As we noted a week ago, the VXX was quite vulnerable due to the large premium to spot VIX. As expiration approached and the Syria situation cooled, the VXX fell more than 10% since that post. The premium of the Sep future to spot VIX is now only 3%:

While I am now long VIX call spreads into the Fed meeting, I also tweeted out that I started an Oct $14 VIX call position for $2.20. Logic would dictate that even though folks keep claiming that the Fed decision is baked in, I think there are many reasons why volatility could rise from here as October approaches and gets underway.

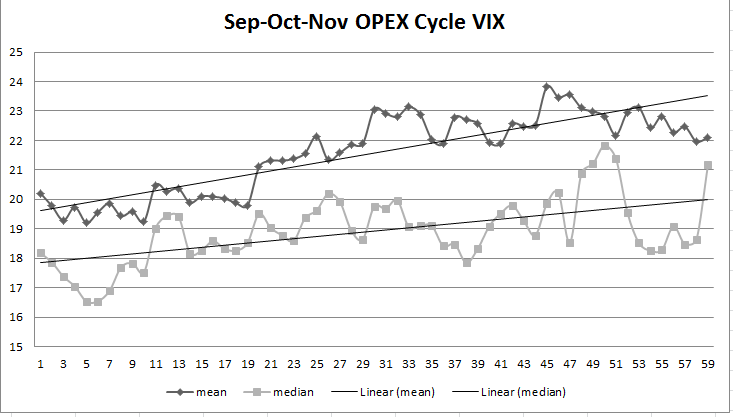

First, this part of September is historically bullish, so what you have seen the past few days was precisely on cue with history. September can be like May, kind early and more volatile late as everyone becomes complacent. Early October has a tough record from the beginning to the middle of the month, and that makes sense when we review the fall volatility wave:

Expiration in this opex cycle is day 19, and you can see what historically happens with vol from that point. October can be a very bumpy month as it was last year.

Second, there remains a lot of event risk. The debt ceiling and budget negotiations have been off page one, but will soon re-emerge. Just a peek at this article demonstrates how tough this could be:

http://thehill.com/homenews/house/321895-boehner-no-resolution-on-spending-bill-to-avert-shutdown

Thirdly, I’m having a hard time understanding what is “baked-in” to the stock market in regard to the Fed decision. It is near the highs of the year. So one can reasonably expect folks to put on some protection next week heading into it. If we get a mild bump in vol, our spreads will work to perfection. Interestingly, the calls expire the morning of the Fed decision, so the post-meeting volatility exhale I commonly refer too will not be a factor in the settlement of these options.

Sure there are expectations for what the Fed will do, but that is not reality yet, thus there is some uncertainty. I suppose that the VIX could sit at or below 14 heading into the meeting, but that is unlikely. I’ve already heard many folks expecting a rally immediately after the Fed decision, now that it will be out of the way. Ok, if that is the consensus heading into the meeting, that makes a downside move even more possible.

Furthermore, opex week is next week, and that makes volatility unpredictable. Like the chart indicates above, historically the volatility in September comes the week after opex, but you can’t make that assumption during an opex week.

The VXX is no bargain though. It is now 85% comprised of October at 15.80. You saw what that means today when the VIX rose, the VXX barely budged as the VXX is essentially holding 1.50 of premium to spot VIX. This is a drag on the VXX when volatility goes higher, essentially impeding its rise. The Oct options give you more leverage to a move in the VIX.

It will be an interesting few days to say the least.