50 S&P points higher in 6 trading days is not bad for a September with so many looming issues to be resolved. The Fed meeting and taper-talk have receded in lieu of other news, and DC has been consumed with Syria, as opposed to dealing with the Federal budget that expires on Sep 30th, and a debt ceiling that will hit in mid-October.

Realizing that volatility is sure to return, I am looking at VIX call spreads, put spreads and long Oct VIX calls. Here is the round trip the VIX and VIX Sep future have made since the Kerry speech:

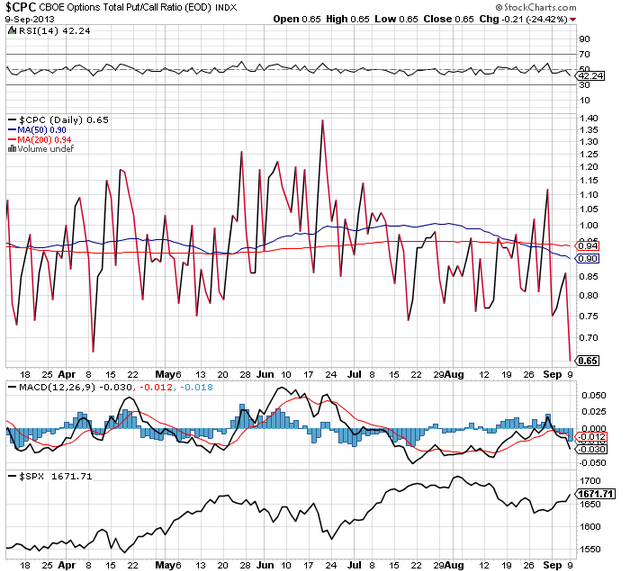

September can often be like May; the hype around how bad it can be is loud as it approaches, then everyone feels a sigh of relief when the market doesn’t sell off in the first week or two. Then, just like May of this year, it is very possible to get caught flat footed. Here is one example of the sudden complacency in the markets:

The total and index put/call ratio is very low, indicating that investors are not anticipating much market volatility. This is just one of a series of indicators, it is not a full-proof indicator by any means, but it should be noticed. OPEX week is approaching and while history suggests that the middle of Sep is good for markets, the end of Sep is not.

With the Fed meeting next Tuesday, there could easily be rising volatility into the event, especially considering the move higher the S&P has made. So I put on two bull call spreads on the VIX today. Long $14/15 for .57 and long $14/16 for .90. These will work if the VIX makes any move higher into the meeting:

The beauty of this trade is that these calls will settle the morning of the announcement. So barring an unforeseen leak of the Fed decision, volatility should rise and hold up into these calls being settled. If the VIX continues to fall toward 14 this week, I may add October naked calls, in anticipation of some volatility at the end of the month. I am eyeing the $14 and $15 calls.

Another option is to sell VIX October put spreads. You could sell the $15/13 put spread for .65, and if the VIX is 15 at expiration, you collect the whole .65. If the VIX spikes, the position can be closed for a profit.