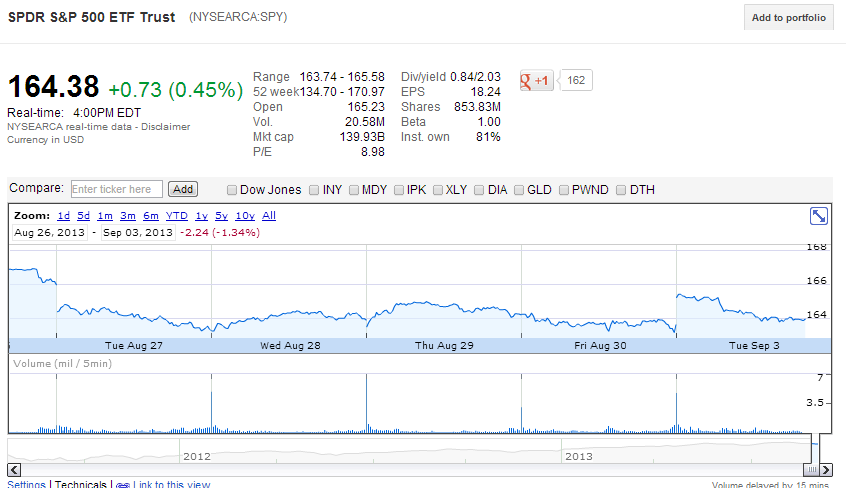

A lot of noise out there, but the markets have essentially gone nowhere since Kerry’s press conference on August 26th, subsequent sell-off and gap lower. Iron condor sellers are loving this environment, especially weeklies sellers. It is no wonder why folks have spent years fighting over the rights to make a market in the S&P options, they are incredibly lucrative:

http://online.wsj.com/article/SB10001424127887323514404578652211969315322.html

The market makers/sellers almost always win. It is not rare to see both sides of the SPY option chain showing red on the first trading day of the week, even if the index makes a .4-5% move. (Use diagonals for a fighting chance if you must trade these….see prior posts)

After higher futures prices coerced the market higher in an attempt to catch up to global markets due the the Labor Day closure, there was no conviction and the selling pushed it right back into the recent channel. I suppose you can consider gap filled. The S&P has done nothing since the Aug 27 open:

The SPY is riding the 100 day moving average, the slope of which is quickly flattening:  If you’re wondering about the colored candles, this particular chart demonstrates the Elder impulse system:Â http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:elder_impulse_system

If you’re wondering about the colored candles, this particular chart demonstrates the Elder impulse system:Â http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:elder_impulse_system

The VIX was more jumpy than the Sep VIX future; it opened lower, went positive, then almost reverted to the open price:

What looks interesting to me is a unique opportunity to be long volatility going into the Fed event, but also be short volatility for a post-Fed exhale after the Sep 18th press conference. Because the VIX futures expire the day of the event, you get a shot to be long vol without the event risk and also hold options that are short vol right after the event. I’m looking at two scenarios.

VIX Sep call spreads:

Since the FED meeting is the day the futures settle on Wednesday the 18th, you can buy a call spread and sell some premium in the outer leg, with the idea that the VIX will not fall before the meeting and you can collect the width of the spread.

The $15-17 spread will run about $.90 and if the VIX remains above 17 on Wednesday morning the 18th, you collect $2. Losses begin at $15.90 VIX at settlement. There are a bunch of combinations here, selling put spreads, widening the call spread, but the idea is the same. You are looking to use the event to expect an elevated risk level. I suppose that Hilsenrath can drop a tape bomb, but this is a delicate meeting and that seems doubtful. Furthermore, you have a host of other events brewing that should hold the VIX up.

Another way to achieve roughly the same thing but with potentially more upside potential is a VXX calendar put spread:

Sell the Sep 13th $16 put and buy the Sep 20th put for a net debit of around .27. If the VXX sits tight or drifts to $16 on Sep 13th, then you get a free runner for a volatility exhale after the Fed meeting. By then, the Syria situation could be clearer as well. If this trade works out perfectly, it could be a four bagger as the VXX heads to $15. You also can take it off next Friday if you so choose.

The VXX is holding nearly 50% of Sep and Oct as of tomorrow.