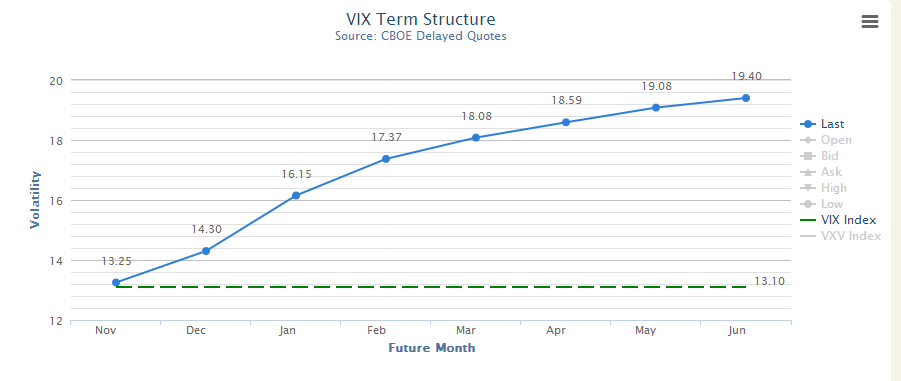

The VXX and UVXY are about to hold entirely the Dec contract and start rolling into Jan. The curve is quite steep:

On Wednesday morning, the VXX and UVXY will be selling each day 1/20th of their holdings in Dec and buying Jan. Right now, that presents a nice opportunity to be short these funds, for multiple reasons. First, the VIX tends to make an annual low in December. That is a 12.5% roll over the next 20 days at today’s prices. (16.15 – 14.31 = 1.84. 1.84 / 14.31 = .128 or 12.8%)

That divided by 20 days is .64% per day for the VXX or 1.28% per day for the UVXY. That is about 30 cents for each ETF roughly per day of negative roll yield. All things being equal, if the Dec and Jan contracts stay at their current prices, this will be subtracted from the ETFs’ indicative value, or their NAV.

You also get the bonus of Thanksgiving decay, one free day of roll without the market being open next week. So it really has to roll up in 19 days. This is a huge headwind.

What can you do to take advantage of this? Sell call spreads in both, so that your risk is capped in case there is a major market sell-off due to an unforeseen event.

Looking at the LiveVol option chain for UVXY:

If you anticipate that the UVXY will be less than 20 using the metrics above on the day after Thanksgiving, you can sell the $20-22 call spread for approximately .80. Your max risk is $2, but there is a ton of roll between now and then, and Thanksgiving week has a very bullish bias in the stock market.

You can do the same in the VXX, say at $47-49 for .60 or the $46-48 for .80 approximately. All you need for these to work is a flat market, so that the roll can do its job. If the market goes higher, the UVXY and VXX will get hit even harder as the Dec futures head lower.