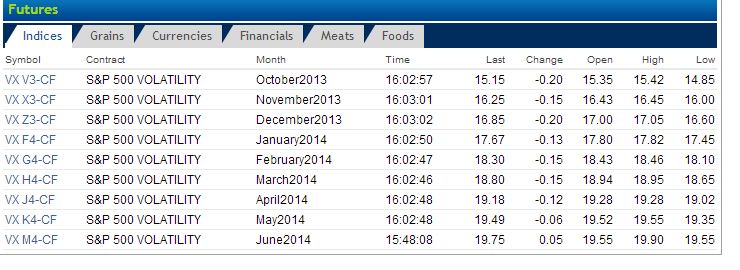

As the markets continue to act poorly for the fourth day in a row, participants are far from concerned as the VIX and futures fell. When the Russell 2000 rolled over in the last hour of the day, the VIX and VIX futures barely noticed:

If you look at the implied volatility in the SPY for example, you will see incredibly low numbers considering the fact that we have a DC debacle brewing, poor market behavior, and seasonal weakness as potential market headwinds. Check out the implied vols for this week and the quarterly options:

This is confusing, I must admit. I closed some October VIX $14 calls for a small profit at $1.55, ($1.35 and $1.40 entry) as I am not going to accept a vol exhale should something positive occur in DC over the weekend. I would much rather sell volatility instead of waiting for it to arrive, and I have seen enough to consider that it is possible it may not show up. No sense hoping, there will always be other opportunities, and selling vol is easier anyway.

The MACD is about to give a sell signal on the S&P, yet the NYMO has retreated to neutral levels. The Russell made an all-time intraday high today, and that signals to me that there could be a lot of folks out there chasing beta due to under-performance. Regardless of the technicals, the market itself is still very vulnerable to a surprise. The abundance of put selling in the SPY is something to watch. If the market falls, the delta hedge is selling the index, so it can sort of feed on itself.