There was no news of significance today, and European markets led the U.S. into a higher open. That open was almost precisely where we closed, and since the S&P 500 was up around 12 pts at the high, a 6 point advance from open to close formed a shooting star candle. A lot of traders love to call this a bearish reversal or ugly candle, but the data does not support that. Bulkowski’s data demonstrates that it is merely a random probability what follows a shooting star:

http://www.thepatternsite.com/ShootingStar.html

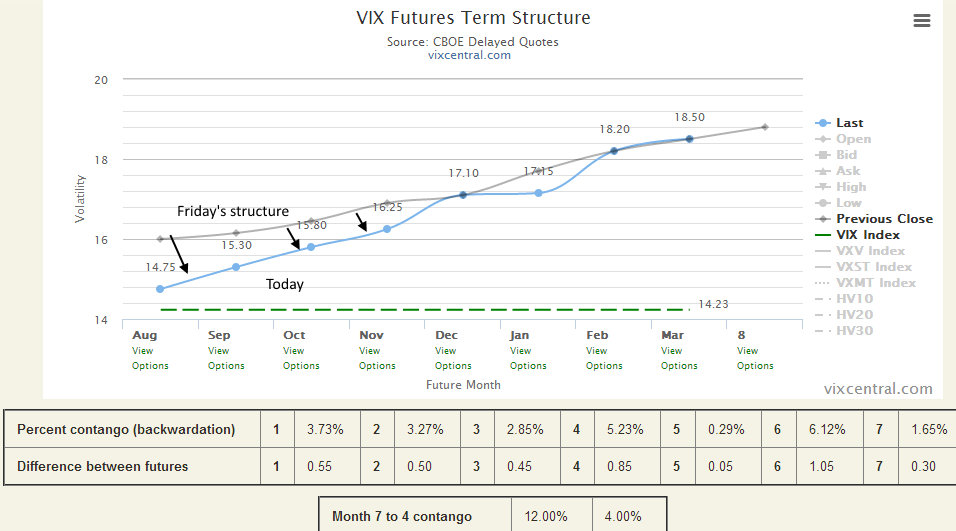

The VIX took the lack of bad news pretty hard as it fell to around 14. Today had the feel of a typical summer session, with low volume and low volatility the characteristics of the day. The VIX term structure steepened and contango widened in the front months of the VIX futures curve:

Meanwhile, this was the trip for the September future. This is the only thing that matters now for VXX and UVXY holders, as it dominates their holdings:

This kind of action in the primary long holding in UVXY did some damage to the UVXY short $100 calls, which of course worked well for subscribers:

The VIX reached July 30th levels:

Our next letter for subscribers will be published tomorrow night. I anticipate a few new trades this week, and we are on quite a roll lately….

Click the link above to subscribe to the newsletter for $25/month.