You would think, and I apparently am the only one with this thought, that the convergence of a declining 10 day moving average with a rapidly approaching 50 day would get some folks prepared for a possible downside moving in equities. Not so. The implied volatility in S&P puts is incredibly low:

Look at the implied volatility on the puts, if this doesn’t amaze you, I don’t know what to say. The S&P 500 falls 20 points from the high of the day, and what did people do? They SOLD puts. They have become so brazen, that they aren’t buying them, they are sellers. Look at the call side, the implied vol going out weeks is higher on the CALL side. All this happened on this kind of price action:

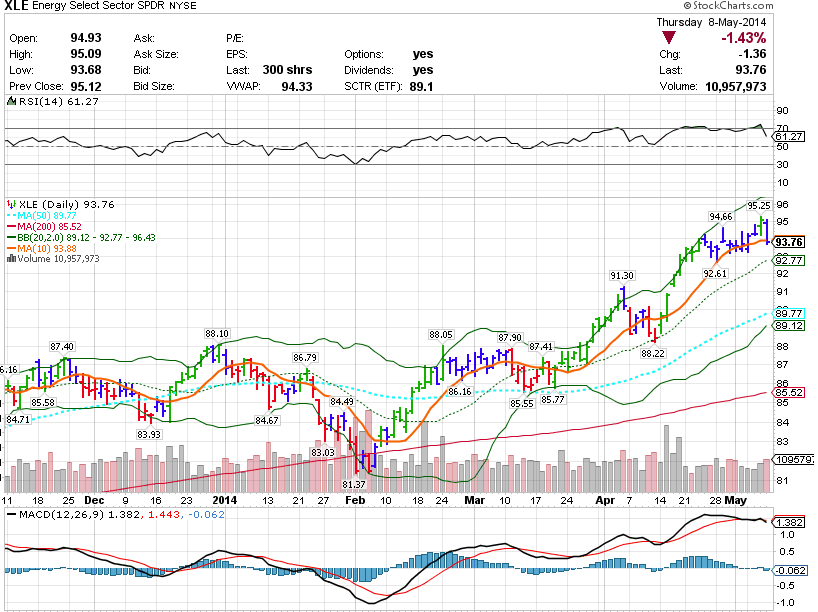

The energy sector has been a leader lately, and look what it did today:

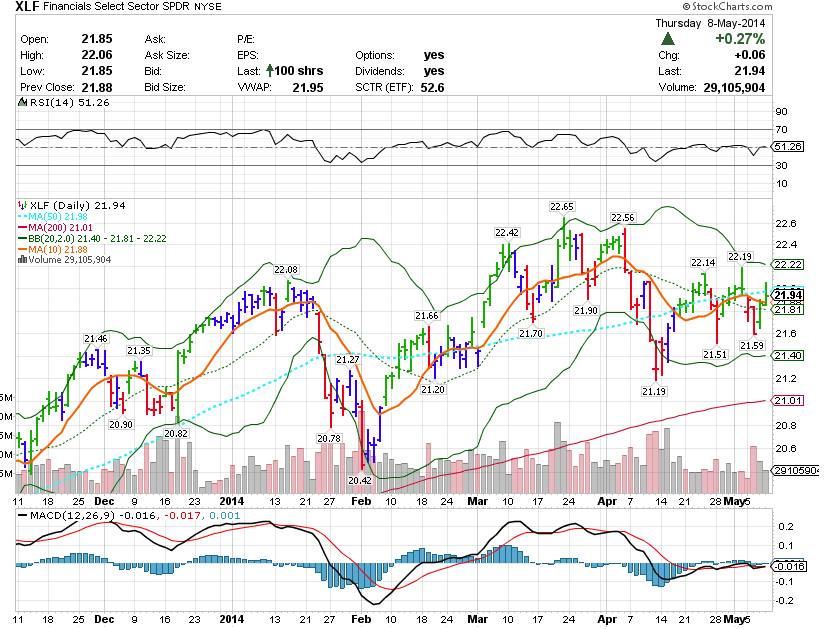

The saving grace for the market today, was the financial sector. The recent leaders, utilities and energy reversed, and higher yields helped out the banks:

But if folks expect the financials to carry the baton from here, the bounce ran out of steam as the 50 rejected the XLF after two strong days:

The recipe is there for a rude awakening. Will it happen? The crowd has voted emphatically that the answer is no.

I added to May 30th VXX $38 calls today.

(I will be starting a volatility newsletter shortly for $25/mo. It will include my perspective on the volatility indexes, trading ideas, VXX analysis, and volatility forecasting using proprietary models. Real-time email trade alerts and volatility email updates will be included. The sample will be available by the end of the week and it will go out on Tuesday nights. Email me at scottmurray1 (at) gmail.com if you are interested.)

![2014-05-08 18_44_42-Main@thinkorswim [build 1860.10]](http://www.volatilityanalytics.com/wp-content/uploads/2014/05/2014-05-08-18_44_42-Main@thinkorswim-build-1860.10.png)

![2014-05-08 18_51_55-SPY - Quick Chart Main@thinkorswim [build 1860.10]](http://www.volatilityanalytics.com/wp-content/uploads/2014/05/2014-05-08-18_51_55-SPY-Quick-Chart-Main@thinkorswim-build-1860.10.png)