I want to thank all the subscribers that have signed up for the newsletter and trade alerts. All of the trades in Tuesday’s installment are working, and I hope you have taken advantage of the trade alerts as well.

Even I expected a larger move in the VIX today when the S&P was down 25 points, but here is why it didn’t:

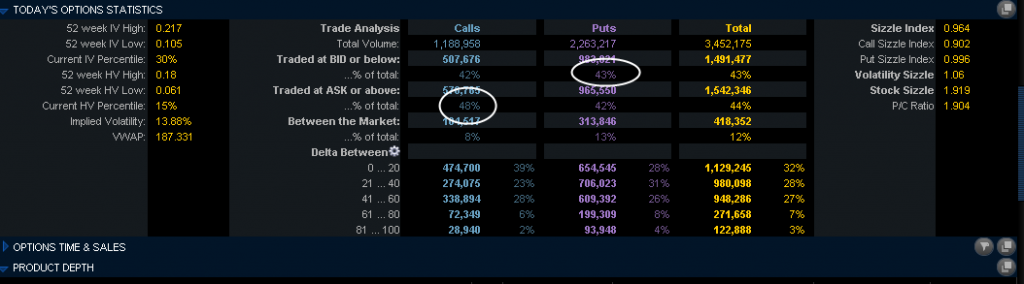

These are the stats for the SPY options today. When the SPY was getting nailed, folks SOLD puts and bought calls. More puts were sold than bought and more calls were bought than sold. That is a recipe for a lower VIX, without a doubt. This implies that no one believes that the S&P 500 can actually fall more than a certain amount before dip buyers will arrive. And you can’t blame them, that intraday buy-the-dip trade has seen it’s share of stick saves of late, which are often accompanied by a gap up the next day. When someone else has your back, why worry about selling the tiniest of volatility premium when it shows up?

But when something gets too easy in the markets, eventually it gets taken away or at least burns a bunch of folks to teach them a lesson. Selling puts like this can be hazardous to your health, maybe not today or tomorrow, but it will catch up to you eventually.

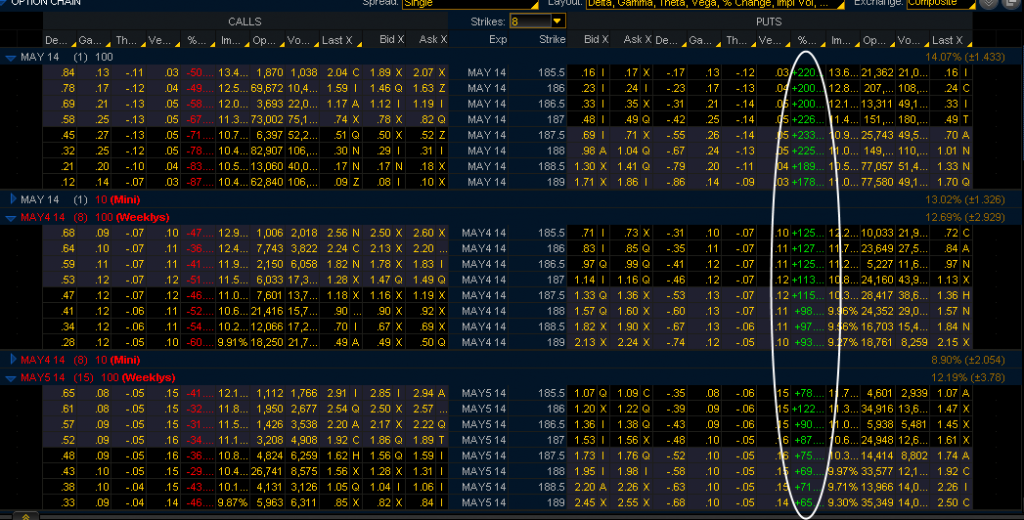

I highlighted in the newsletter that the SPY was technically setting up for a down move, and today it arrived. What happens when there is very little volatility in the options and the index makes a 1% move? This:

This doesn’t even tell the whole story frankly. If you timed a near-the-money SPY put right today, you could easily have made 400%, instead of the 225% seen at the close. Here is a 5 minute chart of the weekly 187 SPY put:

Actually, if you bought it at the open, you could have made 500%. That is what happens when there is no juice in the options. So, while the market is underpricing volatility, that doesn’t mean that you can’t own it in other ways, and this is a prime example. This is a long vol trade without using VXX or VIX.

Actually, if you bought it at the open, you could have made 500%. That is what happens when there is no juice in the options. So, while the market is underpricing volatility, that doesn’t mean that you can’t own it in other ways, and this is a prime example. This is a long vol trade without using VXX or VIX.

We may have more trade and volatility email alerts tomorrow, if you are interested, the newsletter link is in the above menu.