I can not recall a Fed meeting in recent times with so much complacency. The VIX has not risen in anticipation of potential volatility, and markets enter the uncertain announcement with bravado, near all-time highs. Sentiment is very bullish, where folks seem to expect positive results if the Fed tapers in the expected range, or if they don’t taper at all. In either scenario, higher prices are expected.

This market behavior should at the least get your attention to some potential downside. While it can certainly go higher, it can also surprise. Markets are challenged historically after mid-September until November, higher volatility may occur due to an impending budget and debt ceiling battle, and the S&P is extended and overbought signals are showing up in the NYMO and breadth indicators.

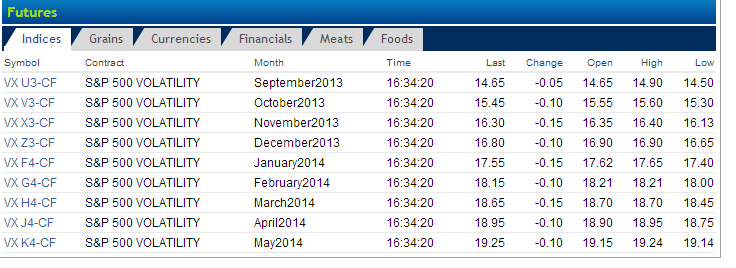

Typically, you would see an elevated level of volatility and a volatility exhale as the market receives the news. If that is the case, and it certainly doesn’t look like the markets are concerned in the least bit, then I suppose it is possible for October’s future could fall below 15. That is only a 3% drop to 15. With the VXX holding all Oct as of tomorrow, then the downside to the VXX is relatively limited. But it also means that if there is a surprise, the VXX can shoot up quickly, since is not holding more expensive November futures yet.

Typically, you would see an elevated level of volatility and a volatility exhale as the market receives the news. If that is the case, and it certainly doesn’t look like the markets are concerned in the least bit, then I suppose it is possible for October’s future could fall below 15. That is only a 3% drop to 15. With the VXX holding all Oct as of tomorrow, then the downside to the VXX is relatively limited. But it also means that if there is a surprise, the VXX can shoot up quickly, since is not holding more expensive November futures yet.

That leaves us with little to do in the vol space. Tomorrow will be all about the reaction and trading that. If vol falls significantly, I want to add to the VIX $14 calls, because there will be volatility in the near future. I am still also long the Sep spreads, which will break even if the opening VIX print tomorrow is around where it is now. The volatility I expected to even mildly enter the market never materialized, but as I sold the 15 and 16’s, the downside was minimal.

Here is the SPY chart. The MACD is bullish, the RSI is high, and frequently when you break the upper bollinger band, you can quickly revisit the lower band:

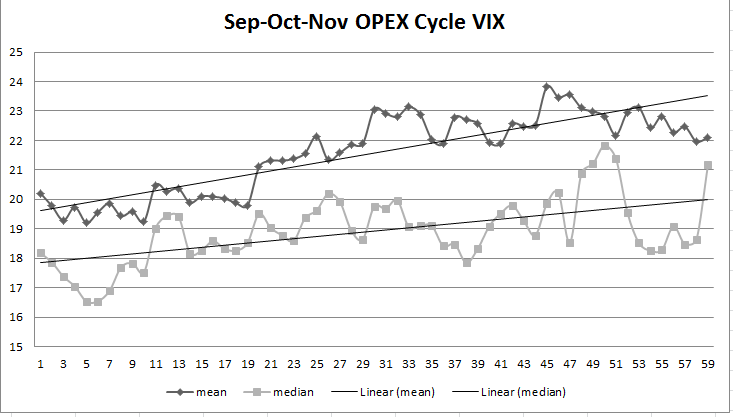

If we get a pop in the market, I will be looking to sell some spreads in the TNA, FAS, and SPY a week or two out. Next week has a notoriously poor history down 17 of the last 22 years. OPEX is Friday, and that is another wildcard, yet recently the the markets have performed well on expiration Friday. Remember this chart, we are about to enter day 20 on Monday, where historically volatility has risen: