There hasn’t been much volatility to speak of, but that could change, especially as we get closer to May and June. As the market’s best season (November-April) is nearing an end, I decided to get back to posting once or twice a week, and more frequently if we experience higher vol levels. There really hasn’t been much to write about this year, frankly, without any political nonsense, taper panic, or Eurozone defaults. Kind of boring, right?

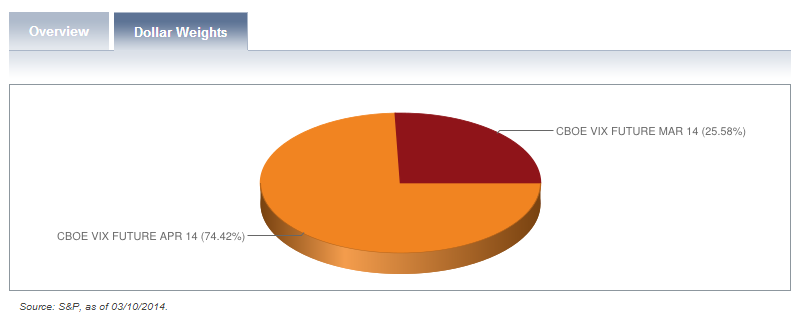

Today I want to go over the VXX structure again, since I endlessly see tweets from folks that are completely baffled by why the VXX doesn’t rise when the VIX rises or the market falls. These events are not mutually inclusive. The VIX can fall in a falling market, and frequently does after market events, like a highly feared/anticipated Fed meeting. Let’s look at the current VXX structure again for starters:

After today, the VXX can only hold 25% of March futures, because it is only being traded for 5 more days. The VXX Pokies rolls every day. So the driver of the VXX is now the April future. Here is what the futures curve looks like:

The April VIX future barely moved today as you can see here:

So there you have it. The April future moved up a measly 1%, and so did the VXX. Now, if the market really cared about the sell-off today, the VIX would have broken 15 to the upside. Without any conviction from those buying S&P puts (the basis for the VIX calculation), then the futures market is not going to take notice, and still has a considerable buffer of 1.2 built in: VIX future of 16.05 less VIX of 14.80. There is no fear or protection being demanded at the moment.

From an options perspective, there isn’t much to do in the VXX or UVXY. The future being 16 is too low to sell VXX calls and too high to sell VXX puts. We will sit and wait for a spike or a dip to get busy.

![2014-03-11 20_49_48-_VXJ4 - Quick Chart Main@thinkorswim [build 1856.8]](http://www.volatilityanalytics.com/wp-content/uploads/2014/03/2014-03-11-20_49_48-_VXJ4-Quick-Chart-Main@thinkorswim-build-1856.8.png)