rough calculations of negative roll yield in the current structure. Now we want to examine some trade set-ups to take advantage of a low volatility environment.

I want to demonstrate three trade scenarios:

-Put spread sales on VXX and UVXY

-Long VXX calls

-Long VXX diagonal spreads

The main premise of these set-ups is two-fold: A. That volatility can go higher in the next month or two due to seasonal factors, and because volatility is at the low end of the range, thus risk is under-priced. B. That these trades can be set up with an asymmetric risk/reward scenario; that the risk of loss is far less than the potential for gain.

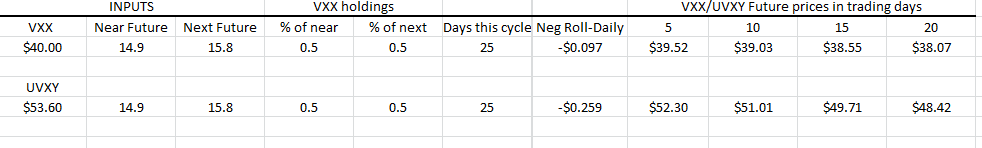

Let’s make a projection of VXX option prices using the negative roll formula:

So if you believe the VIX structure will remain in this format, here are some projections for VXX and UVXY prices at future points in time taking into account the negative roll yield. In 5 trading days the VXX will be roughly 39.52, in 10 days 39.03, etc. The UVXY decays twice as fast, relative to its current price.

VXX Put Spreads:

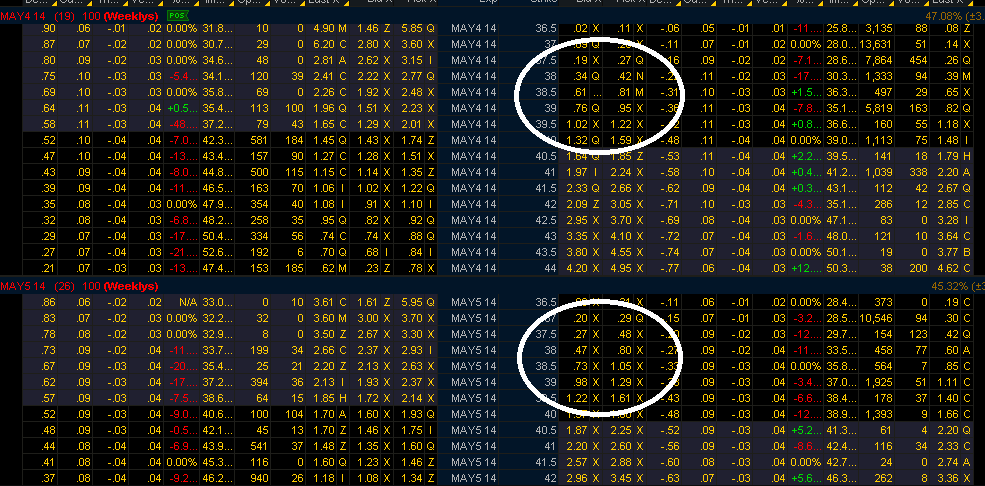

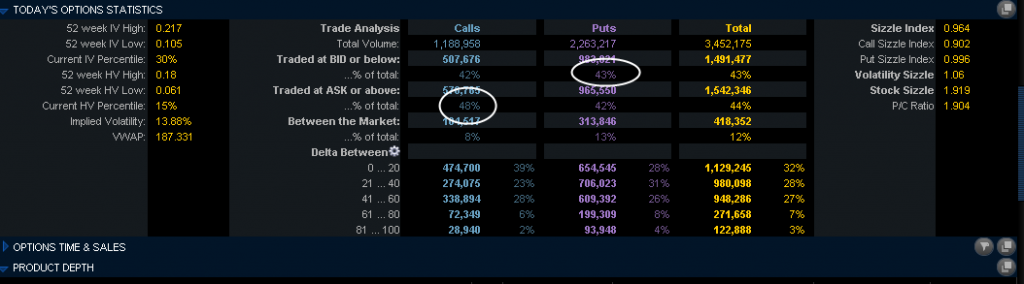

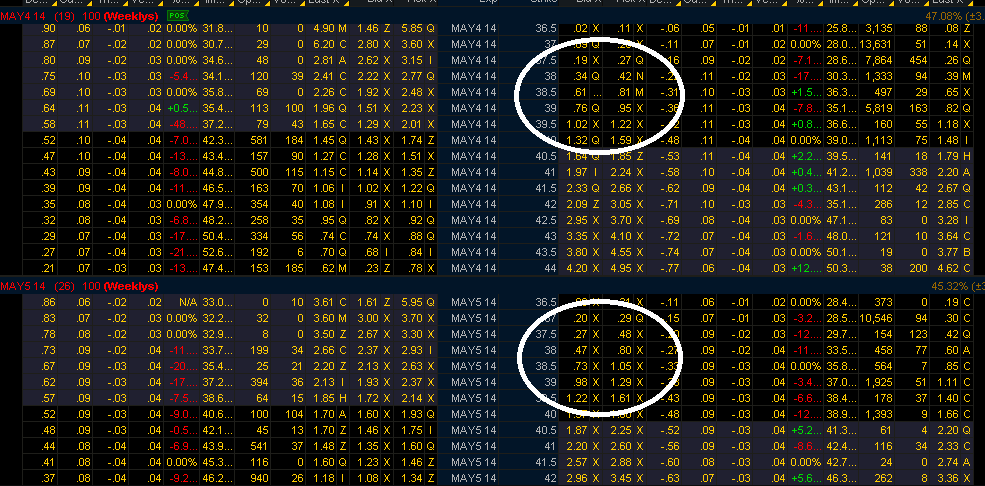

Here is the VXX option chain:

One put spread example would be to sell VXX put spreads for next week or the week after at a level that would take into account the negative roll, and gives you some wiggle room for a shift down in the VIX futures of 1 or 2 percent more. For the May 23rd expiration (May5), the VXX 38-37 put spread can be sold for roughly a .25 credit, whereas 15 days of negative roll only get you to $38.55. If the futures curve fell around 2%, that would equate to a VXX price of roughly the $38.55 less another 2% or 37.75.

Thus, it would take not only a significant drop in vol from here for this trade to lose , but there could be no hiccup in the market during this period. If the S&P saw any selling, the VXX simply cannot get to this price. The odds are that you will keep the premium. This same method can be applied to UVXY, at say the $50-48 levels.

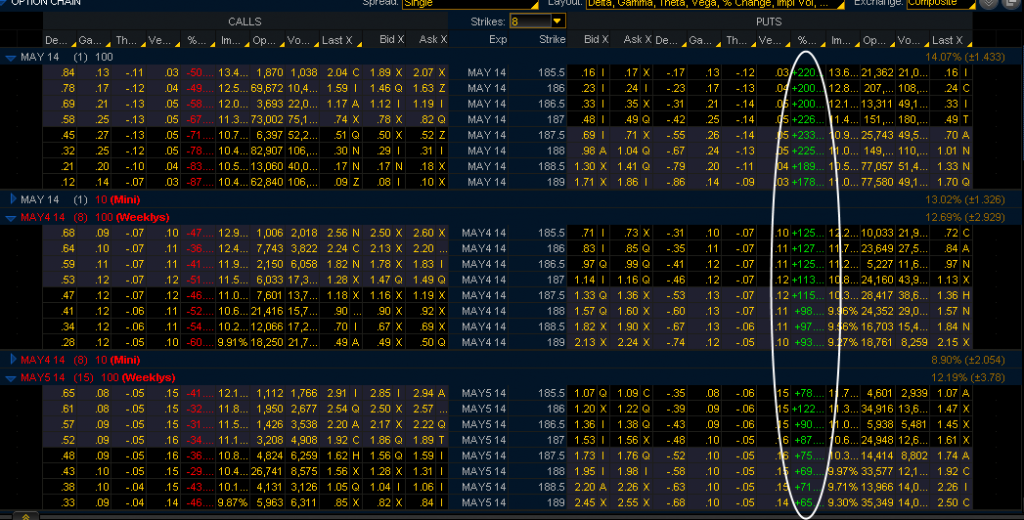

VXX Calls:

In the above case, your profit is capped at .25, but it you are bullish on volatility or bearish on the market, it is not a bad time to get long vol using VXX calls. As we described above, there is only so far for the VXX to fall considering how low the futures are, so you can choose some calls that don’t put the entire cost of the calls at risk yet give you a ton of upside if the market sees increasing volatility or sells off:

![2014-05-04 20_45_26-Main@thinkorswim [build 1860.10]](http://www.volatilityanalytics.com/wp-content/uploads/2014/05/2014-05-04-20_45_26-Main@thinkorswim-build-1860.10.png)

Again, knowing that the VXX will have a tough time falling below $38 in 20 trading days, you could purchase the May 30th VXX $37 calls for $3.35 debit. At risk over the next two weeks is realistically around $1.50 of that $3.35, but if the market sells off between now and May 30, the upside could be 100-300% of your real risk of only $1.50 per contract. It would be up to you in two weeks to reevaluate how you see the next two weeks after that playing out, and adjust accordingly, if you hadn’t sold them by that point.

VXX Diagonal Spreads:

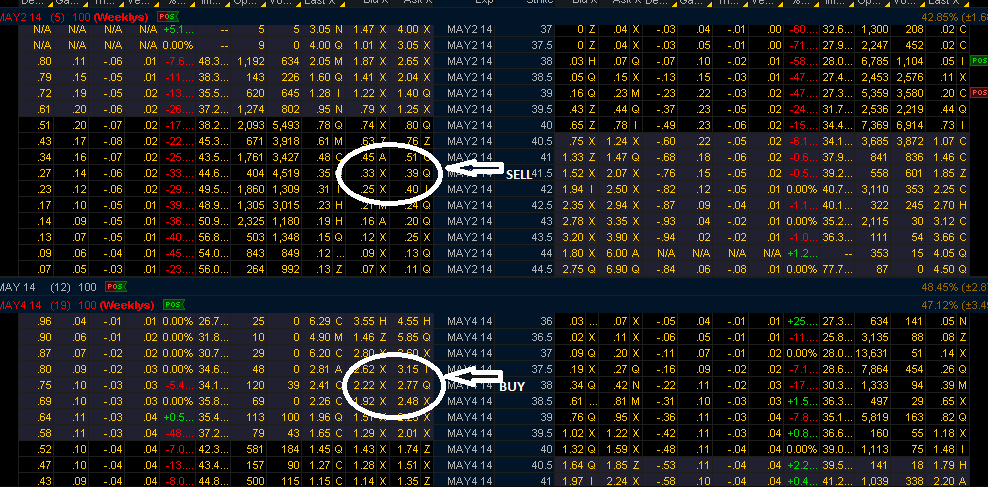

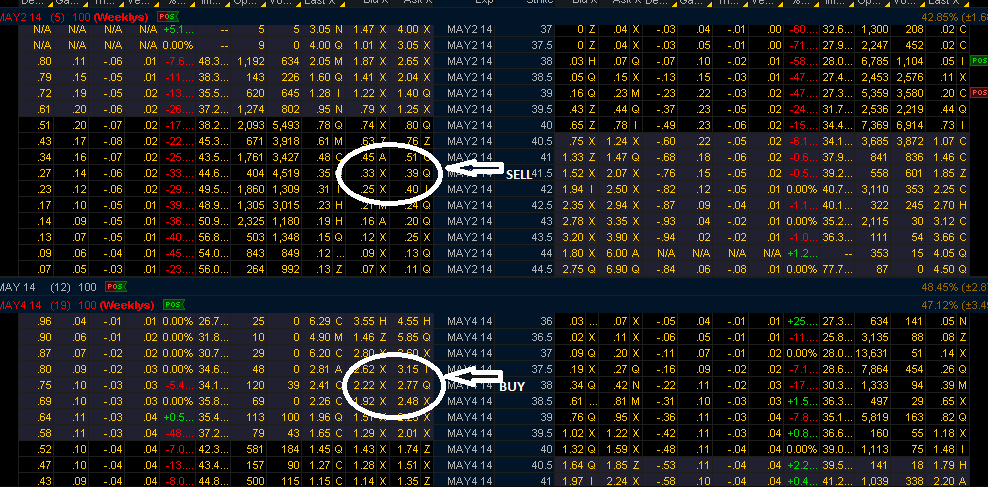

This is about as beautiful as option trades get, because you not only take advantage of rapidly decaying premium out-of-the-money, but use that to defray some of the cost of a long volatility position:

If you suppose that this week will be a quiet one, but there are storm clouds on the horizon, you could sell the May 9th $41 call for .45 Â or the $41.5 call for .35 and buy the May 23rd $38 call for around $2.50. Now you are long volatility for no premium paid, essentially $2 which is the current VXX price, less the strike price of the long call, $38. Another advantage of this trade is that you can sell against it again at the end of this week to further cut into your cost of the long call. Also, if volatility rises between now and Friday, diagonal spreads benefit by rising volatility or vega.

So there are three ways to get long vol without paying high premium in VXX or VIX calls. The odds are with you on these trades, whereas buying out-of-the-money calls on the VIX and VXX as many people do is a consistent losing strategy.

I will be starting a volatility forecasting and signal service shortly for $25/mo if you are interested, and that will also include an email service with real-time trades, and a weekly newsletter breaking down the volatility landscape. There will also be sections with basic option trades and education, ETF analysis for straight trades on volatility, inverse and leveraged funds, and profit loss diagrams. Imagine what you see here and a lot more. Email me at scottmurray1 (at) gmail.com if you are interested.

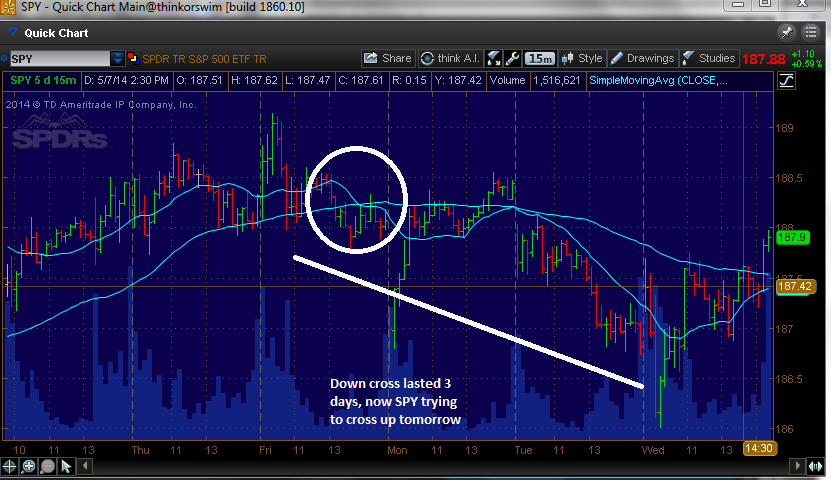

![2014-05-08 18_44_42-Main@thinkorswim [build 1860.10]](http://www.volatilityanalytics.com/wp-content/uploads/2014/05/2014-05-08-18_44_42-Main@thinkorswim-build-1860.10.png)

![2014-05-08 18_51_55-SPY - Quick Chart Main@thinkorswim [build 1860.10]](http://www.volatilityanalytics.com/wp-content/uploads/2014/05/2014-05-08-18_51_55-SPY-Quick-Chart-Main@thinkorswim-build-1860.10.png)

![2014-05-05 17_58_03-_VX - Quick Chart Main@thinkorswim [build 1860.10]](http://www.volatilityanalytics.com/wp-content/uploads/2014/05/2014-05-05-17_58_03-_VX-Quick-Chart-Main@thinkorswim-build-1860.10-1024x565.png)

![2014-05-04 20_45_26-Main@thinkorswim [build 1860.10]](http://www.volatilityanalytics.com/wp-content/uploads/2014/05/2014-05-04-20_45_26-Main@thinkorswim-build-1860.10.png)

![2014-03-16 17_08_31-Main@thinkorswim [build 1856.11]](http://www.volatilityanalytics.com/wp-content/uploads/2014/03/2014-03-16-17_08_31-Main@thinkorswim-build-1856.11-1024x269.png)

![2014-03-16 17_25_10-Main@thinkorswim [build 1856.11]](http://www.volatilityanalytics.com/wp-content/uploads/2014/03/2014-03-16-17_25_10-Main@thinkorswim-build-1856.11-1024x233.png)

![2014-03-11 20_49_48-_VXJ4 - Quick Chart Main@thinkorswim [build 1856.8]](http://www.volatilityanalytics.com/wp-content/uploads/2014/03/2014-03-11-20_49_48-_VXJ4-Quick-Chart-Main@thinkorswim-build-1856.8.png)