You really can’t ask for much more in VXX. So often the VIX futures sit in a range where they are untradeable, usually when the VIX is in the 14-16 area. In those cases, getting long volatility could eat you alive, yet getting short could get you killed. This is not one of those times.

Let’s start with a chart of the front month VIX future this year:

There is a flow to these spikes, no? Granted this is only 2014 right here. But go back to last year and the year before that and you will find that this rhythm persisted then too. I don’t ever look at volatility like folks out there on CNBC and stocktwits, trying to get ready for the next crash, that is wasting precious time and money when you can take what the VIX gives you over and over again. Sure, if there is a crash, I’ll be happy to ride that too, but realistically, we deal with the market we have, not the one that we may want.

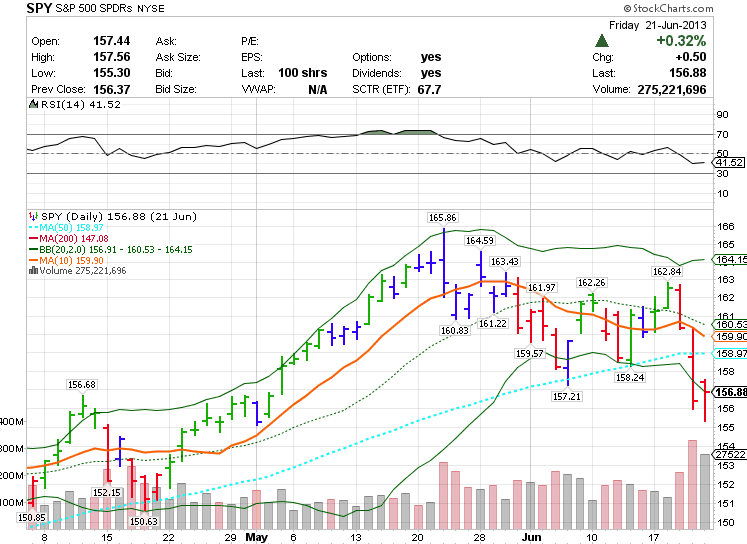

So every 3-6 weeks, you get some sort of rumble, and this is normal and healthy in bull markets. And now that the “sell in May” headlines are fading, it is time to look toward the next rumble. People are feeling better, their tech stocks have stopped cratering, and May is off to a quiet start. Let’s look at how last May went, just for fun:

May 3rd featured a better than expected jobs number, and off it went. The last green bar was on options expiration last May and then things got wild. There are correlations to volatility and the option expiration cycle, and there are correlations to volatility and seasonality. I will go into these frequently in the newsletter.

May 3rd featured a better than expected jobs number, and off it went. The last green bar was on options expiration last May and then things got wild. There are correlations to volatility and the option expiration cycle, and there are correlations to volatility and seasonality. I will go into these frequently in the newsletter.

Today I added a few VXX May 30th $38 calls for 2.35. Tomorrow is the day that I was targeting to add more considering the performance of Tuesday in the markets this year. It has been an automatic ramp on Tuesdays, so it may offer some nice prices to get long vol.

(I will be starting a volatility forecasting and signal service shortly for $25/mo if you are interested, and that will also include an email service with real-time trades, and a weekly newsletter breaking down the volatility landscape. There will also be sections with basic option trades and education, ETF analysis for straight trades on volatility, inverse and leveraged funds, and profit loss diagrams. Imagine what you see here and a lot more. Email me at scottmurray1 (at) gmail.com if you are interested.)

![2014-05-05 17_58_03-_VX - Quick Chart Main@thinkorswim [build 1860.10]](http://www.volatilityanalytics.com/wp-content/uploads/2014/05/2014-05-05-17_58_03-_VX-Quick-Chart-Main@thinkorswim-build-1860.10-1024x565.png)