There has been no volatility to speak of lately, so the posts here have been thin. While my focus therefore has been on specific name volatility arbitrage, (calendar IV spreads) there are hints that volatility may rise in the month ahead. Let’s examine why.

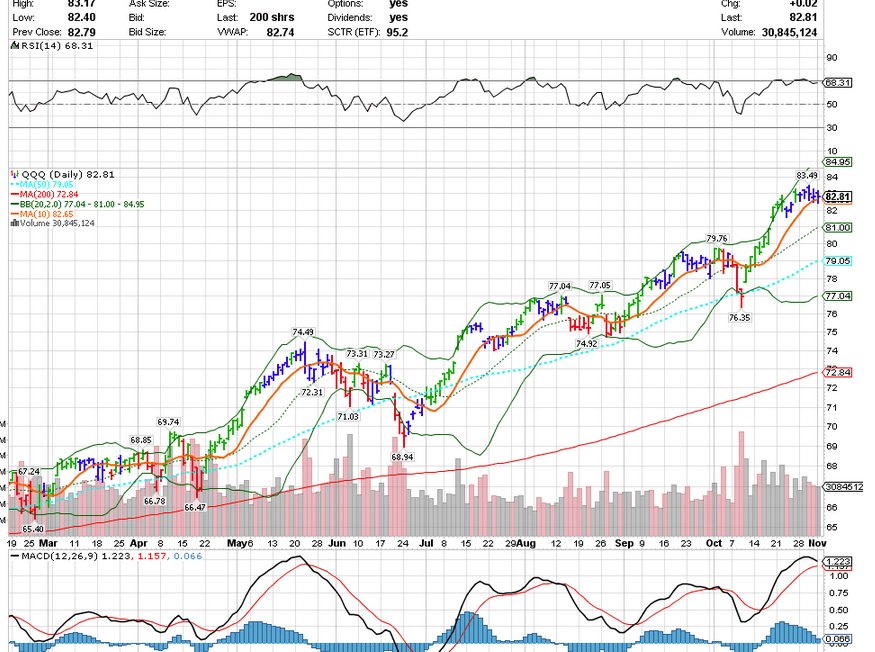

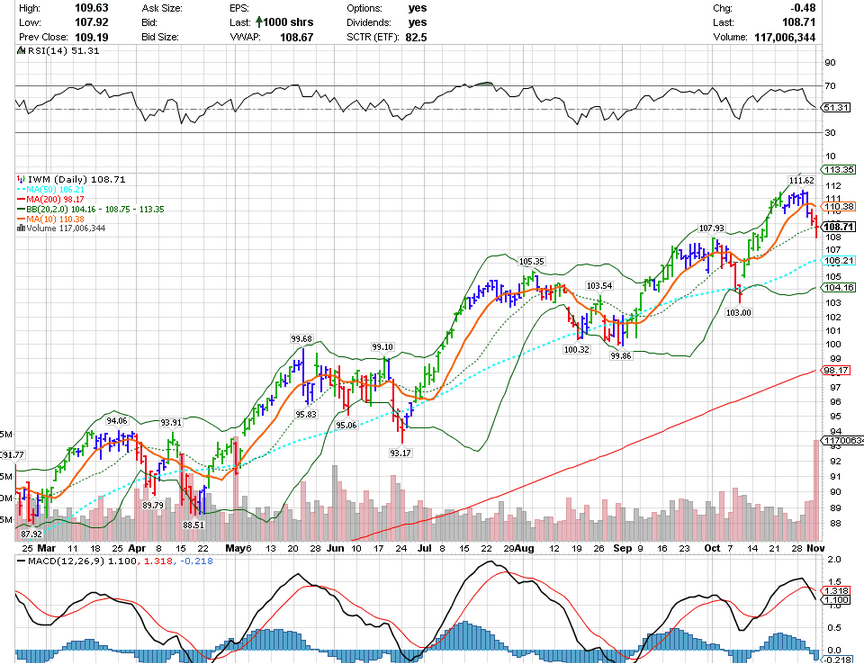

First let’s look at the S&P, NDX, and RUT charts (using SPY, QQQ, and IWM for volume profiling):

All three charts are very bearish, with MACDs rolling or crossing on every one. As you can see, MACD does not immediately turn around and head back higher until it resolves itself. It almost always leads to lower prices. Because uptrends do not reverse on a dime generally, (blow-offs aside) you get some chop at the top. That is what we are doing right now. But the canary in the coal mine may be the Russell 2000. It’s already only 2% above the 50 day after giving up 3% this week alone. Unlike the other indexes, it does not respect the 50 MA that much, unlike the S&P 500, which everyone watches like a hawk when it nears the 50.

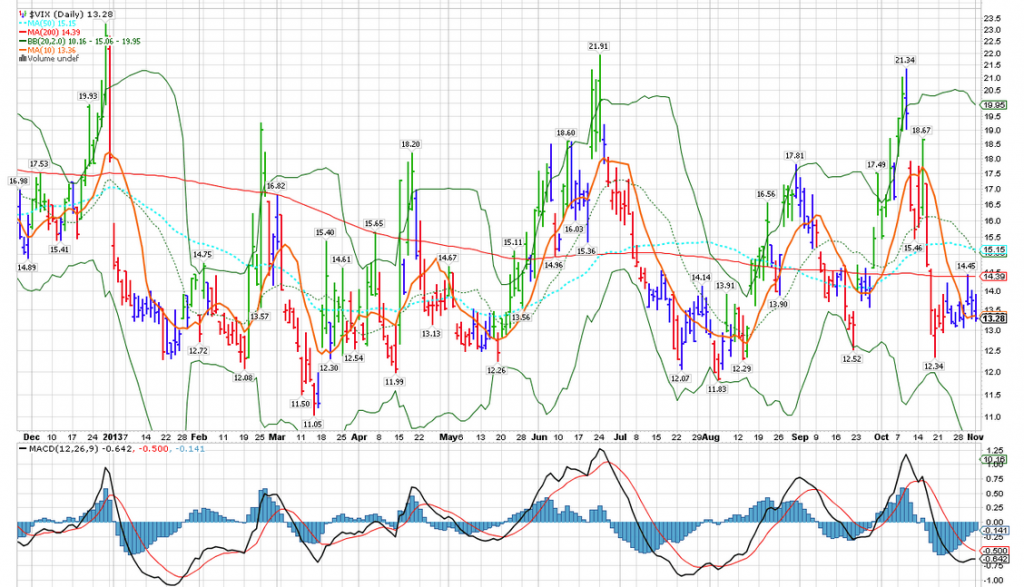

The VIX during this chop is still dormant. While the media tone has slightly changed from “QE forever” to “QE taper in Jan, maybe”, folks are still not bidding up put options. They have reason to be complacent, November is a great month for stocks historically, #3, and when followed by great Seps and Octs, the chase usually is on to Dec 31st. But you more need buying, and there has been a ton of inflow lately to equity markets. The VIX may be lurking though, for at least an uptick:

When the VIX sits down here, it takes 4-6 weeks generally for it to make an inevitable move higher. At least a move off of the 12-13 level. The good thing about the VIX being so low, is that you don’t have to pay much if you like downside options, anticipating a natural consolidation in stocks. One thing that works pretty well in this scenario are diagonal spreads. Let’s look at one example of how to get your risk/reward in asymmetrical shape.

When the VIX sits down here, it takes 4-6 weeks generally for it to make an inevitable move higher. At least a move off of the 12-13 level. The good thing about the VIX being so low, is that you don’t have to pay much if you like downside options, anticipating a natural consolidation in stocks. One thing that works pretty well in this scenario are diagonal spreads. Let’s look at one example of how to get your risk/reward in asymmetrical shape.

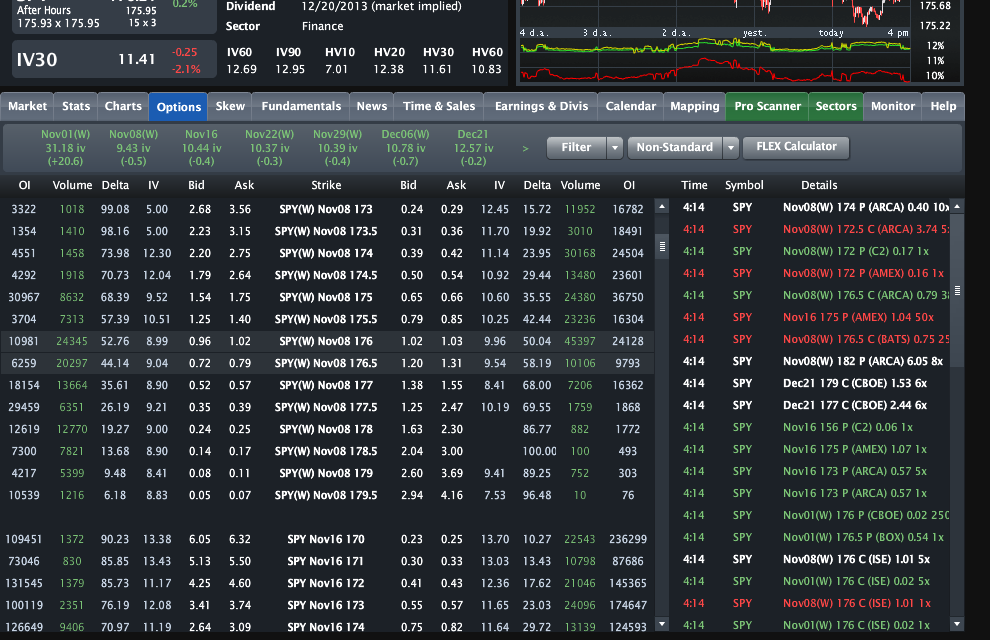

This is the option ladder via the fantastic LiveVol platform. I like diagonal calendar spreads in this scenario. You would sell a nearer term put at one strike and buy another longer dated put at a lower strike, thereby lowering your cost and giving you the opportunity to make multiples on a market slide. One potential trade would be to sell the SPY $174 Nov 8 put for .40 cents and buy the Nov 15 $173 put for .56, for a net debit of .16. If the SPY stays flat or falls over the next two weeks, this trade will work and could be a big winner.

A rise in volatility will also juice the longer dated put as well. It is very hard to lose significantly on this trade. If the market stays right here next week, without even falling this trade will probably make 50%. If it falls to 174 next Friday, then you are looking at a 5x or more return, as the ATM puts for next week are worth around $1. That is without adding any vega to the put value.

Expect more posts in the coming week with vol trade set-ups.