The headlines will say that the market sold off today, but in reality the futures brought down the opening marks which were then bid up most of the day. Tech stocks briefly went green and small caps (IWM) closed in positive territory. The consensus opinion is that the market will rocket higher as soon as D.C. makes a deal, and I must have heard the phrase “buy the dip” 100 times today. There aren’t many bears out there. I was also amazed at how many people were talking about selling volatility, as if there will never be a VIX over 17 again, and these pundits claimed it was a terrific opportunity to sell vol as there is no real market risk.

Someday these folks will learn the hard way that being blindly short volatility can have painful consequences, but it is anybody’s guess when that will be. A lot of today’s vol sellers haven’t seen the VIX really rip higher, it has become sort of a free lunch for them. The VIX futures did not respond commensurately to the rise of implied vol in the S&P puts, as October only rose 4.5%.

Obviously, VIX futures holders expect vol to fall quickly, regardless of the debt ceiling battle immediately behind this one. Even more consensus opinions claim that it is good that D.C. is battling now, because the losing party will not put up much of a fight in the debt ceiling deal.

Clearly, nobody expects anything bad to happen, in the media anyway. I am a bit more cautious and can wait to sell vol when either these things get cleared up or the price for vol goes high enough to compensate for risk. The momentum stocks, small caps and tech stocks have not corrected in the slightest bit, and that means that vol is too low for me to sell it now. Sure we could rip higher if some deal occurs, but you can sell vol for days after a vol exhale, you don’t necessarily have to put yourself out there being early.

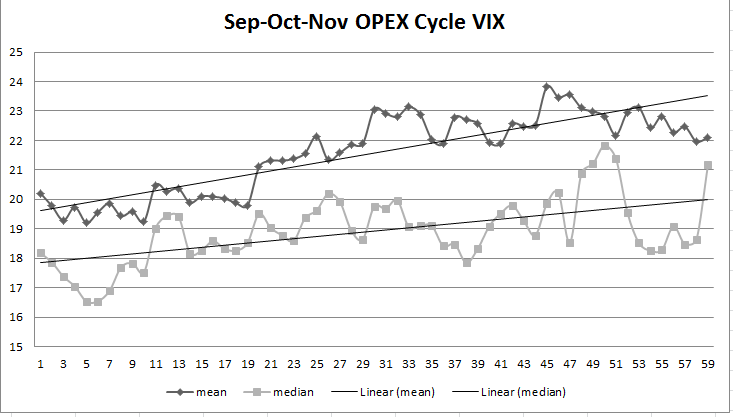

It will be interesting to see if now that the quarter is over, some of these outperforming sectors will sell off a little, after they’ve been propped or painted into quarter end. Recall that October is #11 out of 12 for the Russell 2000 and vol has a history of rising into this month, we are now at day 25 on this chart:

Today was a great day, as I came in short Russell 2k and Nasdaq futures and covered them up early in the day. i was also short crude and covered that also. At the end of the day, when the almost traditional end of day spike arrived, I reshorted both, but this time my stops are quite tight due to the potential for some kind of resolution in D.C.

Seems to me that people are way too bullish and complacent right now. I will get long if the market tells me too, but I am currently more cautious than the crowd. There may be a much better opportunity to sell VXX and VIX call spreads in the weeks ahead, or maybe just get short VXX or UVXY. I will wait a bit and see what happens.