It is entirely possible that the VIX and general market volatility remain subdued for the rest of the year. With so many managers underperforming the indexes, and lots of gold and bond money floating around, there could be a constant bid for stocks heading into year end. This is before any POMO consideration, which I think is over-rated in effectiveness, but has powerful psychological market implications.

I’m not predicting market direction, just surmising that there could be a line of folks looking for an entry, so pullbacks could be small. Thus, the VIX will not respect a falling market until it demonstrates an ability to violate widely watched levels, like the infamous 50 day moving average.

What to do for vol traders? Quite simply, there are always vol opportunities when you consider earnings and event driven trades. Short-term options reflect the potential for big moves, while the longer-term options reflect less volatility. Interestingly, for true vol fans, this concept is discussed by Jamie Mai in Hedge Fund Wizards, one of Jack Schwager’s great interview-style books. Jamie discusses why it is counter-intuitive that longer vol should be lower than short-term vol when the potential for major unknown event risk sits between the short options and the long options. Check it out for some fascinating reading.

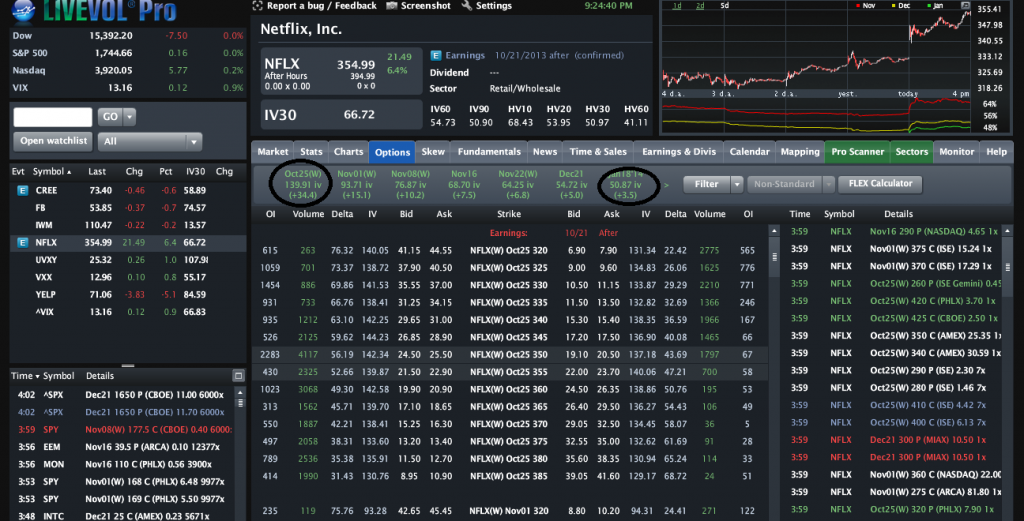

A terrific platform for Online Pokies vol trading is LiveVol, and I have had the privilege of giving it a test drive over the last couple weeks. Vol traders will absolutely love this, it is built specifically for them. And earnings season is perfect for a platform build for setting up vol specific trades.

Let’s look at a specific example using NFLX:

The weekly implied volatility (circled) is 80 points higher than the January calls. This is an excellent opportunity to sell one against the other. When earnings are revealed, the short term IV will implode, while the long-term will fall at a much lower rate.

This is the trade I put on this morning:

Short NFLX weekly $380 for $7.26

Long NFLX Jan 2014 $380 for $17.81

Net debit $10.55

This was set around 10% out of the money when I put it on, and NFLX rose by 5% during the day and 9% after hours. I specifically set the short call 10% out of the money, as I felt I was getting a good value provided by short-term earnings traders. This trade had only about 50% of overnight downside, but has unlimited return potential.

AMZN, FB, and countless other weekly options provide this opportunity. So while the VIX is low, selling vol is still easy to do on an asymmetric risk/reward basis.