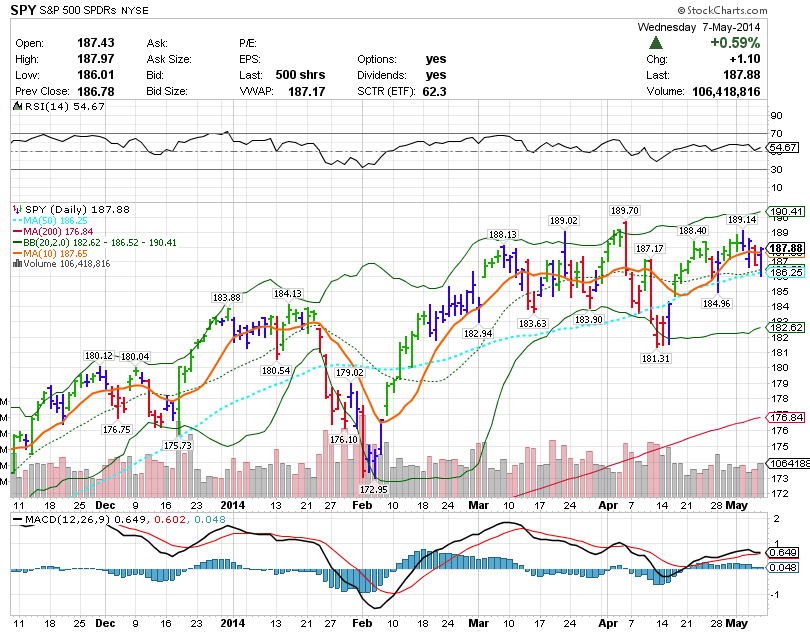

I mentioned a few days ago that May can be very kind to investors, and we looked at last year’s chart of May as an example. There are still a ton of earnings releases, and bull markets do not just turn around and fall. They fight to hang on, because the trend is still up. Today the S&P tested the 50 day moving average and held convincingly:

The SPY was able to reclaim the 10 day moving average as well. We are nearing some kind of inflection point it appears, as the 10 day and the 50 are near a cross. If you see the 10 cross through the 50, get ready for the knuckleheads on CNBC to be trotted out with their “death cross” prognostications.

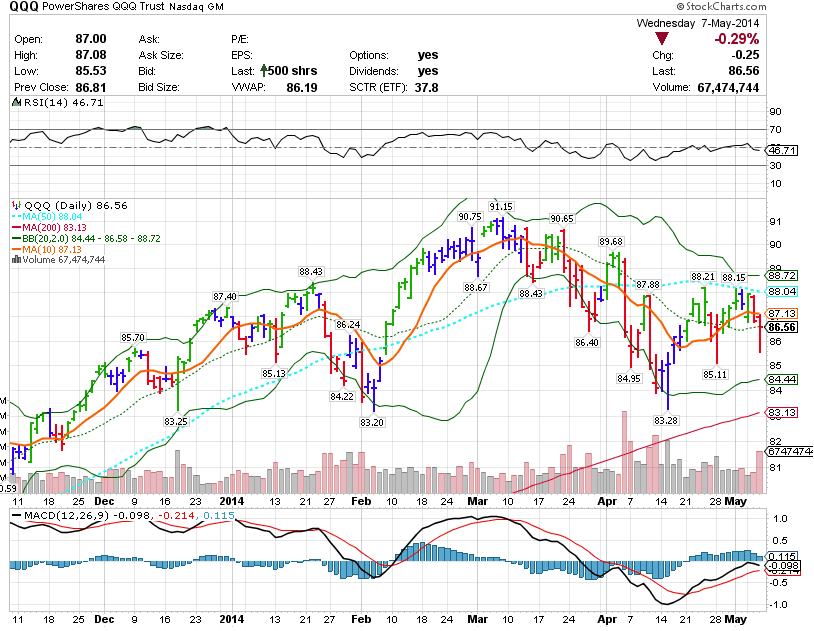

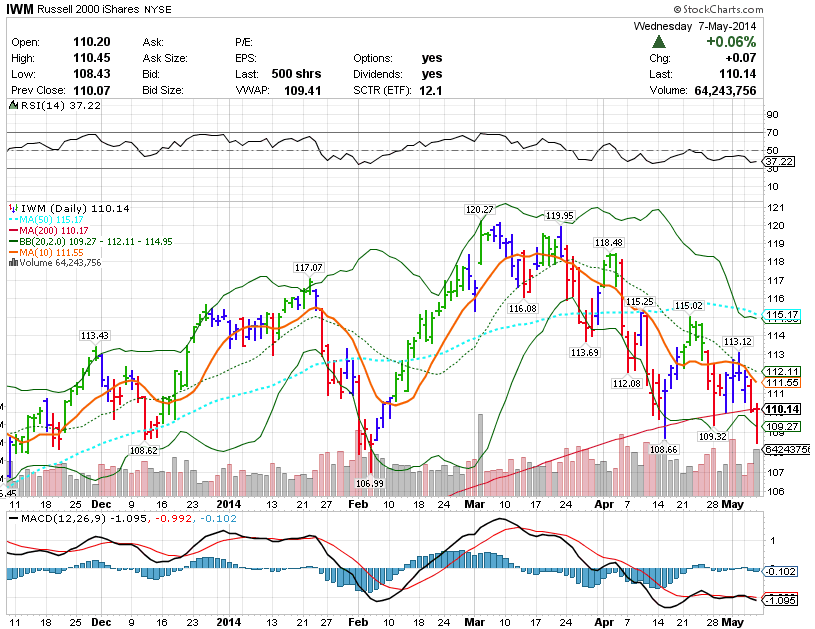

The Nasdaq and Russell 2k look sickly, and the Rut2k barely recaptured the 200 day moving average. That is a big one.

Meanwhile, while under the surface, there are clear rumblings of something brewing, the VIX futures are a mere 20 cents from their lowest point since January:

As you can see, prices at these levels don’t hang around forever. This is the time to prepare, however you see fit. I will be watching closely, and if I can sell some UVXY and VXX spreads a few weeks out or purchase some in the money calls in VXX at prices anywhere near a VIX future of 14 then I will be doing so. I will go out to May 30 or even June. Most folks just wait for volatility to arrive before doing something; it is my preference to be a little bit early rather than late. Friday might be the day to put on some positions, as we are nearing a 8/34 cross on the 30 minute chart, and that can support a bullish market  for hours/days ahead if it can get there. A bullish day tomorrow and I will be on the sideline, being patient.

As you can see, prices at these levels don’t hang around forever. This is the time to prepare, however you see fit. I will be watching closely, and if I can sell some UVXY and VXX spreads a few weeks out or purchase some in the money calls in VXX at prices anywhere near a VIX future of 14 then I will be doing so. I will go out to May 30 or even June. Most folks just wait for volatility to arrive before doing something; it is my preference to be a little bit early rather than late. Friday might be the day to put on some positions, as we are nearing a 8/34 cross on the 30 minute chart, and that can support a bullish market  for hours/days ahead if it can get there. A bullish day tomorrow and I will be on the sideline, being patient.

As you probably know, I almost never buy VXX calls, but this set-up is fairly rare and is occurring with seasonal difficulties, earnings ending, and divergences showing up in many areas. Patience is warranted though, you are probably not going to wake up one day and see the market down 25 S&Ps.

As you probably know, I almost never buy VXX calls, but this set-up is fairly rare and is occurring with seasonal difficulties, earnings ending, and divergences showing up in many areas. Patience is warranted though, you are probably not going to wake up one day and see the market down 25 S&Ps.

I do already own some VXX May 30th $38 calls and am short some UVXY May 16th $48-47 put credit spreads.

(I will be starting a volatility newsletter shortly for $25/mo. It will include my perspective on the volatility indexes, trading ideas, VXX analysis, and volatility forecasting using proprietary models. Real-time email trade alerts and volatility email updates will be included. The sample will be available by the end of the week and it will go out on Tuesday nights. Email me at scottmurray1 (at) gmail.com if you are interested.)