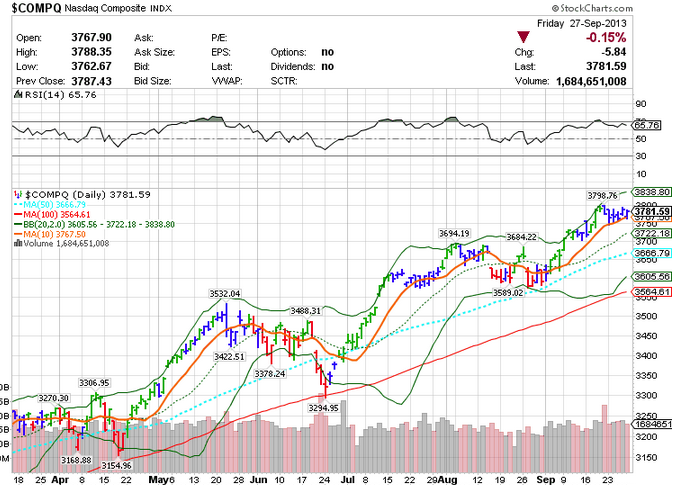

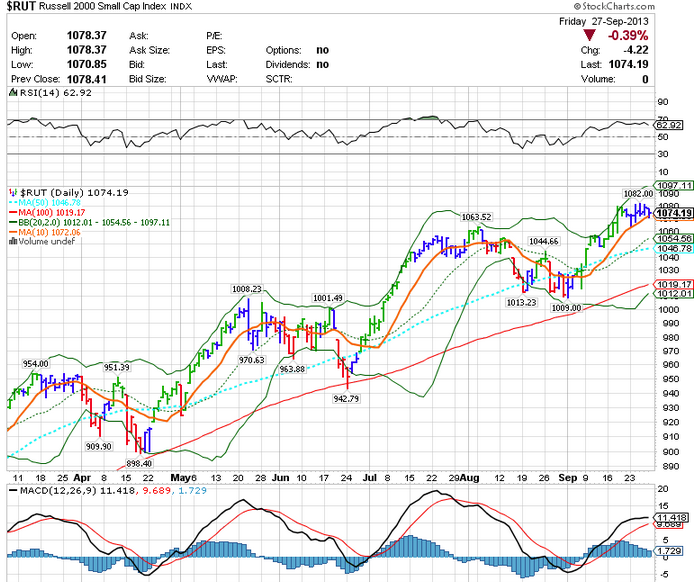

What was different about today that changed the volatility landscape? The S&P fell 7 points, but it has done that for 5 out of 6 days on low volume with the VIX turning a blind eye to all prior dips. The Nasdaq and Russell 2000 barely fell, and are right near their highs. It appears that the beta race by underperforming managers is on, and they will use the momentum names and small caps to desperately catch up.

Could this mean a big push into the end of the year? Quite possibly. But the street seems to know the future already, with everybody claiming the market will be bought at the infamous 50 day moving average. So they can see everything so clearly, a mild pullback as they wait for DC to inevitably compromise, then higher. When everybody is thinking the same thing, it makes me consider the alternatives, like the possibility of something unexpected.

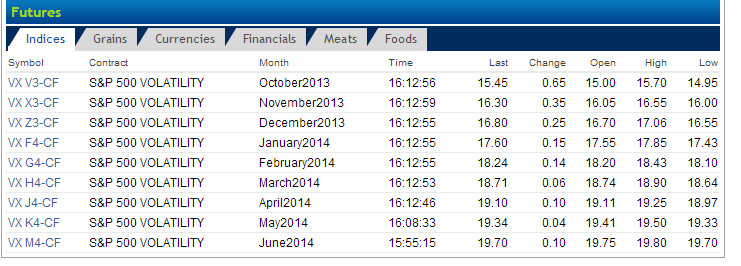

The futures rose, and with over two weeks to expiration met spot VIX. In fact, the spot VIX was higher than the October future for part of the day. This is unusual, as the time premium usually has the future trading higher than spot VIX. Furthermore, the weekend sees spot VIX fall anticipating weekend decay in the options. So, while the VIX level is not high buy any means, it is starting to respect the potential for shenanigans in DC.

This was one of those days where new and uninformed VXX traders sit confused wondering why the VXX was not up 10%. At this point, the VXX is holding about 40% of the more expensive November future, and this will impede a move higher. The futures are not convinced of any real blow up in DC, but why should they be? Real volatility is a distant memory and a lot of folks have made bundles shorting vol. One of these days, this will burn a ton of people.

I closed the remaining Oct VIX $14 calls I had for 1.70, which was a nice return from $1.35 and $1.40. It obviously is too early to sell volatility here. I would be much more inclined to begin selling vol over 17.

If you think we’ve corrected somewhat in stocks, take a look at this chart:

Or this one:

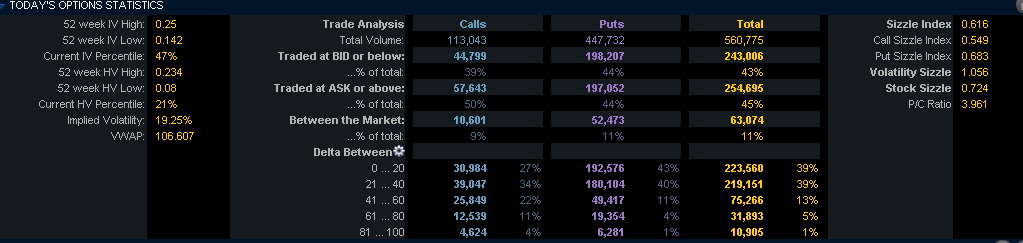

The indexes are basically at the highs. October is a challenging month historically, #8 for the nasdaq, #11 for the Russell 2000, and #7 for the S&P. In fact, the smart money is looking for this to change. The IWM, a proxy for the Russell 2000, saw 4x as many puts as calls trade today. This is an amazing ratio:

I have been short Russell 2000 futures for a couple days and I added a small short Nasdaq futures position as well. I will not fight these, and I will get stopped out on any move higher, period.