True to form, Mr. Bernanke did it again. With zero change in policy, markets rallied and volatility evaporated, consistent with the typical volatility exhale that occurs after he’s taken the stage before. The difference this time was that markets were near the highs and volatility was already low, so the futures could only fall so far.

The VIX settled at 14.77 at the open today, which enabled us to profit from the 14/15 VIX calls spreads put on at .57. Not surprisingly, the 14.77 mark was the high of the day as out of the money puts were bid at the open, allowing almost the maximum pain for VIX put and call holders.

With a stalemate in DC and government shutdown looming, followed closely behind by the debt ceiling, it is not all roses for bulls going forward. It is probably a nice time to be adding/initiating vol positions for what will overtake the newswires in the weeks ahead.

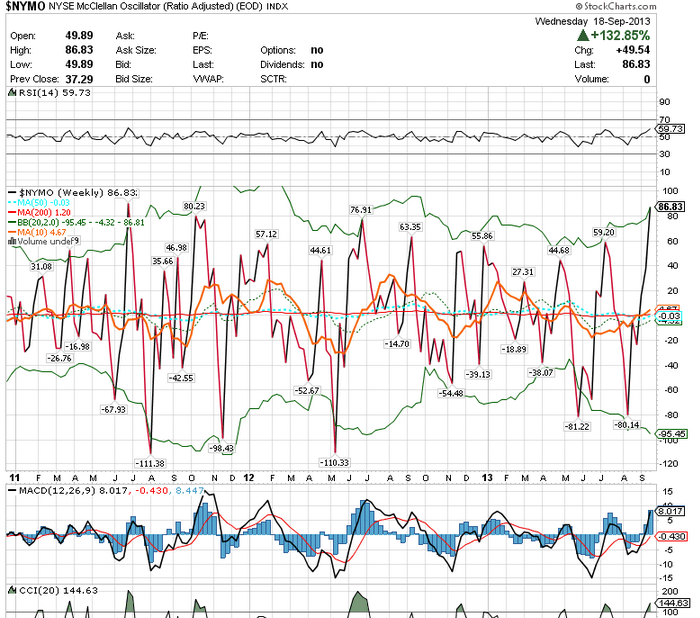

The following chart should get your attention. The NYMO, or McClellan oscillator, a measure of under/overbought conditions in the markets, is the highest since July 2011. That is precisely before the debt ceiling market crash of nearly 20%. I am in no way predicting anything like that, it is just a data point to pay attention to:

The VIX 13 and 14 calls are looking attractive. Believe me, I would prefer selling vol or shorting VXX in some way, but now is not the time. I sold the Dec S&P mini future contract at 1720.5, which is 50x the index. And I am long the VIX Oct 14 at 2.00, and I will add at around 1.30.