For what seems like the umpteenth time in a row, the market dip was bought today, and buyers did not wait until mid-morning this time around. The futures fell slightly, yet these have been in a tight range lately:

| Symbol | Contract | Month | Time | Last | Change | Open | High | Low |

|---|---|---|---|---|---|---|---|---|

| VX Q3-CF | S&P 500 VOLATILITY | August2013 | 16:31:53 | 13.35 | -0.20 | 13.75 | 13.90 | 13.30 |

| VX U3-CF | S&P 500 VOLATILITY | September2013 | 16:31:53 | 15.00 | -0.20 | 15.30 | 15.45 | 14.90 |

| VX V3-CF | S&P 500 VOLATILITY | October2013 | 16:31:53 | 16.05 | -0.05 | 16.20 | 16.39 | 15.90 |

The S&P has been in a 20 point range for most of the last month, yet the technical picture is moderately negative, as the MACD has crossed lower, the 10 and 20 day moving averages are rolling over, the 10 is about to cross the 20 heading lower, and the S&P closed below both averages. But realistically, it is hard to imagine what will send the S&P lower right now in light trading and with no scheduled event risk (FED, GDP, Jobs #’s, etc.) in the immediate future. Oddly enough, the small caps were up today while the financial sector is struggling. That is a very mixed message.

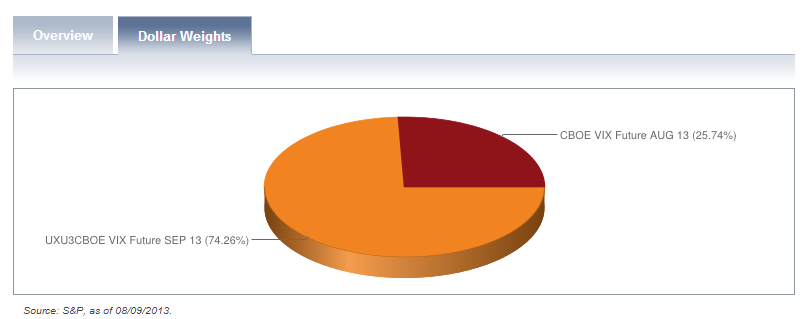

The VXX and UVXY have almost flatlined for the month of August thusfar, and as these continue to roll into September, expect that to continue. September presents some event risk and that premium will hang tough, meaning that the September future does not have much downside. Â The relative weighting of the VXX and UVXY of August and September looked like this on Friday:

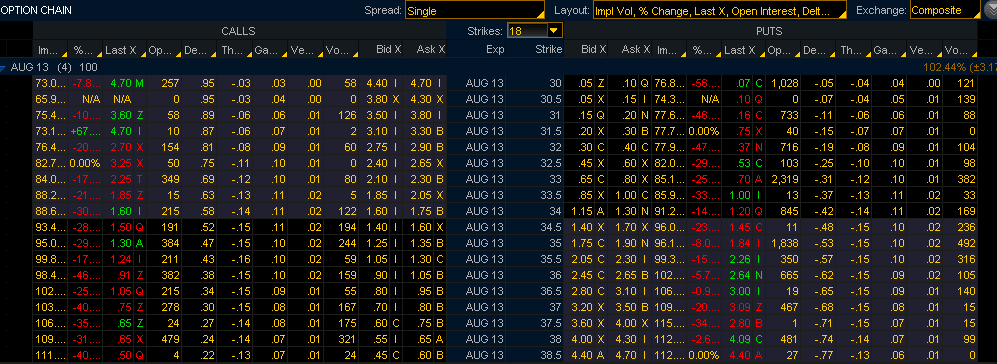

Continuing with the theme of selling vol in the higher volatility instruments while the VXX does not have enough premium to sell these days, the UVXY does, with implied vols in the 80’s and 90’s near the money:

It is easier to assume that the UVXY won’t fall significantly right now than to assume that it won’t rise. So a call spread purchase should be a high probability trade (as opposed to buying a put spread), understanding the weights of each month in the fund and the upcoming event risk. With a negative roll yield of roughly 16 cents per day, consider this call spread:

Buy UVXY weekly $32 call – Sell $34 for a net debit of roughly $1.20. If the UVXY remains above $34 on Friday, you collect .80 on risk of less than $2, understanding the current UVXY structure. Losses would begin around $33.2 on Friday.

A butterfly can be purchased at $32/34/36 for about .60, which would return $2 if the UVXY finds the $34 target on Friday. I consider the risk of this trade somewhat similar, to the call spread, but it is far more difficult to achieve. The call spread works if the UVXY is flat or higher, the fly needs to pin between $32.60 and $35.

We are still waiting patiently for the opportunity to buy the VIX Sep $12 call for around $2.60, so watch the VIX Sep future and if it hits $14.50, you should be able to pull that off as well.