Today had the feel of one of those days where shorts were stuck and there would be no way out. The SPY held the 100 day moving average to the decimal yesterday, and now it resides 21 points higher 25 hours later. Volume was quite low, the lowest since August 26th. Volatility fell, and is diverging from the futures, which means that the VXX was nearly flat as the VIX fell 4.4%. This is not rare, but it is interesting with the event risk that is present. Which will be correct, the futures or the options?

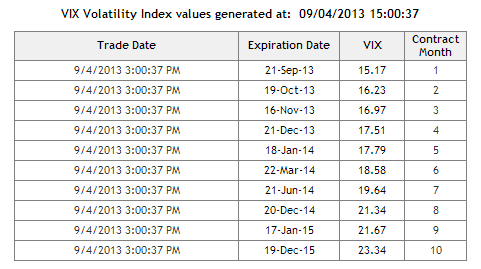

The futures are significantly higher than what the S&P options are indicating. Notice the huge difference between the VIX term structure (the actual VIX inputs using S&P option volatility) and the VIX futures:

What does this mean for the VXX? Quite simply, vol better show up, or the futures better hang tough heading into the Fed meeting. Otherwise, it is sitting on air without a net. The VXX is 50% of each Sep and Oct as of today. So it is buffered by a growing October holding that will have more resilience due to seasonality and the DC events coming after the Fed meeting. It is also rolling fairly cheaply. (relative to itself of course)

But as VIX expiration approaches on the 18th, the VIX and the Sep future will have to converge. In the VXX’s case, the longer it can roll into October by selling an inflated September, the better it will hold up. This situation is better played through the Sep future itself, and the call spreads I mentioned yesterday are nice way to catch the decay into expiration.

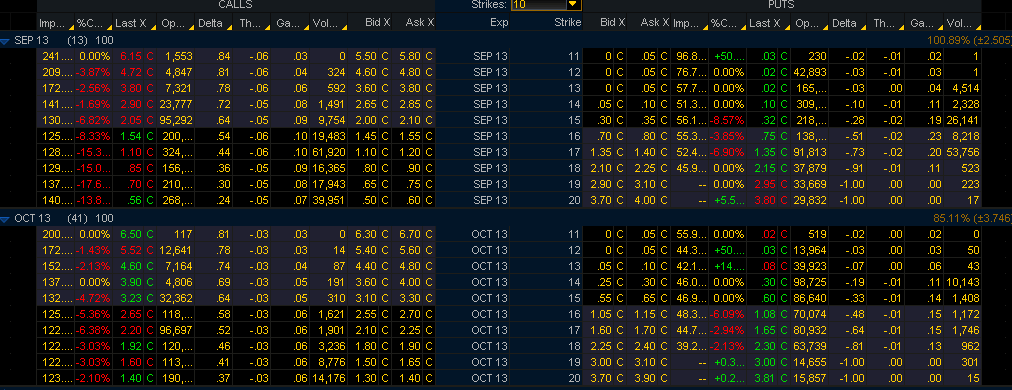

Another way to play this could be VIX option calendar spreads. This in effect is doing what the VXX has to do every day, buy the longer dated future and sell the near future. This would be like building in your own negative roll yield:

This is a terrific way to play the the event risk in multiple ways. For $1 you can sell either the $17 or $18 call in Sep and own October. If the VIX rises to 17 at expiration, that would essentially be a 2x or more return. If you let the Sep expire and hold October, you could take a bearish stance on the next debt debacle, or market seasonality being tough and let it ride. If volatility rises moderately, falls, or remains flat, this trade will work.